JCPenney 2004 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

Management’s Discussion and Analysis of Financial Condition and Results of Operations

8

ognized when DMS assets were reflected as a discontinued opera-

tion and in 2001, a $16 million loss was recognized upon completion

of the sale. These losses were offset by gains of $34 million, $4 mil-

lion and $1 million recognized in 2002, 2003 and 2004, respectively,

due to tax regulation changes and a tax audit.

The Company’s financial statements, accompanying notes and

other information provided in this Annual Report reflect these busi-

nesses as discontinued operations for all periods presented.

RESULTS OF OPERATIONS

The following discussion and analysis, consistent with all other

financial data throughout this Annual Report, focuses on the results

of operations and financial condition from the Company’s continuing

operations. All references to EPS are on a diluted basis, unless oth-

erwise indicated.

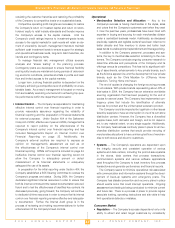

Income from Continuing Operations

2004 represented the fourth consecutive year of substantial

earnings improvement. Income from continuing operations was

$667 million, $364 million and $285 million in 2004, 2003 and 2002,

respectively. Earnings increased as a result of continued strong

sales growth, further gross margin improvement and leveraging of

selling, general and administrative (SG&A) expenses. EPS from

continuing operations increased 84% in 2004 to $2.23 compared to

$1.21 in 2003 and $0.95 in 2002, driven by improved operating

profit.

Retail Sales, Net

($ in millions)

2004 2003 2002

Retail sales, net

$ 18,424 $ 17,786 $ 17,633

Sales percent increase/(decrease):

Total department stores

5.0%

(1)

(

0.6%)

(1)

1.9%

Comparable stores(2)

5.0% 0.9% 2.7%

Catalog/Internet

3.3%

(3)

1.5%

(3)

(22.0)%

(1) Excludes the effect of the 53rd week in 2003. Including sales of $152 million for the 53rd week in

2003, total department store sales increased 4.0% and 0.5% for 2004 and 2003, respectively.

(2) Comparable store sales include the sales of stores after having been open for 12 full consecutive fis-

cal months. New and relocated stores become comparable on the first day of the 13th full fiscal month.

Comparable store sales are presented on a 52-week basis.

(3) Excludes the effect of the 53rd week in 2003. Internet sales increased 34.0% and 47.8% for those

periods. Including sales of $46 million for the 53rd week in 2003, total Catalog/Internet sales increased

1.5% and 3.3% for 2004 and 2003, respectively.

Comparable department store sales increased for the fourth con-

secutive year. Department Store sales, which were strong across the

country and in all merchandise divisions in 2004, have continued to

benefit from positive customer response to the Company’s merchan-

dise assortments, compelling marketing programs and continued

improvement in the store shopping experience. The focus on main-

taining fresh, stylish seasonal assortments contributed to the improve-

ment in sales. Total department store sales include sales from the

Renner Department Stores in Brazil of $329 million, $273 million and

$249 million in 2004, 2003 and 2002, respectively.

Catalog/Internet sales on a 52-week basis increased 3.3% for

2004, compared to a 1.5% increase in 2003 and a 22.0% decline in

2002. Sales continue to reflect a focus on targeted specialty media

and the expanded assortments and convenience of the Internet.

Total Internet sales, which are an integral part of the Company’s multi-

channel retailing strategy, increased approximately 32% in 2004, to

$812 million, compared to $617 million for 2003 and $409 million for

2002. The 2003 increase in Catalog/Internet sales over the 2002

amount also reflected favorable customer response to better mer-

chandise assortments, sharper pricing and certain marketing events,

including free shipping.

The Company continues to edit its merchandise assortments to

help ensure it is meeting the needs and wants of its targeted moder-

ate customer. In May 2004, the Company launched the Chris

Madden home furnishings collection, reflecting the Company’s con-

tinuing strategy to provide its customers with style and quality at a

competitive price. The Chris Madden for JCPenney Home Collection,

Turning Home into Haven, is JCPenney’s largest home furnishings

launch ever and was introduced with a comprehensive national

advertising campaign. Sales results from the collection were strong

throughout the remainder of 2004, particularly in bedding and furni-

ture. This line is being expanded in 2005 with new furniture, bedding

and window coverings collections. In early 2005, the Company

launched nicole by Nicole Miller, and W-work to weekend, an expan-

sion of the Company’s Worthington private brand, a dressy casual

collection for women.

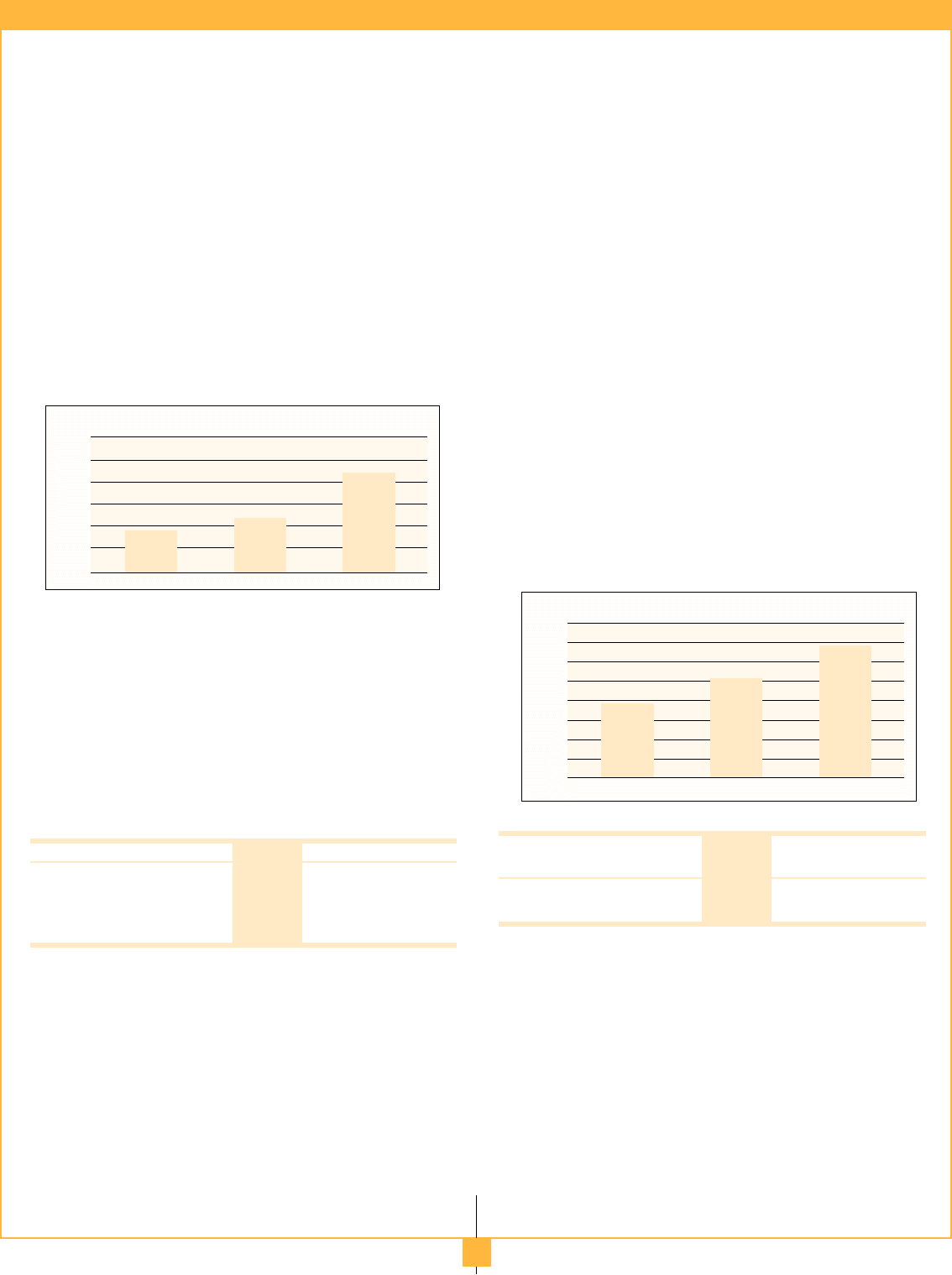

Gross Margin

($ in millions)

2004 2003 2002

FIFO gross margin

$ 7,121 $ 6,614 $ 6,340

LIFO credit/(charge)

18 6 (6)

LIFO gross margin

$ 7,139 $ 6,620 $ 6,334

As a percent of sales

38.7% 37.2% 35.9%

Gross margin improved for the fourth consecutive year and was

$7,139 million compared to $6,620 million in 2003 and $6,334 million

in 2002. As a percent of sales, gross margin improved 150 basis

points over last year and represents a 690 basis-point increase over

the past four years, which restores the Company’s gross margin to

competitive levels and was part of the turnaround plan. The continued

improvement reflects better inventory management, good seasonal

transition, better timing of clearance markdowns, more consistent

execution and continuing benefits from the centralized merchandis-

ing model. Benefits of the centralized model, which was substantial-

ly in place by the end of 2004, have included enhanced merchandise

offerings, an integrated marketing plan, leverage in the buying and

merchandising process and more efficient selection and allocation of

merchandise to individual department stores. Gross margin also

reflects initial benefits from the Company’s new planning, allocation

and replenishment systems, which were rolled out in the latter part of

the year.

$3.00

$2.50

$2.00

$1.50

$1.00

$0.50

$-

$0.95

$1.21

$2.23

2002 2003 2004

Diluted Earnings Per Share - Continuing Operations

Gross Margin % of Sales

40.0%

39.0%

38.0%

37.0%

36.0%

35.0%

34.0%

33.0%

32.0%

35.9%

37.2%

38.7%

2002 2003 2004