JCPenney 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

Management’s Discussion and Analysis of Financial Condition and Results of Operations

16

established and consists of associates dedicated full-time to man-

aging the ongoing process of monitoring and self-testing key con-

trols throughout the organization, documenting and testing signifi-

cant changes to internal controls over financial reporting and meet-

ing all of the related reporting requirements.

Independent Support Functions

— Internal Audit, Legal and

Finance support the Company’s risk management function. They

operate independently of the operating divisions of the Company.

As an important component of the Company’s control structure, the

Internal Audit department reports functionally to the Audit

Committee of the Board of Directors. Internal Audit performs

reviews and completes test work to ensure that: (a) risks are appro-

priately identified and managed; (b) interaction with various inter-

nal governance groups, such as the legal compliance coordina-

tors, occurs as needed; (c) significant financial, managerial and

operating information is reliable and timely; (d) associates’ actions

are in compliance with policies, standards, procedures and appli-

cable laws and regulations; (e) resources are acquired economi-

cally, used efficiently and adequately protected; (f) quality and con-

tinuous improvement are fostered in the organization’s control

process; and (g) significant legislative or regulatory issues impact-

ing the organization are recognized and addressed appropriately.

Legal compliance coordinators, working with Internal Audit, are

responsible for ensuring that all areas of the Company have effec-

tive procedures in place to comply with various laws and regula-

tions and any changes thereto.

Categories of Risk

Management defines risk as the potential deviation from planned

operating results that may have a negative impact on investor enter-

prise value in the short or long term. The deviation can arise from

inadequate or ineffective internal processes or systems, external

events or Company personnel. The Company’s key risks and relat-

ed risk mitigation/management practices are discussed below.

Business

•Strategic —The Company’s key business risk would be the

failure to consistently execute in a centralized environment and

achieve sustainable operating performance at the Company’s

targeted levels. In addition, it will be critical to continue the

positive momentum experienced over the last four years to

transition from a turnaround to a leadership position in both sales

and profitability.

A strong foundation has been built as the Company has made

the transition to a centralized merchandising model, improved the

merchandise assortments and related marketing and strength-

ened the Company’s core private brands. The Company has

established centralized store distribution centers and inventory

systems that allow the Company to improve the planning of mer-

chandise assortments, allocate inventory and stock stores and

better track sales trends enabling prompt replenishment and

timely pricing decisions. The Company’s overall goal is to provide

customers with stylish merchandise at competitive prices in an

exciting and consistent store environment. The Company’s initia-

tives over the next few years will be to improve the customer

experience by leveraging the Company’s multiple shopping

channels with coordinated merchandise assortments and mar-

keting events, continue to build and improve the Company’s

strong private brands, invest in the renewal of high-potential

stores, expand the Company’s presence through the addition of

off-mall stores and invest in new technology.

While results have been positive and the turnaround is essen-

tially complete, the Company will face continued challenges, par-

ticularly as it moves beyond the turnaround to its longer-term

strategic priorities. Key to meeting the Company’s long-term cus-

tomer and financial goals is continued realization of the benefits

from centralized buying and allocation. The effectiveness of

these processes and systems is an important component of the

Company’s ability to have the right inventory at the right place,

time and price. Also key to success will be the customer’s

response to initiatives related to new private brands being rolled

out, such as nicole by Nicole Miller, expansion of other private

brands, such as the Chris Madden for JCPenney Home

Collection, Turning Home into Haven, as well as investments to

make the shopping experience easier, such as the new point-of-

sale technology that will be rolled out in 2005 and 2006.

•Management —Since 2000, the Company has hired

seasoned individuals, including executive level and

others with a breadth of experience in merchandising,

marketing, buying and allocation under a centralized model, as

well as to manage Catalog and Internet operations. The Board of

Directors dedicated significant effort during 2004 to

identify and appoint the right individual to lead the Company

beyond the turnaround. This search led to the appointment of

Myron E. Ullman, III, as the Company’s new Chairman of the

Board and Chief Executive Officer effective December 1, 2004.

While the risk always exists that key management associates

could decide to leave the Company, the depth of experience in

all critical areas of the Company mitigates that risk to a certain

degree. In addition, one of the CEO’s priorities is to make

JCPenney a great place to work. This initiative, combined with

the sense of accomplishment for the progress that has been

made over the past few years, creates an atmosphere where

associates want to be part of a winning team and should con-

tribute to the Company’s ability to retain quality personnel over

the longer term.

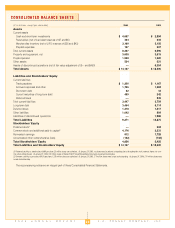

Financial

•Financial Position and Liquidity —The Company’s successful

execution of its financing strategy over the past four years,

combined with the sale of Eckerd in 2004, has mitigated the

strategic risk inherent during the turnaround period by providing the

financial resources necessary to increase capital spending to

fund planned department store renewals, new mall and off-mall

stores and relocations, and to make additional investments in

technology. This has allowed the operating leadership within

the Company time to focus on converting to a centralized

merchandising organization, enhance the merchandise

assortments and marketing efforts, with the ultimate goal of