JCPenney 2004 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

Notes to the Consolidated Financial Statements

44

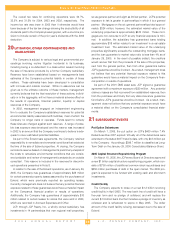

The discount rates used for the postretirement plan are the same

as those used for the defined benefit plans, as disclosed on pages

41-42, for all periods presented. Changes in the postretirement

benefit obligation are as follows:

Postretirement Benefit Obligation

($ in millions)

2004 2003

Benefit obligation, beginning of year

$ 171 $ 186

Service and interest cost

14 16

Participant contributions

33 37

Transfer of liability from Eckerd plan

1––

Actuarial (gain)

(28) (27)

Gross benefits paid

(42) (41)

Net postretirement obligation

$ 149 $ 171

The Company’s postretirement benefit plans were amended in

2001 to reduce and cap the per capita dollar amount of the bene-

fit costs that would be paid by the Company. Thus, changes in the

assumed or actual health care cost trend rates do not materially

affect the APBO or the Company’s annual expense.

Cash Contributions

Although no additional funding was required under ERISA, the

Company made voluntary contributions of $300 million, or $190 mil-

lion after tax, to its pension plan in October of 2004 and 2003.

For the qualified pension plan, the Company does not expect to be

required to make a contribution in 2005 under ERISA. It may decide

to make a discretionary contribution, however, depending on market

conditions and the resulting funded position of the plan. The

Company’s policy with respect to funding the qualified plan is to fund

at least the minimum required by ERISA of 1974, as amended, and

not more than the maximum amount deductible for tax purposes. The

Company does not currently have minimum funding requirements, as

set forth in employee benefit and tax laws. All contributions made to

the funded pension plan for 2004 and 2003 were voluntary.

Company payments to the unfunded non-qualified supplemental

retirement plans are equal to the amount of benefit payments made to

retirees throughout the year and for 2005 are anticipated to be

approximately $61 million. The expected contributions for 2005 to

2008 have increased compared to those in recent years due to a

December 2003 amendment to these plans that allowed participants

aone-time irrevocable election to receive remaining unpaid benefits

over a five-year period in equal annual installments.

All other postretirement benefit plans are not funded and are not

subject to any minimum regulatory funding requirements. The

Company estimates the 2005 postretirement plan payments will

approximate $14 million, representing the Company’s defined dollar

contributions toward medical coverage.

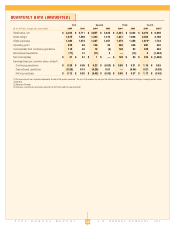

Estimated Future Benefit Payments

Primary Other

Pension Plan Supplemental Postretirement

($ in millions)

Benefits(1) Plan Benefits(1) Benefits(1) Total(1)

2005

$ 210 $ 61 $ 14 $ 285

2006

219 63 13 295

2007

229 65 13 307

2008

239 68 13 320

2009

250 19 13 282

2010-2014

1,412 99 63 1,574

(1) Does not include plan expenses.

Defined Contribution Plans

The Company’s Savings, Profit-Sharing and Stock Ownership

Plan is a defined contribution plan available to all eligible associ-

ates of the Company and certain subsidiaries. Associates who

have completed at least 1,000 hours of service within an eligibility

period (generally 12 consecutive months) and have attained age

21 are eligible to participate in the plan. Vesting of Company con-

tributions occurs over a five-year period. The Company con-

tributes to the plan an amount equal to 4.5% of the Company’s

available profits, as well as discretionary contributions designed to

generate a competitive level of benefits. Total Company contribu-

tions for 2004 and 2003 were $47 million and $45 million, respec-

tively, of which $19 million was a discretionary contribution in 2003.

Associates have the option of reinvesting matching contributions

made in Company stock into a variety of investment options, pri-

marily mutual funds. In addition, the Company has Mirror Savings

Plans, which are offered to certain management associates.

Total Company expense for defined contribution plans, including

the Mirror Plans, for 2004, 2003 and 2002 was $52 million, $47

million and $49 million, respectively.

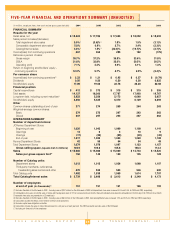

18 REAL ESTATE AND OTHER EXPENSE/(INCOME)

($ in millions)

2004 2003 2002

Real estate activities

$ (30) $ (28) $ (25)

Net gains from sale of

real estate

(8) (51) (16)

Asset impairments, PVOL and

other unit closing costs

19 57 75

Management transition costs

29 –– ––

Other

2 5 25

Total

$ 12 $ (17) $59

Real Estate Activities and Net Gains from Sale of Real Estate

Real estate activities consist of operating income for the

Company’s real estate subsidiaries. The Company recognized net

gains on the sale of facilities that were no longer being used in

Company operations and income from investments in real estate

partnerships.

Asset Impairments, PVOL and Other Unit Closing Costs

In 2004, the Company recorded charges of $19 million for asset

impairments, present value of operating lease obligations (PVOL)

and other unit closing costs. These costs consisted of $12 million

of asset impairments and $7 million of unit closing costs related pri-

marily to remaining lease obligations.

In 2003, the Company recorded charges of $57 million for asset

impairments, PVOL and other unit closing costs. These costs con-

sisted of $22 million of accelerated depreciation for Catalog facilities

closed in the second quarter of 2003, $26 million of asset impair-

ments and $9 million of unit closing costs related primarily to remain-

ing lease obligations and other.

The Company recorded charges of $75 million in 2002 related

primarily to asset impairments and PVOL for certain department

stores, catalog and other facilities. The impairment charges result-

ed from the Company’s ongoing process of evaluating the produc-

tivity of its asset base.