JCPenney 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

Notes to the Consolidated Financial Statements

31

urement of the Company’s pension obligation, as of October 31,

2004, the Company began using the Retirement Plans 2000 Table of

Combined Healthy Lives, projected to 2005, using Scale AA to fore-

cast mortality improvements five years into the future to 2005.

Previously, the Company had utilized the 1983 Group Annuity

Mortality Table, which it continues to use for calculating funding

requirements based on Internal Revenue Service regulations.

Income Taxes

Income taxes are accounted for under the asset and liability

method prescribed by SFAS No. 109, “Accounting for Income

Taxes.” Deferred tax assets and liabilities are recognized for the

future tax consequences attributable to differences between the

financial statement carrying amounts of existing assets and liabili-

ties and their respective tax bases and operating loss and tax cred-

it carryforwards. Deferred tax assets and liabilities are measured

using enacted tax rates expected to apply to taxable income in the

years in which those temporary differences are expected to be

recovered or settled. The effect on deferred tax assets and liabili-

ties of a change in tax rates is recognized in income in the period

that includes the enactment date. A valuation allowance is record-

ed to reduce the carrying amounts of deferred tax assets unless it

is more likely than not that such assets will be realized.

Earnings/(Loss) per Share

Basic earnings/(loss) per share (EPS) is computed by dividing net

income/(loss) less dividend requirements on the Series B ESOP

Convertible Preferred Stock, net of tax as applicable, by the weight-

ed-average number of common shares outstanding for the period.

Except when the effect would be anti-dilutive at the continuing oper-

ations level, the diluted EPS calculation includes the impact of restrict-

ed stock units and shares that, during the period, could have been

issued under outstanding stock options, as well as common shares

that would have resulted from the conversion of convertible deben-

tures and convertible preferred stock. If the applicable shares are

included in the calculation, the related interest on convertible deben-

tures (net of tax) and preferred stock dividends (net of tax) are added

back to income, since these would not be paid if the debentures or

preferred stock were converted to common stock. Both the convert-

ible debentures and preferred stock were converted to common

stock in the second half of 2004. See Note 3.

Stock-Based Compensation

The Company has a stock-based compensation plan, which is

discussed more fully in Note 15. The Company accounts for the

plan under the recognition and measurement principles of

Accounting Principles Board Opinion No. 25, “Accounting for Stock

Issued to Employees” (APB No. 25), and related interpretations.

No stock-based employee compensation cost is reflected in the

accompanying Consolidated Statements of Operations for stock

options, since all options granted under the plan have an exercise

price equal to the market value of the underlying common stock on

the date of grant. Compensation expense for restricted stock

awards with pro-rata vesting is recorded on a straight-line basis

over the vesting period, which typically ranges from one to five

years.

The following table illustrates the effect on net income/(loss) and

EPS as if the Company had applied the fair value recognition pro-

visions of SFAS No. 123, “Accounting for Stock-Based

Compensation,” to stock options. Pro-forma expense for stock

options with pro-rata vesting is reflected on a straight-line basis

over the vesting period, which typically ranges from one to five

years.

($ in millions, except EPS)

2004 2003 2002

Net income/(loss), as

reported

$ 524 $ (928) $ 405

Add: Stock-based employee

compensation expense

included in reported net

income/(loss), net of related tax

effects

1353

Deduct: Total stock-based

employee compensation

expense determined under

fair value method for all

awards, net of related

tax effects

(24) (26) (23)

Pro-forma net income/(loss)

$ 513 $ (949) $ 385

Earnings/(loss) per share:

Basic—as reported

$ 1.83 $ (3.50) $ 1.41

Basic—pro forma

$ 1.80 $ (3.58) $ 1.34

Diluted—as reported

$ 1.76 $ (3.13) $ 1.36

Diluted—pro forma

$ 1.73 $ (3.20) $ 1.30

The Company used the Black-Scholes option-pricing model to

estimate the grant date fair value of its stock option grants for the

periods presented above. For stock options issued in 2004, the

Company updated its assumptions related to stock option valua-

tion in order to better reflect expected stock option exercise behav-

ior and expected future stock price volatility. These changes were

based on a detailed review of historical exercise patterns, as well

as a normalization of volatility, both due to upward movement of the

Company’s stock price with improved operating performance dur-

ing the turnaround and were made in consultation with an outside

valuation specialist. Including these changes, the following Black-

Scholes assumptions were used to estimate the grant date fair

value of stock options:

Option Assumptions

2004 2003 2002

Dividend yield

1.4% 3.9% 3.9%

Expected volatility

30.0% 42.4% 40.0%

Risk-free interest rate

3.0% 3.4% 4.7%

Expected option term

5 years 7 years 7 years

Weighted-average fair value

of options at grant date

$ 8.58 $ 6.07 $ 6.32

The Company will begin recognizing stock option expense in fis-

cal 2005 based on the fair value of the award on the date granted.

See discussion under Effect of New Accounting Standards on

page 33.

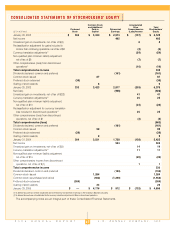

Comprehensive Income/(Loss)

Comprehensive income/(loss) consists of two components: net

income/(loss) and other comprehensive income/(loss). Other com-

prehensive income/(loss) is the sum of currency translation adjust-

ments, unrealized gains/(losses) on investments and non-qualified

plan minimum liability adjustments. Other Comprehensive

Income/(Loss) is presented in the Consolidated Statements of

Stockholders’ Equity.