Holiday Inn 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Liquidity and capital resources

Sources of liquidity

The Group is financed by a $1.07bn syndicated bank facility which

expires in November 2016 (the Syndicated Facility), £250m of public

bonds which are repayable on 9 December 2016 and £400m of public

bonds which are repayable on 28 November 2022. $361m was drawn

under the $1.07bn Syndicated Facility at the year end. The bonds are

issued under the Group’s £750m Medium Term Notes programme.

Short-term borrowing requirements are met from drawings under

bilateral bank facilities. Additional funding is provided by the 99-year

finance lease (of which 91 years remain) on InterContinental Boston

and other uncommitted bank facilities (see note 21 to the Group

Financial Statements). In the Group’s opinion, the available facilities

are sufficient for the Group’s present liquidity requirements.

The Syndicated Facility contains two financial covenants;

interest cover and net debt divided by earnings before interest,

tax, depreciation and amortisation. The Group is in compliance

with all of the financial covenants in its loan documents, none

of which is expected to present a material restriction on funding

in the near future.

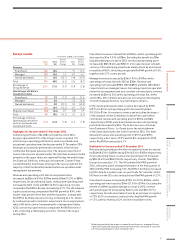

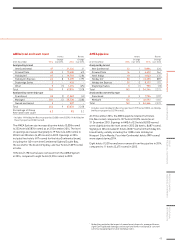

Net debt of $1,533m (2013 $1,153m) is analysed by currency

as follows:

2014

$m

20131

$m

Borrowings

Sterling 1,028 671

US dollar 557 709

Euros 103 11

Other 710

Cash and cash equivalents

Sterling (21) (87)

US dollar (54) (40)

Euros (25) (15)

Canadian dollar (14) (25)

Chinese renminbi (8) (15)

Other (40) (66)

Net debt21,533 1,153

Average debt levels 1,322 985

1

Restated for the adoption of ‘Offsetting Financial Assets and Financial

Liabilities’ (Amendments to IAS 32), see page 107.

2 Including the impact of currency derivatives.

Borrowings included bank overdrafts of $107m (2013 $114m)

which were matched by an equivalent amount of cash and cash

equivalents under the Group’s cash pooling arrangements.

Under these arrangements, each pool contains a number of bank

accounts with the same financial institution and the Group pays

interest on net overdraft balances within each pool. The cash

pools are used for day-to-day cash management purposes and

are managed daily as closely as possible to a zero balance on

a net basis for each pool. Overseas subsidiaries are typically in

a cash positive position, with the most significant balances in

the US and Canada, and the matching overdrafts are held by

the Group’s central treasury company in the UK.

IHG pursues a tax strategy that is consistent with its business

strategy and its overall business conduct principles. This strategy

seeks to ensure full compliance with all tax filing, payment and

reporting obligations on the basis of communicative and transparent

relationships with tax authorities. Policies and procedures related

to tax risk management are subject to regular review and update

and are approved by the Board.

Tax liabilities or refunds may differ from those anticipated,

in particular as a result of changes in tax law, changes in the

interpretation of tax law, or clarification of uncertainties in the

application of tax law. Procedures to minimise risk include the

preparation of thorough tax risk assessments for all transactions

carrying tax risk and, where appropriate, material tax uncertainties

are discussed and resolved with tax authorities in advance.

IHG’s contribution to the jurisdictions in which it operates includes

asignificant contribution in the form of taxes borne and collected,

including taxes on its revenues and profits and in respect of the

employment its business generates.

IHG earns approximately 70% of its revenues in the form of

franchise, management or similar fees, with 85% of IHG branded

hotels being franchised. In jurisdictions in which IHG does

franchise business, the prevailing tax law will generally provide

for IHG to be taxed in the form of local withholding taxes based on

a percentage of fees rather than based on profits. Costs to support

the franchise business are normally incurred regionally or globally

and therefore profits for an individual franchise jurisdiction cannot

be separately determined.

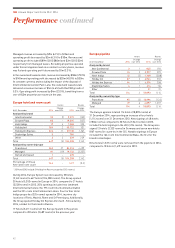

Dividends

The Board has proposed a final dividend per ordinary share of

52¢ (33.8p). With the interim dividend per ordinary share of 25¢

(14.8p), the full-year dividend per ordinary share for 2014 will

total 77¢ (48.6p), an increase of 10.0% over 2013.

On 2 May 2014, the Group announced a $750m return to

shareholders by way of special dividend and share consolidation.

The dividend was paid to shareholders on 14 July 2014.

Under the $500m share buyback programme announced on

7 August 2012, which commenced on 12 November 2012 and

completed on 29 May 2014, a total of 17.3m shares have been

repurchased for total consideration of $500m.

Earnings per ordinary share

Basic earnings per ordinary share increased by 12.3% to

158.3¢ from 140.9¢ in 2013. Adjusted earnings per ordinary

share remained unchanged at 158.3¢.

Share price and market capitalisation

The IHG share price closed at £25.95 on 31 December 2014,

up from £20.13 on 31 December 2013. The market capitalisation

of the Group at the year end was £6.4bn.

50

IHG Annual Report and Form 20-F 2014

Performance continued