JCPenney 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

Management’s Discussion and Analysis of Financial Condition and Results of Operations

13

fundamental part of the Company’s store operations.

While this ratio is not intended to be a substitute for the compa-

rable GAAP measure, management believes that this provides a

more comprehensive and realistic view of financial leverage. Debt

investors and the credit rating agencies also consider off-balance

sheet debt when evaluating financial leverage.

Debt percent to total capital, both including and excluding the

impact of PVOL, is as follows:

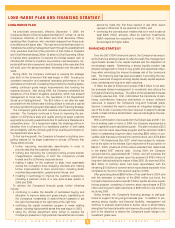

($ in millions)

2004 2003 2002

Long-term debt(1)

$ 3,923 $ 5,356 $ 5,173

Short-term debt

22 18 13

Total debt

3,945 5,374 5,186

PVOL

711 657 659

Total debt, including PVOL

4,656 6,031 5,845

Consolidated equity

4,856 5,425 6,370

Total capital(2)

$ 9,512 $ 11,456 $ 12,215

Debt percent to total capital

44.8%(3) 49.8% 44.9%

Debt percent to total capital,

including PVOL

48.9%(3) 52.6% 47.9%

(1) Includes current maturities, capital leases and other.

(2) Eckerd PVOL of $3.3 billion and $2.9 billion for 2003 and 2002, respectively, and securitization of

receivables of approximately $200 million for both 2003 and 2002 have been excluded due to Eckerd

being reported as a discontinued operation.

(3) Assuming the completion of $1 billion of common stock repurchases in the 2004 Capital Structure

Repositioning Plan, debt percent to total capital would be 50.9% and debt percent to total capital, includ-

ing PVOL, would be 55.0%.

The Company’s capital structure in 2004 was positively impacted

by improved earnings and $599 million of positive free cash flow

generated from continuing operations. The Eckerd sale and the sub-

sequent capital structure repositioning plan also served to strength-

en the Company’s financial position. Going forward, the financing

strategy is well-positioned to support the Company’s business plans.

In addition to preserving strong liquidity and financial flexibility, man-

agement will continue to evaluate opportunities to deliver value to

stockholders, strengthen the financial position and improve the cred-

it rating profile in support of its objective to restore the Company’s

credit ratings to an investment-grade level.

Working Capital

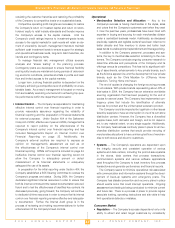

($ in millions)

2004 2003

Current assets

$ 8,427 $ 6,590

Less: Current liabilities

(3,447) (3,754)

Working capital

$ 4,980 $ 2,836

Working capital increased approximately $2.2 billion at year-end

2004 to $5.0 billion compared to $2.8 billion at year-end 2003. This is

primarily the result of a net increase in Cash and Short-Term Investments

from better operating performance that generated approximately $600

million of free cash flow, along with the proceeds from the Eckerd

sale.

Total LIFO inventory was $3,169 million at the end of 2004 compared

with $3,156 million at the end of 2003. FIFO merchandise inventory was

$3,194 million at the end of 2004, basically flat with last year’s $3,199

million. After an effective transition from fall and holiday assortments,

the Company was well positioned with fresh merchandise for the Spring

season. Inventory reflected a good balance among seasonal, basics

and key items. Using new systems and the network of store distribu-

tion centers, the Company has continued to enhance its ability to allo-

cate and flow merchandise to stores in-season by recognizing sales

trends earlier and accelerating receipts, replenishing individual stores

based on rates of sale and consistently providing high in-stock levels in

basics and advertised items. This continued improvement of inventory

management has helped to drive more profitable sales.

Credit Agreement

The Company has a $1.5 billion revolving credit agreement (cred-

it facility) that is scheduled to expire in May 2005. Indebtedness

incurred under the credit facility is collateralized by all eligible

domestic inventory, as defined in the credit facility agreement. This

credit facility provides the Company with an additional source of liq-

uidity for working capital needs and letter of credit support. During

2004, the credit facility was amended to permit the sale of Eckerd

Corporation and its affiliates and assets, allow a broader range of

cash investments and permit issuing banks to extend maturities of

certain letters of credit past the expiration of the credit facility as long

as they are collateralized with cash at that time. No borrowings have

been made under this credit facility, other than the issuance of import

and standby letters of credit, which totaled $153 million as of year-

end 2004. The Company was in compliance with all financial

covenants of the credit facility as of January 29, 2005. See further

discussion of these covenants below.

As discussed previously, the Company is planning to replace its

$1.5 billion credit facility with a new $1.2 billion credit facility in April

2005. The dollar amount of the credit facility is being decreased due

to the Eckerd sale. It is expected that the new credit facility will have

no collateral requirement and provide adequate liquidity for the

Company’s peak seasonal working capital needs.

Debt Covenants and Other

Under the $1.5 billion credit facility discussed above, the Company

is required to maintain an asset coverage ratio, defined as eligible

inventory to total revolving credit exposure, of at least 1.75 to 1.0.

Given that there were no borrowings other than the issuance of letters

of credit, this ratio was 20.3 to 1.0 at year-end 2004, far exceeding the

requirement.

Additionally, the $1.5 billion credit facility includes a leverage ratio

covenant, which consists of a maximum ratio of total debt to consoli-

dated earnings before interest, taxes, depreciation and amortization

(EBITDA, as defined in the credit agreement), as measured on a trail-

ing four-quarters basis, calculated at each quarter end. As of year-

end 2004, the actual leverage ratio was 2.14 to 1.0, well within the

prescribed limit of 3.75 to 1.0.

The Company also has indentures covering approximately $275

million of long-term debt that contain a financial covenant requiring

the Company to have a minimum of 200% net tangible assets to sen-

ior funded indebtedness (as defined in the respective indentures).

These indentures permit the Company to issue additional long-term

debt if it is in compliance with the covenant. At year-end 2004, the

Company’s percent of net tangible assets to senior funded indebted-

ness was 302%.

The Company’s liquidity is enhanced by the fact that the current

debt portfolio and material lease agreements contain no provisions

that could trigger acceleration of payments or collateral support in the

event of adverse changes in the Company’s financial condition.