Holiday Inn 2014 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

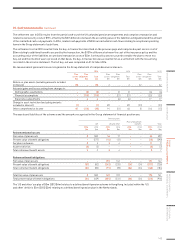

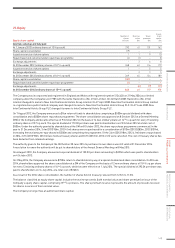

31. Related party disclosures

2014

$m

2013

$m

2012

$m

Total compensation of key management personnel¹

Short-term employment benefits 21.5 20.7 20.0

Post-employment benefits 0.7 0.8 0.8

Termination benefits ––0.6

Equity compensation benefits 7.9 8.1 8.6

30.1 29.6 30.0

1 Excludes ICETUS cash-out payment of £9.4m (see Directors’ Remuneration Report, page 85).

There were no other transactions with key management personnel during the years ended 31 December 2014, 2013 or 2012.

Key management personnel comprises the Board and Executive Committee.

Related party disclosures for associates and joint ventures are as follows:

Associates Joint ventures Total

2014

$m

2013

$m

2012

$m

2014

$m

2013

$m

2012

$m

2014

$m

2013

$m

2012

$m

Revenue from associates and joint ventures 44 5 –– – 44 5

Loans to associates 3– – –– – 3– –

Other amounts owed by associates and

joint ventures 11 2 2 –– – 11 2 2

In addition, loans both to and from the Barclay associate of $237m are offset in accordance with the provisions of IAS 32 and presented

net in the Group statement of financial position. Interest payable and receivable under the loans is equivalent (average interest rate of

1.8% in 2014) and presented net in the Group income statement.

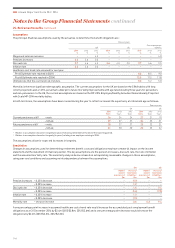

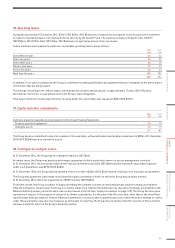

32. System Fund

The Group operates a System Fund (the Fund) to collect and administer assessments and contributions from hotel owners for specific use

in marketing, the IHG Rewards Club loyalty programme and the global reservation system. The Fund and loyalty programme are accounted

for in accordance with the accounting policies set out on page 112 of the Financial Statements.

The following information is relevant to the operation of the Fund:

2014

$m

2013

$m

2012

$m

Income1:

Assessment fees and contributions received from hotels 1,271 1,15 4 1,106

Proceeds from sale of IHG Rewards Club points 196 153 144

Key elements of expenditure1:

Marketing 267 245 250

IHG Rewards Club 296 219 250

Payroll costs 267 239 221

Net (deficit)/surplus for the year1(18) 35 12

Interest payable to the Fund 22 2

1 Not included in the Group income statement in accordance with the Group’s accounting policies.

The payroll costs above relate to 4,975 (2013 4,615, 2012 4,431) employees whose costs are borne by the Fund.

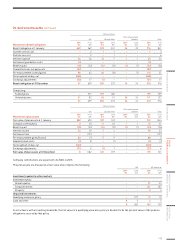

The following liabilities relating to the Fund are included in the Group statement of financial position:

2014

$m

2013

$m

2012

$m

Cumulative short-term net surplus 68 86 51

Loyalty programme liability 725 649 623

793 735 674

The net change in the loyalty programme liability and Fund surplus contributed an inflow of $58m (2013 $61m, 2012 $57m) to the Group’s

cash flow from operations.

continuedNotes to the Group Financial Statements

IHG Annual Report and Form 20-F 2014

152