Holiday Inn 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

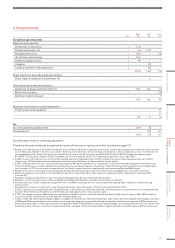

The service cost of providing pension benefits to employees,

together with the net interest expense or income for the year, is

charged to the income statement within ‘administration expenses’.

Net interest is calculated by applying the discount rate to the net

defined benefit asset or liability, after any asset restriction. Past

service costs and gains, which are the change in the present value

of the defined benefit obligation for employee service in prior

periods resulting from plan amendments, are recognised

immediately the plan amendment occurs. Settlement gains and

losses, being the difference between the settlement cost and the

present value of the defined benefit obligations being settled, are

recognised when the settlement occurs.

Re-measurements comprise actuarial gains and losses, the

return on plan assets (excluding amounts included in net interest)

and changes in the amount of any asset restrictions. Actuarial

gains and losses may result from: differences between the

actuarial assumptions underlying the plan liabilities and

actual experience during the year or changes in the actuarial

assumptions used in the valuation of the plan liabilities.

Re-measurement gains and losses, and taxation thereon,

are recognised in other comprehensive income and are not

reclassified to profit or loss in subsequent periods.

Actuarial valuations are normally carried out every three years

and are updated for material transactions and other material

changes in circumstances (including changes in market prices

and interest rates) up to the end of the reporting period.

Revenue recognition

Revenue arises from the sale of goods and provision of services

where these activities give rise to economic benefits received and

receivable by the Group on its own account and result in increases

in equity.

Revenue is derived from the following sources: franchise fees;

management fees; owned and leased properties and other

revenues which are ancillary to the Group’s operations,

including technology fee income.

Revenue is recorded (excluding VAT and similar taxes) net of

discounts. The following is a description of the composition

of revenues of the Group:

Franchise fees – received in connection with the licence of the

Group’s brand names, usually under long-term contracts with

the hotel owner. The Group charges franchise royalty fees as a

percentage of rooms revenue. Revenue is recognised when the

fee is earned in accordance with the terms of the contract.

Management fees – earned from hotels managed by the Group,

usually under long-term contracts with the hotel owner.

Management fees include a base fee, generally a percentage of

hotel revenue, which is recognised when earned in accordance

with the terms of the contract and an incentive fee, generally

based on the hotel’s profitability or cash flows and recognised

when the related performance criteria are met under the terms

of the contract.

Owned and leased – primarily derived from hotel operations,

including the rental of rooms and food and beverage sales

from owned and leased hotels operated under the Group’s

brand names. Revenue is recognised when rooms are occupied

and food and beverages are sold.

Franchise fees and management fees include liquidated damages

received from the early termination of contracts.

Other revenues are recognised when earned in accordance with

the terms of the contract.

Government grants

Government grants are recognised in the period to which they

relate when there is reasonable assurance that the grant will

be received and that the Group will comply with the attached

conditions. Government grants are recognised within other

operating income and expenses in the Group income statement.

Share-based payments

The cost of equity-settled transactions with employees is

measured by reference to fair value at the date at which the right

to the shares is granted. Fair value is determined by an external

valuer using option pricing models.

The cost of equity-settled transactions is recognised, together

with a corresponding increase in equity, over the period in which

any performance or service conditions are fulfilled, ending on

the date on which the relevant employees become fully entitled

to the award (vesting date).

The income statement charge for a period represents the

movement in cumulative expense recognised at the beginning

and end of that period. No expense is recognised for awards that

do not ultimately vest, except for awards where vesting is

conditional upon a market or non-vesting condition, which are

treated as vesting irrespective of whether or not the market or

non-vesting condition is satisfied, provided that all other

performance and/or service conditions are satisfied.

Leases

Operating lease rentals are charged to the income statement

on a straight-line basis over the term of the lease.

Assets held under finance leases, which transfer to the Group

substantially all the risks and benefits incidental to ownership of

the leased item, are capitalised at the inception of the lease, with

a corresponding liability being recognised for the fair value of the

leased asset or, if lower, the present value of the minimum lease

payments. Lease payments are apportioned between the

reduction of the lease liability and finance charges in the income

statement so as to achieve a constant rate of interest on the

remaining balance of the liability. Assets held under finance

leases are depreciated over the shorter of the estimated useful

life of the asset and the lease term.

Disposal of non-current assets

The Group recognises sales proceeds and any related gain or loss

on disposal on completion of the sales process. In determining

whether the gain or loss should be recorded, the Group considers

whether it:

• has a continuing managerial involvement to the degree

associated with asset ownership;

• has transferred the significant risks and rewards associated

with asset ownership; and

• can reliably measure and will actually receive the proceeds.

STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS

ADDITIONAL

INFORMATION

111