JCPenney 2004 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

Management’s Discussion and Analysis of Financial Condition and Results of Operations

14

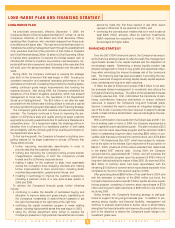

Contractual Obligations and Commitments

Aggregated information about the Company’s contractual obligations and commitments as of January 29, 2005 is presented in the

following tables.

Contractual Obligations After

($ in millions)

Total 2005 2006 2007 2008 2009 5 years

Long-term debt, including current maturities

$ 3,923 $ 459 $ 21 $ 433 $ 203 $ –– $ 2,807

Short-term debt - Renner

22 22 — — — — —

Trade payables

1,200 1,200 — — — — —

Operating leases(1)

1,197 226 185 149 130 110 397

Contributions to non-qualified supplemental retirement

and postretirement medical plans(2)

504 75 76 78 81 32 162

Contractual obligations(3)

163 107 43 10 3 –– ––

Total

$ 7,009 $ 2,089 $ 325 $ 670 $ 417 $ 142 $ 3,366

(1) Represents future minimum lease payments for non-cancelable operating leases, including operating lease obligations assumed when the Company terminated third-party service contracts for certain store

distribution centers.

(2) Includes expected payments through 2014.

(3) Consists primarily of (a) minimum purchase requirements for exclusive merchandise; (b) royalty obligations; and (c) minimum obligations for energy services, software maintenance and network services.

The Company is predominantly engaged in the retailing business of buying and selling merchandise. In the normal course of business, the

Company issues purchase orders to vendors/suppliers for merchandise inventory to meet customer demand for style, seasonal and basic mer-

chandise. The Company’s purchase orders are not unconditional commitments but, rather, represent executory contracts requiring perform-

ance by vendors/suppliers, including delivering the merchandise prior to a specified cancellation date and meeting product specifications and

other requirements. Failure to meet agreed-upon terms and conditions may result in the cancellation of the order. Accordingly, the table above

excludes outstanding purchase orders for merchandise inventory that has not been shipped. Under the terms of the purchase orders, mer-

chandise is purchased on a F.O.B. (Free on Board) shipping point basis. As a result, the cost of merchandise shipped but not received by the

Company as of year end (in-transit merchandise) is recorded on the Consolidated Balance Sheets in Merchandise Inventory with a correspon-

ding offset to Trade Payables. As of January 29, 2005, the Company had approximately $364 million of domestic and foreign in-transit mer-

chandise, which together with trade payables for merchandise already received, is reflected in the table above. Additionally, the Company

issues letters of credit for merchandise inventory sourced overseas, which are included in the Commitments table below.

Commitments

After

($ in millions)

Total 2005 2006 2007 2008 2009 5 years

Standby and import letters of credit(1)

$ 153 $ 153 $—$—$—$—$—

Surety bonds(2)

80 80—————

Guarantees(3)

76 — 8 7 –– 3 58

Total

$ 309 $ 233 $ 8 $ 7 $ –– $ 3 $ 58

(1) Standby letters of credit ($143 million at January 29, 2005) are issued as collateral to a third-party administrator for self-insured workers’ compensation and general liability claims. The remaining $10 million are

outstanding import letters of credit.

(2) Surety bonds are primarily for previously incurred and expensed obligations related to workers’ compensation and general liability claims.

(3) Includes (a) $28 million for certain personal property leases assumed by the purchasers of Eckerd; (b) $18 million on loans related to a real estate investment trust; (c) $20 million related to a third-party reinsurance

guarantee; and (d) $10 million related to certain leases for stores that were sold in 2003, which is recorded in Accrued Expenses and Other.

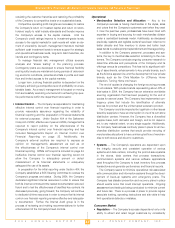

FIFO EBITDA

($ in millions)

2004 2003 2002

Income from continuing

operations before

income taxes (GAAP)

$ 1,020 $ 546 $ 415

Add back/(deduct):

Net interest expense

233 261 226

Bond premiums and

unamortized costs

47 –– ––

Real estate and other

expense/(income)

12 (17) 59

Depreciation and

amortization

368 372 365

LIFO (credit)/charge

(18) (6) 6

FIFO EBITDA of continuing

operations (non-GAAP)

$ 1,662 $ 1,156 $ 1,071

Earnings before interest, taxes, depreciation and amortization

and LIFO (FIFO EBITDA) of continuing operations was $1,662 mil-

lion, $1,156 million and $1,071 million for 2004, 2003 and 2002,

respectively. The improvement over the past three years is due to

consistent execution of the Company’s turnaround strategies and

resulting higher income from continuing operations. FIFO EBITDA

is included in the leverage ratio covenant in the Company’s credit

agreement and is a key measure of cash flow generated and is

focused upon by debt investors and the credit rating agencies. It

is provided as an alternative assessment of operating perform-

ance. It is not intended to be a substitute for GAAP measurements

and may vary for other companies.