Holiday Inn 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DR Policy were the use of relative TSR as a measure in the LTIP,

and the fact that the DR Policy did not require Executive Directors

to hold shares beyond the three-year vesting date.

I explained then that the outcome of the 2011/13 LTIP cycle

was in line with performance and reflected shareholder value

creation. I also pointed out that our Executive Directors had very

substantial shareholdings and formally requiring further holding

periods seemed unnecessary. Shareholders voted 94.01 per cent

in favour of the 2013 Directors’ Remuneration Report.

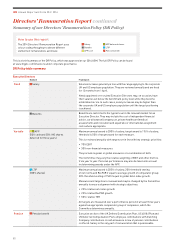

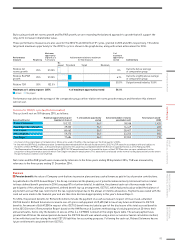

We are not making any changes to the DR Policy itself for 2015.

There is, however, one substantive change to how we will

implement the DR Policy. We have introduced a three-year

clawback clause post-vesting or payment of awards, applying

to awards made relating to 2015 and future financial years.

This will apply in addition to the existing malus provision in the

DRPolicy, which allows for awards to be reduced prior to vesting.

The details are set out on pages 81 and 91 of the Annual Report.

Remuneration and business strategy

We feel strongly that we should make changes to the DR Policy in

a coherent way if it is to retain credibility with management and

serve its purpose of motivating and rewarding outstanding

performance. Reward arrangements for senior executives of a

global business are inevitably quite complicated and need to be

communicated as an intrinsic part of the business strategy. We

are keen to avoid, if possible, the introduction of ad-hoc changes,

especially where there is no link to the business strategy.

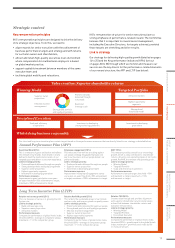

The current executive reward structure was introduced five years

ago. It includes the key performance measures at the heart

of the current business strategy; an annual plan to incentivise

and reward the delivery of good financial results, as well as

from 2013, improvements in guest satisfaction and employee

engagement; and a long-term plan to reward the delivery of strong

shareholder returns and better-than-market number of rooms

and RevPAR growth. All these measures remain relevant to

future business strategy. However, after five years, it is right to

revisit whether other measures and remuneration approaches

could even better support the strategic priorities for the coming

five years, as well as consider further questions shareholders

have raised. Therefore, during 2015, the Remuneration Committee

will revisit all aspects of the APP and LTIP to ensure they remain

fit for purpose. This will include consideration of the following:

• the mix of short and long-term incentives and what is

appropriate for different levels of senior executives;

• the performance measures most aligned with business

strategy and shareholder returns over the next five years;

• executive shareholding requirements and post-vesting

holding periods;

• how best to communicate the overall policy to senior executives

globally to ensure it helps drive performance; and

• how to further improve communication on remuneration to

shareholders, in particular the level of disclosure of targets

and outcomes.

We will consult major shareholders and shareholder organisations

during 2015 and put the new DR Policy to all shareholders at our

2016 AGM for approval.

Dear Shareholder

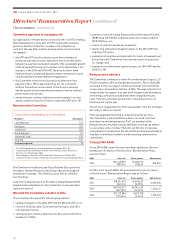

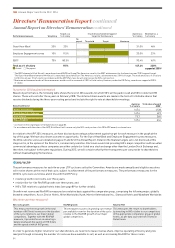

2014 corporate performance and incentive outcomes

Executive Director remuneration has reflected another year

of strong performance. Annual Performance Plan (APP) awards

are comparable to last year, reflecting continued good growth of

Earnings Before Interest and Tax (EBIT) as well as encouraging

progress on guest satisfaction and Employee Engagement survey

scores. Another three years of high Total Shareholder Return (TSR)

was the main driver for the vesting under the 2012/14 Long Term

Incentive Plan (LTIP) cycle, which is marginally below last year.

Directors’ Remuneration Policy

At the 2014 AGM, shareholders approved our Directors’

Remuneration Policy (DR Policy), as set out in our 2013 Annual

Report, with 90.94 per cent support. I mentioned in the 2013

Directors’ Remuneration Report the issues we had discussed at

some depth with shareholders prior to the vote at the AGM. The

two we know prompted some shareholders to vote against the

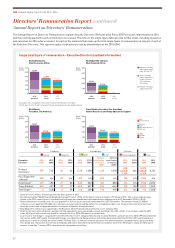

Corporate performance

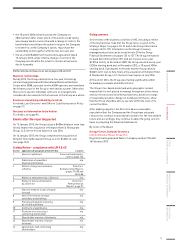

indicators 2014 2013 2012

Operating profit before

exceptional items

-2.5%

$651m1

+10.4%

$668m2

+10.4%

$605m3,4

Full-year dividend

per share(excluding

any special dividends

and capital returns)

77.0¢

48.6p

70.0¢

43.2p

64.0¢

41.2p

Three-year total

TSR (annualised) +31.7% +18.4% +28.2%

1 Includes two liquidated damages receipts in 2014: $7m, both in

The Americas.

2 Includes three liquidated damages receipts in 2013: $31m in The Americas,

$9m in Europe and $6m in AMEA.

3

Includes one significant liquidated damages receipt in 2012 of $3m

in The Americas.

4

With effect from 1 January 2013, the Group adopted IAS 19 (Revised)

‘Employee Benefits’ resulting in the following additional charges to

operating profit: $5m for the six months ended 30 June 2012 and $9m

for the 12 months ended 31 December 2012.

“ Our Directors’ Remuneration Policy

rewards the successful execution of the

business strategy, as demonstrated by

this year’s outcomes. So that it remains

eective for the future, we will review it

in 2015 and seek shareholders’ approval

again in 2016.”

Remuneration Committee Chairman’s Statement

IHG Annual Report and Form 20-F 2014

76

Directors’ Remuneration Report