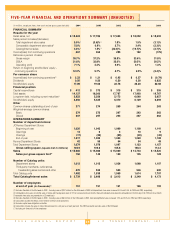

JCPenney 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

Notes to the Consolidated Financial Statements

39

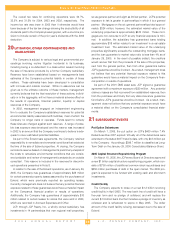

12 INTEREST EXPENSE, NET

($ in millions)

2004 2003 2002

Short-term debt

$3$6$4

Long-term debt

373 429 403

Short-term investments

(63) (30) (41)

Other, net

17 20 22

Less: Interest expense of

discontinued operations(1)(2)

(97) (164) (162)

Total

$ 233 $ 261 $ 226

(1) Includes interest expense from Mexico Department Stores of $— million, $1 million and $1 million

in 2004, 2003 and 2002, respectively.

(2) See Note 2 for an explanation of interest expense allocated to Eckerd.

13 CAPITAL STOCK

The Company had 43,242 stockholders of record as of January

29, 2005. On a combined basis, the Company’s 401(k) savings

plan, including the Company’s employee stock ownership plan

(ESOP), held 30 million shares of common stock or 11% of the

Company’s outstanding common stock. See Note 3 for a discussion

of the Company’s ongoing common stock repurchase program.

Preferred Stock

The Company has authorized 25 million shares of preferred

stock; no shares of preferred stock were issued and outstanding as

of January 29, 2005. On August 26, 2004, the Company redeemed,

through conversion to common stock, all of its outstanding shares

of Series B ESOP Convertible Preferred Stock (Preferred Stock), all

of which were held by the Company’s Savings, Profit Sharing and

Stock Ownership Plan, a 401(k) savings plan. Each holder of

Preferred Stock received 20 equivalent shares of JCPenney com-

mon stock for each one share of Preferred Stock in their savings

plan account. Preferred Stock shares, which are included in the

diluted earnings per share calculation as appropriate, were con-

verted into approximately nine million shares of common stock on

August 26, 2004. As of January 31, 2004, 505,759 shares were

issued and outstanding. Prior to redemption, cumulative dividends

were paid semi-annually at an annual rate of $2.37 per common

share equivalent, a yield of 7.9%.

Preferred Stock Purchase Rights

In January 2002, the Board of Directors issued one preferred

stock purchase right on each outstanding and future share of com-

mon stock. These rights entitle the holder to purchase, for each

right held, 1/1000 of a share of Series A Junior Participating

Preferred Stock at a price of $140. The rights are exercisable by

the holder upon the occurrence of certain events and are

redeemable by the Company under certain circumstances as

described by the rights agreement. The rights agreement contains

a three-year independent director evaluation (TIDE) provision. This

TIDE feature provides that a committee of the Company’s inde-

pendent directors will review the rights agreement at least every

three years and, if they deem it appropriate, may recommend to the

Board a modification or termination of the rights agreement.

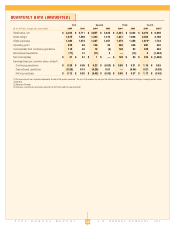

14 ACCUMULATED OTHER COMPREHENSIVE (LOSS)/INCOME

2004 2003

Deferred Deferred

Pre-Tax Tax Asset/ Net of Tax Pre-Tax Tax Asset/ Net of Tax

Amount (Liability) Amount Amount (Liability) Amount

Foreign currency translation adjustments(1) $

(104)

$ –– $ (104) $ (115) $ –– $ (115)

Non-qualified plan minimum liability adjustment

(168) 66 (102) (134) 52 (82)

Net unrealized gains on investments

115 (41) 74 92 (32) 60

Other comprehensive (loss) from

discontinued operations

–– –– –– (2) 1 (1)

Accumulated other comprehensive (loss)

$ (157) $ 25 $ (132) $ (159) $ 21 $ (138)

(1) A deferred tax asset has not been established due to the historical reinvestment of earnings in the Company’s Brazilian subsidiary.

15 STOCK-BASED COMPENSATION

In May 2001, the Company’s stockholders approved a 2001 Equity Compensation Plan (2001 Plan), which initially reserved 16 million

shares of common stock for issuance, plus 1.2 million shares reserved but not subject to awards under the Company’s 1997 and 2000 equi-

ty plans. No future grants will be made under the 1997 and 2000 plans. The 2001 Plan provides for grants to associates of options to pur-

chase the Company’s common stock, stock awards or stock appreciation rights. At January 29, 2005, 5.7 million shares of stock were avail-

able for future grants. Stock options and awards typically vest over performance periods ranging from one to five years. The number of

option shares is fixed at the grant date, and the exercise price of stock options is generally set at the market price on the date of the grant.