JCPenney 2004 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

Notes to the Consolidated Financial Statements

40

The 2001 Plan does not permit awarding stock options below grant-date market value. Options have a maximum term of 10 years. Over

the past three years, the Company’s annual stock option grants have averaged about 1.6% of total outstanding stock.

The 2001 Plan also provides for grants of restricted stock awards and stock options to non-employee members of the Board of Directors.

Restricted stock awards granted to such directors are not transferable until a director terminates service. The Company granted shares of

common stock totaling 24,024, 36,682 and 21,266 to non-employee members of the Board of Directors in 2004, 2003 and 2002, respectively.

Total expense recorded for these directors’ awards was $0.8 million, $0.7 million and $0.5 million in 2004, 2003 and 2002, respectively.

Stock Options

At January 29, 2005, options to purchase 13.8 million shares of common stock were outstanding. If all options were exercised, common

stock outstanding would increase by 5.1%. At the end of 2004, 10.8 million, or 78% of the 13.8 million outstanding options, were exercis-

able. Of those, 72% were "in-the-money" or had an exercise price below the closing price of $41.69 on January 29, 2005, as shown in the

following schedule:

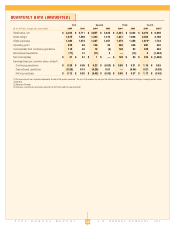

(shares in thousands, price is weighted-average exercise price)

Exercisable Unexercisable Total

Shares % Price Shares % Price Shares % Price

In-the-money

7,797 72% $25 2,956 97% $31 10,753 78% $27

Out-of-the-money(1)

2,983 28% 56 95 3% 42 3,078 22% 55

Total options outstanding

10,780 100% $33 3,051 100% $31 13,831 100% $33

(1) Out-of-the-money options are those with an exercise price equal to or above the closing price of $41.69 at the end of 2004.

A summary of stock option activity follows:

(shares in thousands, price is weighted-average exercise price)

Outstanding Exercisable

Shares Price Shares Price

January 26, 2002

18,690 $ 30 5,840 $ 48

Granted

4,993 20

Exercised

(610) 15

Canceled/forfeited

(806) 38

January 25, 2003

22,267 $ 28 14,551 $ 33

Granted

5,136 20

Exercised

(1,843) 17

Canceled/forfeited

(1,083) 39

January 31, 2004

24,477 $ 27 17,642 $ 30

Granted

3,365 31

Exercised

(12,835) 19

Canceled/forfeited

(1,176) 46

January 29, 2005

13,831 $ 33 10,780 $ 33

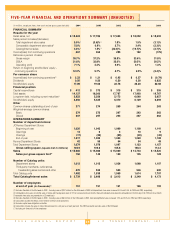

Net cash proceeds from exercise of stock options were $248 mil-

lion, $31 million and $9 million in 2004, 2003 and 2002, respec-

tively. The related income tax benefit totaled $82 million, $4 million

and $1 million in 2004, 2003 and 2002, respectively.

The following table summarizes stock options outstanding at

January 29, 2005:

(shares in thousands, price is weighted-average exercise price)

Outstanding Exercisable

Exercise Remaining

Price Range Shares Price Term (Years) Shares Price

$11-below $20

3,384 $18 6.7 3,249 $18

$20-$29

1,620 21 7.1 1,603 21

$30-$39

5,668 33 6.7 2,864 36

$40-$49

2,072 46 1.8 1,977 46

$50-$71

1,087 71 2.8 1,087 71

Total

13,831 $33 5.7 10,780 $33

The Company follows the intrinsic value expense recognition

provisions of APB No. 25 as permitted by SFAS No. 123. As a

result, no compensation expense is recognized for stock options

since all options granted have an exercise price equal to the mar-

ket value of the underlying stock on the date of grant. As required

by SFAS No. 123, the Company estimates the pro-forma effect of

recording the estimated Black-Scholes fair value of stock options

as expense over the vesting period. See Stock-Based

Compensation in Note 1 on page 31. The Company will begin

expensing stock options in fiscal 2005. See discussion under Effect

of New Accounting Standards in Note 1 on page 33.

Stock Awards

The Company awarded approximately 567,000, 364,000 and

227,000 shares of stock to employees with weighted-average grant-

date fair values per share of $33.59, $19.43 and $20.09 in 2004,

2003 and 2002, respectively. Total expense recorded for restricted

stock awards was $22 million, $8 million and $5 million in 2004, 2003

and 2002, respectively.

16 LEASES

The Company conducts the major part of its operations from

leased premises that include retail stores, store distribution cen-

ters, warehouses, offices and other facilities. Almost all leases will

expire during the next 20 years; however, most leases will be

renewed or replaced by leases on other premises. Rent expense

for real property operating leases totaled $238 million in 2004,

$231 million in 2003 and $252 million in 2002, including contingent

rent, based on sales, of $26 million, $23 million and $24 million for

the three years, respectively.

JCPenney also leases data processing equipment and other

personal property under operating leases of primarily three to five

years. Rent expense for personal property leases was $72 million

in 2004, $80 million in 2003 and $85 million in 2002.

In December 2003, JCP notified the third-party service providers

of the six outsourced store distribution centers of its intent to termi-

nate contracted services. On January 30, 2004, JCP purchased

the equipment of four of the outsourced store distribution centers

for $34 million. In accordance with the related service contracts,

JCP assumed approximately $115 million of the building and

remaining equipment leases during 2004. Accordingly, the table

below includes these lease obligations.