Holiday Inn 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• the 10-year £400m bond issued by the Company on

28 November 2012, under which, if the bond’s credit rating

was downgraded in connection with a change of control, the

bond holders would have the option to require the Company

to redeem or, at the Company’s option, repurchase the

outstanding notes together with interest accrued; and

• the six-month $400m term loan facility agreement dated

13 January 2015, under which a change of control of the

Company would entitle the lender to declare all amounts

due to it payable.

Further details on these are set out on pages 169 and 170.

Business relationships

During 2012, the Group entered into a five-year technology

outsourcing agreement with International Business Machines

Corporation (IBM), pursuant to which IBM operates and maintains

the infrastructure of the Group’s reservations system. Otherwise,

there are no specific individual contracts or arrangements

considered to be essential to the business of the Group as a whole.

Existence of qualifying indemnity provisions

For details, see Directors’ and Officers’ Liability Insurance Policy

on page 72.

Disclosure of information to the Auditor

For details, see page 94.

Events after the reporting period

On 13 January 2015, the Group raised a $400m bilateral term loan

to help finance the acquisition of Kimpton Hotel & Restaurant

Group, LLC; the term loan expires in July 2016.

On 16 January 2015, the Group completed the acquisition of

Kimpton Hotel & Restaurant Group, LLC for $430m in cash

(see page 153).

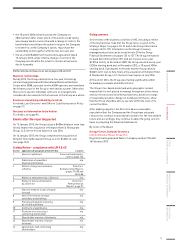

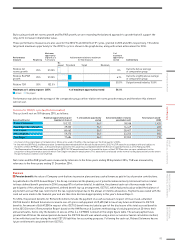

Listing Rules – compliance with LR 9.8.4C

Section Applicable sub-paragraph within LR 9.8.4C Location

1Interest capitalised Financial Statements,

note 6, page 122

2Publication of unaudited

financial information

n/a

4Details of long-term incentive

schemes

Directors’

Remuneration Report,

pages 79, 80 and

84 to 86

5Waiver of emoluments by a Director n/a

6Waiver of future emoluments

by a Director

Directors’

Remuneration

Report, page 91

7Non pre-emptive issues of equity

for cash

n/a

8Item (7) in relation to major

subsidiary undertakings

n/a

9Parent participation in placing

by a listed subsidiary

n/a

10 Contracts of significance n/a

11 Provision of services by a

controlling shareholder

n/a

12 Shareholder waivers of dividends n/a

13 Shareholder waivers of future

dividends

n/a

14 Agreements with controlling

shareholders

n/a

Going concern

An overview of the business activities of IHG, including a review

of the key business risks that the Group faces, is given in the

Strategic Report on pages 2 to 51 and in the Group Information

on pages 162 to 170. Information on the Group’s treasury

management policies can be found in note 20 to the Group

Financial Statements on pages 135 to 137. The Group refinanced

its bank debt in November 2011 and put in place a five-year

$1.07bn facility. In December 2009, the Group issued a seven-year

£250m sterling bond and, in November 2012, a 10-year £400m

sterling bond. Subsequent to the year end the Group raised a

$400m term loan to help finance the acquisition of Kimpton Hotel

& Restaurant Group, LLC; the term loan expires in July 2016.

At the end of 2014, the Group was trading significantly within

its banking covenants and debt facilities.

The Group’s fee-based model and wide geographic spread

means that it is well placed to manage through uncertain times

and our forecasts and sensitivity projections, based on a range

of reasonably possible changes in trading performance, show

that the Group should be able to operate within the level of its

current facilities.

After making enquiries, the Directors have a reasonable

expectation that the Company and the Group have adequate

resources to continue in operational existence for the foreseeable

future and, accordingly, they continue to adopt the going concern

basis in preparing the Financial Statements.

By order of the Board

George Turner, Company Secretary

InterContinental Hotels Group PLC

Registered in England and Wales, Company number 5134420

16 February 2015

75

STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS

ADDITIONAL

INFORMATION