JCPenney 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

Management’s Discussion and Analysis of Financial Condition and Results of Operations

22

retiree prescription drug benefits that are at least actuarially equiva-

lent to those offered under the government sponsored Medicare Part

D. While the provisions of FSP SFAS No. 106-2 were effective in the

Company’s third quarter of 2004, final regulations that define actuar-

ial equivalency were not issued until January 2005. As a result, the

disclosures included in Note 17 do not reflect the potential effects of

the Act, which, due largely to the cap on Company contributions, are

not expected to have a material effect on the Company’s consolidat-

ed financial statements.

In November 2004, the FASB issued SFAS No. 151, “Inventory

Costs – An Amendment of ARB No. 43, Chapter 4.” SFAS No. 151

amends the guidance in ARB No. 43, Chapter 4, “Inventory Pricing,”

to clarify the accounting for abnormal amounts of idle facility

expense, freight, handling costs and wasted material (spoilage).

SFAS No. 151 is effective for fiscal years beginning after June 15,

2005 and will be early-adopted by the Company in the first quarter

of fiscal 2005. The Company does not expect SFAS No. 151 to have

amaterial impact on the Company.

In December 2004, the FASB issued SFAS No. 123 (revised)

(SFAS No. 123R), "Share-Based Payment." SFAS No. 123R will elim-

inate the ability to account for share-based compensation transac-

tions using APB No. 25 and will require instead that compensation

expense be recognized based on the fair value of the award on the

date of grant. Additional footnote disclosures will also be required.

While the Company is not required to adopt SFAS No. 123R until the

third quarter of 2005, it has elected to early-adopt the statement

effective January 30, 2005 using the modified prospective method of

application. Under this method, in addition to reflecting compensa-

tion expense for new share-based awards, expense will also be rec-

ognized to reflect the remaining vesting period of awards that had

been included in pro-forma disclosures in prior periods. The

Company estimates that the adoption of SFAS No. 123R in 2005 will

result in a charge of $19 million ($11 million after tax), or $0.05 per

share. The Company will not adjust prior year financial statements

under the optional modified retrospective method of adoption.

On February 7, 2005, the Chief Accountant of the Securities and

Exchange Commission (SEC) issued a letter to the American Institute

of Certified Public Accountants expressing the SEC staff’s views on

certain operating lease accounting issues and their application

under GAAP. As a result, the Company reviewed its accounting for

store leases and leasehold improvements and recorded an $8 mil-

lion pre-tax charge, primarily to synchronize the depreciation periods

of buildings and leasehold improvements with the related lease

terms, including renewal periods that were considered reasonably

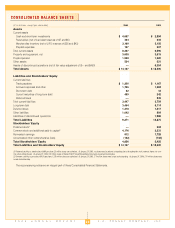

assured of occurring. In addition, the Company recorded a $111 mil-

lion balance sheet adjustment at January 29, 2005 to increase

Property and Equipment, Net and establish a deferred rent liability,

included in Other Liabilities in the Company’s Consolidated Balance

Sheet, for the unamortized balance of developer/tenant allowances.

Historically, construction allowances were classified as reductions to

Property and Equipment, Net. The Company has changed its

accounting policies related to lease accounting to be consistent with

the SEC guidance. See Note 1 on page 30.

FISCAL YEAR 2005

In February 2005, management communicated the following guid-

ance for 2005:

•Comparable department store sales are expected to increase

low-single digits for 2005, and Catalog/Internet sales are expected to

increase low-to-mid single digits for the year.

• Earnings from continuing operations are expected to be in the

range of $2.89 to $3.01 per share for 2005, including the impact of

charges related to planned open-market purchases of debt.

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION

This Annual Report, including the Chairman’s letter, may contain

forward-looking statements made within the meaning of the Private

Securities Litigation Reform Act of 1995, which reflect the Company’s

current view of future events and financial performance. The words

expect, plan, anticipate, believe, intent, should, will and similar

expressions identify forward-looking statements. Any such forward-

looking statements are subject to risks and uncertainties that may

cause the Company’s actual results to be materially different from

planned or expected results. Those risks and uncertainties include,

but are not limited to, the risks and uncertainties set forth on pages

15-18, competition, consumer demand, seasonality, economic con-

ditions, including gasoline prices, changes in management, retail

industry consolidations, acts of terrorism or war and government

activity. In addition, the Company typically earns a disproportionate

share of its operating income in the fourth quarter due to holiday buy-

ing patterns, which are difficult to forecast with certainty. While the

Company believes that its assumptions are reasonable, it cautions

that it is impossible to predict the impact of such factors that could

cause actual results to differ materially from predicted results. The

Company intends the forward-looking statements in this Annual

Report to speak only at the time of its release and does not under-

take to update or revise these projections as more information

becomes available.