Holiday Inn 2014 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

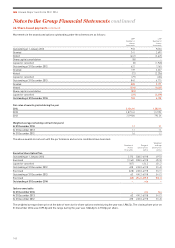

33. Events after the reporting period

On 16 January 2015, the Group completed the acquisition of Kimpton Hotel & Restaurant Group, LLC (‘Kimpton’), an unlisted company

based in the US, for $430m paid in cash. Kimpton is the world’s largest independent boutique hotel operator which, together with IHG’s

Hotel Indigo and EVEN brands, creates a leading boutique and lifestyle hotel business.

The assets and liabilities acquired largely comprise intangible assets, being the Kimpton brand and management contracts, deferred tax

assets and goodwill. Due to the close proximity of the acquisition date to the date of these financial statements, the initial accounting for

the business combination is incomplete and the Group is unable to provide a quantification of the fair values of these assets. The fair value

exercise is ongoing and it is expected that the Group will include an acquisition balance sheet with its interim results for 2015.

Acquisition transaction costs of $7m were incurred in the year to 31 December 2014 (see note 5).

If the acquisition had taken place on 1 January 2014, it is estimated that Group revenue and Group EBITDA for the year ended

31 December 2014 would have been $37m and $20m higher respectively.

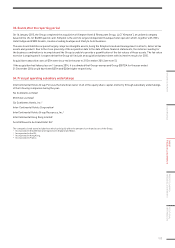

34. Principal operating subsidiary undertakings

InterContinental Hotels Group PLC was the beneficial owner of all of the equity share capital, indirectly through subsidiary undertakings,

of the following companies during the year:

Six Continents Limited1

IHG Hotels Limited1

Six Continents Hotels, Inc.2

Inter-Continental Hotels Corporation2

InterContinental Hotels Group Resources, Inc.2

InterContinental Hong Kong Limited3

Société Nouvelle du Grand Hotel SA4

The companies listed above include those which principally affect the amount of profit and assets of the Group.

1 Incorporated in Great Britain and registered in England and Wales.

2 Incorporated in the US.

3 Incorporated in Hong Kong.

4 Incorporated in France.

STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS

ADDITIONAL

INFORMATION

153