Holiday Inn 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

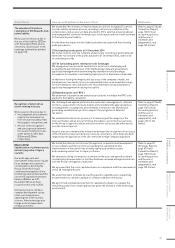

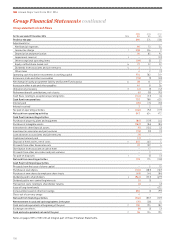

Area of focus How our audit addressed the area of focus References

The valuation of the future

redemption of IHG Rewards Club

points liability

We focused on this area due to

the size of the liability, ($725m

at 31 December 2014), and its

sensitivity, in particular, to the

breakage estimate (as defined

on page 113).

We tested the effectiveness of internal financial controls, including IT controls,

over the liability valuation process, including controls over validation of the

completeness and accuracy of data provided to IHG’s external actuarial adviser

and management’s internal review process of the inputs and the overall estimate

of the rewards point liability.

For the three key inputs into the liability valuation we undertook the following

audit procedures:

(1) Outstanding loyalty points at 31 December 2014

We tested controls over the complete and accurate recording of points data and

tested the roll forward of the points balance to 31 December 2014, and traced

to underlying records.

(2) The outstanding points redemption ratio (breakage)

We engaged our own actuarial specialists to assist us in challenging and

evaluating the appropriateness of the methodology, data and assumptions

applied by management in determining key redemption ratio/breakage

assumption for member’s outstanding loyalty points at the balance sheet date.

In addition to testing the integrity and accuracy of the company’s model, we

developed our own model to form an independent view on an acceptable range

for the redemption ratio and assess the reasonableness of key assumptions

applied by management in valuing the liability.

(3) Redeemed point cost (‘RPC’)

We undertook substantive and analytical procedures to validate the RPC to be

applied to the liability calculation.

Refer to page 67 (Audit

Committee Report),

page 113 (Critical

accounting policies

and the use of

estimates and

judgements), and

page 152 (notes).

Recognition of deferred tax

assets relating to losses

We focused on this area due to:

• the judgement and estimates

required to determine the

level of future taxable profits

that support recognition; and

• the size of the recognised

and unrecognised deferred

tax assets relating to losses

at the balance sheet date,

$154m and $256m,

respectively.

We challenged and applied professional scepticism to management’s rationale

for the re-assessment of forecast models and considered the appropriateness

of management’s assumptions and estimates in relation to the likelihood of

generating suitable future profits to support the recognition of deferred

tax assets.

We evaluated the historical accuracy of forecasting and the integrity of the

forecast models and as a result of these procedures, we formed our own view

on the Group’s capacity to obtain effective relief for tax losses and other assets

over the forecast period.

In particular, we considered the interaction between the recognition of tax losses

in the UK and overseas jurisdictions to ensure consistency, since these are both

impacted by the application of the UK controlled foreign company legislation.

Refer to page 67 (Audit

Committee Report),

page 113 (Critical

accounting policies

and the use of

estimates and

judgements), and

pages 122 to 124

(notes).

(New in 2014)

Capitalisation of software assets

and carrying value of legacy

systems

Our audit approach and

assessment of key areas of audit

focus changes in response to

circumstances affecting the

Group. Given the Group’s

continued development of the

technology environment and the

size of the capitalised software

balance ($264m as at 31

December 2014), we have

focused on this area in 2014.

Software projects can have

complex development cycles,

often over many phases,

spanning two to three years,

or more. New technology also

brings a risk of impairment

of legacy systems.

We tested the internal controls over the approval, acquisition and development

of new software and the controls surrounding the capitalisation and

determination of the useful lives of newly capitalised software assets

and remaining useful lives for legacy software.

We obtained a listing of new projects initiated in the year, and agreed a sample

to underlying documentation to test they had been reviewed and approved in line

with the Group’s delegation of authority.

We assessed that the costs capitalised were in compliance with the requirements

of IAS 38 ‘Intangible Assets’.

We undertook tests of details by vouching specific expenditures to supporting

documentation to validate a sample of software additions in the year.

We performed a detailed assessment of capitalised software to evaluate the

remaining useful lives remain appropriate given the evolution of the technology

environment.

Refer to page 22

(Strategic Report),

page 67 (Audit

Committee Report),

page 113 (Critical

accounting policies

and the use of

estimates and

judgements), and

page 129 (notes).

STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS

ADDITIONAL

INFORMATION

97