Holiday Inn 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

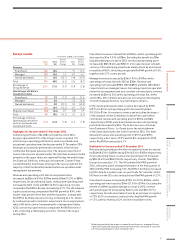

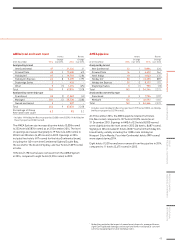

System Fund

System Fund assessments

12 months ended 31 December

2014

$m

2013

$m

2014 vs

2013 %

change

2012

$m

2013 vs

2012 %

change

Assessment fees and

contributions received

from hotels

1,271 1,154 10.1 1,106 4.3

Proceeds from sale

ofIHG RewardsClub

points

196 153 28.1 144 6.3

Total 1,467 1,307 12.2 1,250 4.6

In addition to management or franchise fees, hotels within the

IHG System pay assessments and contributions which are collected

by IHG for specific use within the System Fund. The System Fund

also receives proceeds from the sale of IHG Rewards Club points.

The System Fund is managed for the benefit of hotels in the IHG

System with the objective of driving revenues for the hotels.

The System Fund is used to pay for marketing, the IHG Rewards

Club loyalty programme and the global reservation system.

The operation of the System Fund does not result in a profit or loss

for the Group and consequently the revenues and expenses of the

System Fund are not included in the Group Income Statement.

Highlights for the year ended 31 December 2014

In the year to 31 December 2014, System Fund income increased

by 12.2% to $1,467m primarily as a result of a 10.1% increase in

assessment fees and contributions from hotels resulting from

increased hotel room revenues, reflecting increases in RevPAR

and IHG System size. Continued strong performance in co-branded

credit card schemes drove the 28.1% increase in proceeds from

the sale of IHG Rewards Club points.

Highlights for the year ended 31 December 2013

In the year to 31 December 2013, System Fund income increased

by4.6% to $1,307m primarily as a result of growth in hotel room

revenues due to increases in RevPAR and IHG System size. The

increase in proceeds from the sale of IHG Rewards Club points

mainly reflects the continued strong performance of co-brand

credit cardschemes.

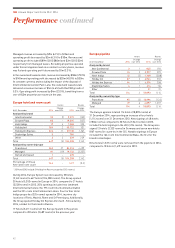

Other financial information

Exceptional operating items

Exceptional operating items totalled a net gain of $29m. The

exceptional gain of $130m related to the sale of InterContinental

Mark Hopkins San Francisco and the disposal of an 80% interest in

InterContinental New York Barclay. Exceptional charges included

$14m foreign exchange losses resulting from recent changes to

the Venezuelan exchange rate mechanisms and the adoption of

the SICAD II exchange rate; $29m relating primarily to structural

change programmes across the Global Human Resources and

Global Technology functions; $6m arising from a partial cash-out

of the UK unfunded pension arrangements; $45m relating to the

cost of securing a restructuring of the UK hotel portfolio; and

$7m Kimpton Hotels & Restaurants acquisition transaction costs.

See note 5 to the Group Financial Statements for further detail.

Exceptional operating items are treated as exceptional by reason

oftheir size or nature and are excluded from the calculation of

adjusted earnings per ordinary share in order to provide a more

meaningful comparison of performance.

Net financial expenses

Net financial expenses increased by $7m to $80m reflecting

an increase in average net debt levels and the translation of

interest on the two sterling bonds.

Financing costs included $2m (2013 $2m) of interest costs

associated with IHG Rewards Club where interest is charged

on the accumulated balance of cash received in advance of the

redemption of points awarded. Financing costs in 2014 also

included $19m (2013 $19m) in respect of the InterContinental

Boston finance lease.

Taxation

The effective rate of tax on operating profit excluding the impact

of exceptional items was 31% (2013 29%). Excluding the impact

of prior year items the equivalent tax rate would be 35% (2013 32%).

This rate is higher than the average UK statutory rate of 21.5%

(2013 23.25%) due mainly to certain overseas profits (particularly

in the US) being subject to statutory rates higher than the UK

statutory rate, unrelieved foreign taxes and disallowable expenses.

Taxation within exceptional items totalled a charge of $29m

(2013 $51m). In 2014 the charge comprised $56m relating to the

disposal of an 80% interest in InterContinental New York Barclay

offset by a credit of $27m relating to a restructuring of the UK

hotel portfolio and other reorganisation costs. In 2013 the charge

comprised $6m relating to the exceptional operating items

and $64m consequent upon the disposal of InterContinental

London Park Lane, offset by a credit of $19m relating to an

internal restructuring.

Net tax paid in 2014 totalled $136m (2013 $97m) including $nil

(2013 $5m) in respect of disposals. Tax paid represents an

effective rate of 23% (2013 16%) on total profits and is lower than

the effective income statement tax rate of 31% primarily due to

the impact of deferred taxes (including the realisation of assets

such as tax losses), the receipt of refunds in respect of prior years

and provisions for tax for which no payment of tax has currently

been made.

49

STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS

ADDITIONAL

INFORMATION