Holiday Inn 2014 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

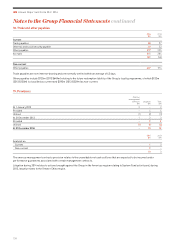

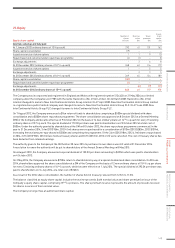

25. Retirement benefits

UK

Historically UK retirement and death in service benefits have been provided for eligible employees in the UK principally by the

InterContinental Hotels UK Pension Plan, which has both defined benefit and defined contribution sections. The defined benefit section

was subject to a buy-in transaction on 15 August 2013 whereby the assets of the plan were invested in a bulk purchase annuity policy

with the insurer Rothesay Life under which the benefits payable to defined benefit members became fully insured. On 31 October 2014,

the plan completed the move to a full buy-out of the defined benefit section, following which Rothesay Life has become fully and directly

responsible for the pension obligations. On completion of the buy-out, the defined benefit assets (comprising the Rothesay Life insurance

policy) and matching defined benefit liabilities were derecognised from the Group statement of financial position. The buy-out transaction

also triggered the return to the Company of the £3m that remained in the IHG Funding Trust.

On 6 August 2014, members of the defined contribution section of the plan were transferred to a new mirror plan, the IHG UK Defined

Contribution Pension Plan. Existing and new employees who are eligible for pension benefits in the UK, including those who have been

auto-enrolled since 1 September 2013, are provided with defined contribution arrangements under this plan; benefits are based on each

individual member’s personal account.

Both plans are HM Revenue & Customs registered and governed by a Trustee Board which comprises a combination of independent

and company nominated trustees, assisted by professional advisers as and when required. The overall operation of the plans is subject

to the oversight of The Pensions Regulator. The Trustee Board is currently in the process of winding-up the InterContinental Hotels UK

Pension Plan.

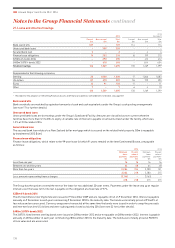

In addition to the above, additional benefits are provided to members of an unfunded pension arrangement who were affected by lifetime

or annual allowances under the former defined benefit arrangements. Accrual under this arrangement ceased with effect from 1 July

2013. In March 2014, the Company made an offer to each member to cash-out their pension entitlement by means of a one-off lump sum

cash payment. Members had until 30 June 2014 to accept the offer with the Company reserving the right to revoke any acceptances up

to the date of payment. In the event, cash payments totalling £27m were made to the accepting members on 28 July 2014 (with an additional

£7m deferred for payment until 2015), thereby extinguishing approximately 70% of the unfunded pension obligations. A charge over certain

ring-fenced bank accounts totalling £31m at 31 December 2014 (see note 15) is currently held as security on behalf of the remaining

members of the unfunded arrangement.

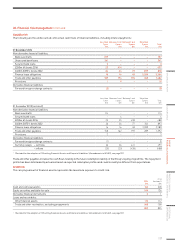

US and other

The Group also maintains the following US-based defined benefit plans; the funded Inter-Continental Hotels Pension Plan, unfunded

Inter-Continental Hotels Non-qualified Pension Plans and unfunded Inter-Continental Hotels Corporation Postretirement Medical,

Dental, Vision and Death Benefit Plan. All plans are closed to new members. In respect of the funded plan, an Investment Committee has

responsibility for the oversight and management of the plan’s assets, which are held in a separate trust. The Committee comprises senior

company employees and is assisted by professional advisers as and when required. The company currently makes contributions that equal

or exceed the minimum funding amounts required by the Employee Retirement Income and Security Act of 1974 (‘ERISA’). The investment

objective is to achieve full funding over time by following a specified ‘glide path approach’ which results in a progressive switching from

return seeking assets to liability-matching assets as the funded status of the plan increases. During the year, the funded status reached

85% which triggered a further de-risking of the investment portfolio.

The Group also operates a number of smaller pension schemes outside the UK, themost significant of which is a defined contribution

scheme in the US; there is no material difference between the pension costs of, and contributions to, these schemes.

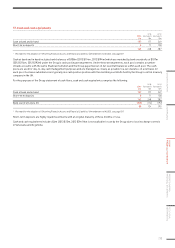

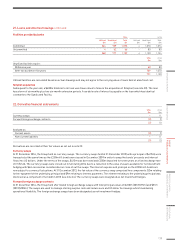

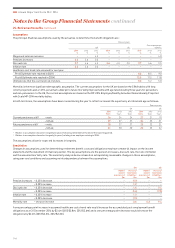

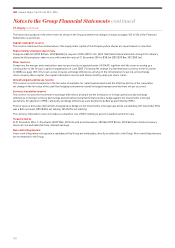

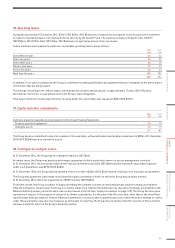

In respect of the defined benefit plans, the amounts recognised in the Group income statement, in administrative expenses, are:

Pension plans

UK US and other

Post-employment

benefits Total

2014

$m

2013

$m

2012

$m

2014

$m

2013

$m

2012

$m

2014

$m

2013

$m

2012

$m

2014

$m

2013

$m

2012

$m

Current service cost –2 5 11 1 –– – 13 6

Past service cost –– – –1 – –– – –1 –

Net interest expense 2– 1 33 3 11 1 64 5

Administration costs 31 1 –1 1 –– – 32 2

Operating profit before exceptional items 53 7 46 5 11 1 10 10 13

Exceptional items:

Settlement cost 6147 ––– – –– – 6147 –

11 150 746 5 11 1 16 157 13

continuedNotes to the Group Financial Statements

IHG Annual Report and Form 20-F 2014

142