JCPenney 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. PENNEY COMPANY, INC.

2004 ANNUAL REPORT

STORES CATALOG .COM

Table of contents

-

Page 1

STORES C ATA L O G .COM J. C. P E N N E Y C O M PA N Y, I N C. 2004 ANNUAL REPORT -

Page 2

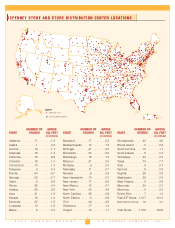

... I O N C E N T E R L O C AT I O N S STATE NUMBER OF STORES GROSS SQ. FEET (in millions) STATE NUMBER OF STORES GROSS SQ. FEET (in millions) STATE NUMBER OF STORES GROSS SQ. FEET (in millions) Alabama ...17 Alaska ...1 Arizona ...19 Arkansas ...16 California ...76 Colorado ...16 Connecticut... -

Page 3

OUR BUSINESS JCPenney is one of the largest retailers in the United States and offers its customers merchandise via three shopping channels - Department Stores, Catalog and Internet. Merchandise offerings consist of family apparel, jewelry, shoes, accessories and home furnishings. In addition, ... -

Page 4

...2003 2004 2004 A C C OM PL ISHME NT S • Achieved 7.1% operating profit margin, the mid-point of the targeted range of 6% to 8%, one year ahead of plan • Achieved sales gains for Department Stores and Catalog/Internet: + Comparable department store sales increased 5.0% + Catalog/Internet sales... -

Page 5

... sales. In November, we marked the 10-year anniversary of jcpenney.com, which has become one of the leading apparel and home furnishings sites in the retail industry. Further evidence of our progress in the Department Store and Catalog/Internet business this past year was our operating profit margin... -

Page 6

... comparable store sales growth, profitability, inventory productivity, and expense management. And, we are committed to being a great place to work. In my first months at JCPenney, I have conducted a number of town-hall type meetings. As I listen and learn from associates across this Company, I am... -

Page 7

... across the Company's three shopping channels and making further improvements to store environment, including better merchandise presentation, graphics and fixtures; and • investing in technology to improve the customer experience, including a planned rollout of a new point-of-sale system in 2005... -

Page 8

... total Catalog/Internet sales. Improved Profitability - Operating profit for 2004 increased 270 basis points to 7.1% of sales. With this improvement, the Company achieved its turnaround objective of 6% to 8% operating profit one year ahead of schedule. Strong sales growth, continued improvements in... -

Page 9

... of Long-Lived Assets," Eckerd's net assets were classified as "held for sale" and its results of operations and financial position presented as a discontinued operation as of year-end 2003, with prior periods reclassified accordingly. On July 31, 2004, the Company closed on the sale of Eckerd... -

Page 10

...Company's gross margin to competitive levels and was part of the turnaround plan. The continued improvement reflects better inventory management, good seasonal transition, better timing of clearance markdowns, more consistent execution and continuing benefits from the centralized merchandising model... -

Page 11

...Net gains from sale of real estate Asset impairments, PVOL(1) and other unit closing costs Management transition costs Other Total 700 3.9% $ (30) $ (8) 19 29 2 12 (28) $ (51) 57 - 5 (17) $ (25) (16) 75 -- 25 59 $ $ (1) Represents the present value of operating leases. Operating profit(1) As... -

Page 12

... to strengthen its financial position through improved operating performance, free cash flow and the 2004 sale of Eckerd. At year-end 2004, the Company had approximately $4.7 billion of Cash and Short-Term Investments, which exceeded the $3.9 billion of outstanding long-term debt, including current... -

Page 13

...of the Company's investment in both new and existing stores, as well as new point-of-sale technology. In accordance with its long-term financing strategy, the Equity - During 2004, the Company returned approximately $2.1 billion to stockholders through common stock repurchases and dividend payments... -

Page 14

...Repositioning Plan In August 2004, the Company initiated a major equity and debt reduction program focused on enhancing stockholder value, strengthening the capital structure and improving the credit rating profile. The Company is using the $3.5 billion in expected net cash proceeds from the sale of... -

Page 15

...based on rates of sale and consistently providing high in-stock levels in basics and advertised items. This continued improvement of inventory management has helped to drive more profitable sales. Long-term debt(1) Short-term debt Total debt PVOL Total debt, including PVOL Consolidated equity Total... -

Page 16

... maintenance and network services. The Company is predominantly engaged in the retailing business of buying and selling merchandise. In the normal course of business, the Company issues purchase orders to vendors/suppliers for merchandise inventory to meet customer demand for style, seasonal and... -

Page 17

...the system of internal control and financial reporting that is relied upon to provide reasonable assurance of compliance with the Company's operational risk management processes. The Finance Committee reviews the Company's overall financing plan and dividend policy, as well as the liquidity position... -

Page 18

... and related marketing and strengthened the Company's core private brands. The Company has established centralized store distribution centers and inventory systems that allow the Company to improve the planning of merchandise assortments, allocate inventory and stock stores and better track sales... -

Page 19

... applications used throughout the Company to track inventory flow, process transactions and generate performance and financial reports. The Company seeks to minimize operational risk associated with communication and information systems through the development of back-up systems and emergency plans... -

Page 20

... offerings or pricing, changing merchandise allocations among various store formats and locations based on customer demand shifts and changing marketing programs. The Company has multiple selling channels (e.g., department stores, catalogs and the Internet), and many different product lines... -

Page 21

...expected long-term rate of return on plan assets and the discount rate. Assumptions are determined based on Company information and market indicators and are evaluated at each annual measurement date (October 31). A change in any of these assumptions would have an effect on the Company's pension and... -

Page 22

...its long-term investment horizon. See further discussion of the asset allocation strategy for plan assets in Note 17. Since the inception of the Company's primary pension plan in 1966 through the October 31, 2004 measurement date, the average annual return has been 9.4%. After three years of decline... -

Page 23

...investors and have an associated cost of capital. The Company made cash contributions to its primary pension plan annually during the 1966-1983 period in order to provide an asset base to support the accelerating liability growth in the early years of the plan. Over the 1984-2004 period, the Company... -

Page 24

...Catalog/Internet sales are expected to increase low-to-mid single digits for the year. • Earnings from continuing operations are expected to be in the range of $2.89 to $3.01 per share for 2005, including the impact of charges related to planned open-market purchases of debt. CAUTIONARY STATEMENT... -

Page 25

... public accounting firm that audited the financial statements included in this 2004 Annual Report to Myron E. Ullman, III Chairman and Chief Executive Officer Robert B. Cavanaugh Executive Vice President and Chief Financial Officer Stockholders, has issued an attestation report on management... -

Page 26

... financial statements referred to above present fairly, in all material respects, the financial position of J. C. Penney Company, Inc. and subsidiaries as of January 29, 2005 and January 31, 2004, and the results of their operations and their cash flows for each of the years in the three-year period... -

Page 27

... M E NT S OF O P E R AT I O N S ($ in millions, except per share data) 2004 2003 2002 Retail sales, net Cost of goods sold Gross margin Selling, general and administrative expenses Net interest expense Bond premiums and unamortized costs Real estate and other expense/(income) Income from continuing... -

Page 28

... maturities of long-term debt Deferred taxes Total current liabilities Long-term debt Deferred taxes Other liabilities Liabilities of discontinued operations Total Liabilities Stockholders' Equity Preferred stock(1) Common stock and additional paid-in capital(2) Reinvested earnings Accumulated other... -

Page 29

... plan minimum liability adjustment, net of tax of $14 Other comprehensive income from discontinued operations, net of tax of $(1) Total comprehensive income Dividends declared, common and preferred Common stock issued Common stock repurchased and retired Preferred stock redeemed Vesting of stock... -

Page 30

..., PVOL and other unit closing costs Depreciation and amortization Net gains on sale of assets Company contributions to savings and profit sharing plans Benefit plans expense Pension contribution Stock-based compensation Deferred taxes Change in cash from: Receivables Inventory Prepaid expenses and... -

Page 31

... James Cash Penney in 1902 and has grown to be a major retailer, operating 1,017 JCPenney Department Stores throughout the United States and Puerto Rico and 62 Renner Department Stores in Brazil. The Company sells family apparel, jewelry, shoes, accessories and home furnishings to customers through... -

Page 32

... date of each year. The rate of compensation increase is another significant assumption used in the actuarial model for pension accounting and is determined based upon the Company's historical experience and future expectations. For retiree medical plan accounting, the health care cost trend rates... -

Page 33

...1.34 1.36 1.30 The Company used the Black-Scholes option-pricing model to estimate the grant date fair value of its stock option grants for the periods presented above. For stock options issued in 2004, the Company updated its assumptions related to stock option valuation in order to better reflect... -

Page 34

... on ending inventory, an internal index measuring price changes from the beginning to the end of the year is calculated using merchandise cost data at the item level. Total Company LIFO (credits)/charges included in Cost of Goods Sold were $(18) million, $(6) million and $6 million in 2004, 2003 and... -

Page 35

... of Long-Lived Assets," Eckerd's net assets were classified as "held for sale" and its results of operations and financial position presented as a discontinued operation as of year-end 2003, with prior periods reclassified accordingly. On July 31, 2004, the Company closed on the sale of Eckerd... -

Page 36

... the costs to exit the Colorado and New Mexico markets, severance payments to former Eckerd associates, assumption of the Eckerd Pension Plan and various post-employment benefit obligations and environmental indemnifications. Management reviewed and updated the reserves in the fourth quarter of 2004... -

Page 37

...t a t e me n t s Direct Marketing Services In 2001, JCP closed on the sale of its J. C. Penney Direct Marketing Services, Inc. (DMS) assets, including its J. C. Penney Life Insurance subsidiaries and related businesses, to a U.S. subsidiary of AEGON, N.V. The DMS sale generated net cash proceeds of... -

Page 38

...and other factors. The Company repurchased and retired 50.1 million shares of common stock during 2004 at a cost of approximately $2.0 billion. This represents approximately two-thirds of the total planned common stock repurchases under the 2004 Capital Structure Repositioning Program. As of January... -

Page 39

... a fair value of $5.9 billion. Concentrations of Credit Risk The Company has no significant concentrations of credit risk. 6 OTHER ASSETS ($ in millions) 2004 2003 Real estate investments Leveraged lease investments Capitalized software, net Goodwill - Renner Debt issuance costs, net Other Total... -

Page 40

...quarter end. As of year-end 2004, the actual leverage ratio was 2.14 to 1.0, well within the prescribed limit of 3.75 to 1.0. Effective June 2, 2004, this credit facility was amended to permit the sale of Eckerd Corporation and its affiliates and assets, to permit a broader range of cash investments... -

Page 41

...(k) savings plan, including the Company's employee stock ownership plan (ESOP), held 30 million shares of common stock or 11% of the Company's outstanding common stock. See Note 3 for a discussion of the Company's ongoing common stock repurchase program. Preferred Stock The Company has authorized 25... -

Page 42

... retail stores, store distribution centers, warehouses, offices and other facilities. Almost all leases will expire during the next 20 years; however, most leases will be renewed or replaced by leases on other premises. Rent expense for real property operating leases totaled $238 million in 2004... -

Page 43

... plans for certain management associates, a 1997 voluntary early retirement program, a contributory medical and dental plan and a 401(k) and employee stock ownership plan. Total Company expense for all retirement-related benefit plans was $167 million, $207 million and $106 million in 2004... -

Page 44

... to continued improvement in capital market returns in 2004 following the market rebound in 2003. The actual one-year return on pension plan assets at the October 31 measurement date in 2004 and 2003 was 11.7% and 19.5%, respectively. The unrecognized losses, including prior service cost, of $1,268... -

Page 45

... investment manager and monitored by the Company. Direct investments in JCPenney securities are not permitted, even though ERISA rules allow such investments up to 10% of a plan's assets. The plan's asset allocation policy is designed to meet the plan's future pension benefit obligations. The policy... -

Page 46

... on the sale of facilities that were no longer being used in Company operations and income from investments in real estate partnerships. Asset Impairments, PVOL and Other Unit Closing Costs In 2004, the Company recorded charges of $19 million for asset impairments, present value of operating lease... -

Page 47

..., the Company established an estimated current deferred tax liability of $875 million based on the pending sale Federal income tax at statutory rate State and local income tax, less federal income tax benefit Tax effect of dividends on ESOP shares Other permanent differences and credits Effective... -

Page 48

... million purchases of debt in the open market. The 2005 program is expected to be funded with existing cash and short-term investments. Credit Facility The Company expects to close on a new $1.2 billion revolving credit facility in April 2005. The new bank line of credit will have a five-year term... -

Page 49

...for the 2004 Capital Structure Repositioning Program to date up to 51.8 million shares at a cost of approximately $2,034 million. This represents approximately 68% of the total planned common stock repurchases under this program. 2005 Equity Compensation Plan In February 2005, the Company's Board of... -

Page 50

... independently for each of the quarters presented. The sum of the quarters may not equal the total year amount due to the impact of changes in average quarterly shares outstanding. (2) Represents 14 weeks. (3) Includes a cumulative pre-tax expense adjustment of $8 million related to lease accounting... -

Page 51

...' equity Financial position Capital expenditures Total assets Long-term debt, including current maturities(5) Stockholders' equity Other Common shares outstanding at end of year Weighted-average common shares: Basic Diluted OPERATIONS SUMMARY Number of department stores: JCPenney Department Stores... -

Page 52

.... The Company annually recognizes its associates' personal volunteer endeavors through the James Cash Penney Awards for Community Service. A more complete review of JCPenney's community relations efforts is available online at www.jcpenney.net/company/commrel. Diversity JCPenney has been a corporate... -

Page 53

... Chinni Executive Vice President, General Merchandise Manager, Home and Leisure, Fine Jewelry, Women's Accessories and Family Footwear Dale H. Nichol Senior Vice President, Director of Retail Systems Thomas A. Clerkin Senior Vice President, Director of Finance for Stores, Catalog and Internet... -

Page 54

... Annual Report. Common Stock Holdings The following table shows the approximate ownership percentage of the Company's common stock by major category as of December 31, 2004: % Ownership Institutional Company savings plans Individual and other 78% 11% 11% Dividends Paid Per Share and Market Price... -

Page 55

...Sales Period Release Date JCPenney Mailing Address J. C. Penney Company, Inc. P.O. Box 10001, Dallas, TX 75301-4314 Stock Exchange Listing Trading Symbol JCP New York Stock Exchange SEC Filings JCPenney SEC filings, including the following, are available on the Company's Investor Relations Web site... -

Page 56

... all in our power to pack the customer's dollar full of value, quality and satisfaction. To continue to train ourselves and our associates so that the service we give will be more and more intelligently performed. To improve constantly the human factor in our business. To reward the men and women in...