Holiday Inn 2014 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

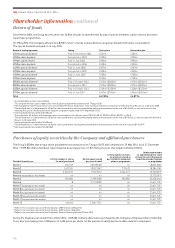

Disposal of interest in InterContinental Paris –

Le Grand

On 7 December 2014, a share sale and purchase agreement was

entered into between BHR Holdings BV (part of IHG) and

Constellation Hotels France Grand SA. Under the agreement, BHR

Holdings BV agreed to sell its 100 per cent interest in Société Des

Hotels InterContinental France, the owner of InterContinental

Paris – Le Grand, to Constellation Hotels France Grand SA. The

gross sale proceeds agreed are €330 million in cash.

In connection with the sale, IHG secured a 30-year management

contract on the hotel, with three 10-year extension rights at IHG’s

discretion, giving an expected contract length of 60 years.

Under the agreement, BHR Holdings BV gave certain customary

warranties and indemnities to Constellation Hotels France

Grand SA.

Acquisition of the Kimpton Hotels & Restaurants

business

On 15 December 2014, a share sale and purchase agreement

was entered into between Kimpton Group Holding LLC and

Dunwoody Operations, Inc., an affiliate of IHG. Under the

agreement, Dunwoody Operations, Inc. agreed to buy a 100 per

cent interest in Kimpton Hotel & Restaurant Group, LLC, the

principal trading company of the Kimpton group, from Kimpton

Group Holding LLC. The purchase completed on 16 January 2015.

Under the agreement, Dunwoody Operations, Inc. gave certain

customary warranties and indemnities to the seller.

The purchase price payable by Dunwoody Operations, Inc. in

respect of the acquisition was $430 million paid in cash.

£750 Million Euro Medium Term Note Programme

In 2012, the Group updated its Euro Medium Term Note

programme (Programme) and issued a tranche of £400 million

3.875% notes due 28 November 2022.

On 9 November 2012, an amended and restated trust deed (Trust

Deed) was executed by InterContinental Hotels Group PLC as

issuer (Issuer), Six Continents Limited and InterContinental Hotels

Limited as guarantors (Guarantors) and HSBC Corporate Trustee

Company (UK) Limited as trustee (Trustee), pursuant to which the

trust deed dated 29 November 2009, as supplemented by the first

supplemental trust deed dated 7 July 2011 between the same

parties relating to the Programme, was amended and restated.

Under the Trust Deed, the Issuer may issue notes (Notes)

unconditionally and irrevocably guaranteed by the Guarantors,

up to a maximum nominal amount from time to time outstanding

of £750 million (or its equivalent in other currencies). Notes are to

be issued in series (each a Series) in bearer form. Each Series may

comprise one or more tranches (each a Tranche) issued on different

issue dates. Each Tranche of Notes will be issued on the terms and

conditions set out in the updated base prospectus dated 9 November

2012 (Base Prospectus) as amended and/or supplemented by a

document setting out the final terms (Final Terms) of such Tranche

or in a separate prospectus specific to such Tranche.

Under the Trust Deed, each of the Issuer and the Guarantors

has given certain customary covenants in favour of the Trustee.

Final Terms were issued (pursuant to the previous base prospectus

dated 27 November 2009) on 9 December 2009 in respect of the

issue of a Tranche of £250 million 6% Notes due 9 December 2016

(2009 Issuance). Final Terms were issued pursuant to the Base

Prospectus on 26 November 2012 in respect of the issue of a

Working Time Regulations 1998

Under EU law, many employees of Group companies are now

covered by the Working Time Regulations which came into force

in the UK on 1 October 1998. These regulations implemented the

European Working Time Directive and parts of the Young Workers

Directive, and lay down rights and protections for employees in

areas such as maximum working hours, minimum rest time,

minimum days off and paid leave.

In the UK, there is in place a national minimum wage under the

National Minimum Wage Act. At 31 December 2014, the minimum

wage for individuals between 18 and under the age of 21 was

£5.13 per hour and £6.50 per hour for individuals age 21 and

above (in each case, excluding apprentices aged under 19 years

or, otherwise, in the first year of their apprenticeships). This

particularly impacts businesses in the hospitality and retailing

sectors. Compliance with the National Minimum Wage Act is being

monitored by the Low Pay Commission, an independent statutory

body established by the UK government.

Less than five per cent of the Group’s UK employees are covered

by collective bargaining agreements with trade unions.

Continual attention is paid to the external market in order to ensure

that terms of employment are appropriate. The Group believes the

Group companies will be able to conduct their relationships with

trade unions and employees in a satisfactory manner.

Material contracts

The following contracts have been entered into otherwise than

in the course of ordinary business by members of the Group:

(i) in the two years immediately preceding the date of this

document in the case of contracts which are or may be material;

or (ii) that contain provisions under which any Group member has

any obligation or entitlement that is material to the Group

as at the date of this document. To the extent that these

agreements include representations, warranties and indemnities,

such provisions are considered standard in an agreement of that

nature, save to the extent identified below.

Disposal of 80 per cent interest in InterContinental

New York Barclay

On 19 December 2013, Constellation Barclay Holding US, LLC,

which is an affiliate of Constellation Hotels Holding Limited,

agreed to acquire, pursuant to a contribution agreement, an

80 per cent interest in a joint venture with IHG’s affiliates to own

and refurbish the InterContinental New York Barclay hotel. The

80 per cent interest was acquired for gross cash proceeds of

$274million. IHG’s affiliates hold the remaining 20 per cent

interest. The disposal was completed on 31 March 2014.

IHG’s management affiliate has also secured a 30-year

management contract on the hotel, which commenced in 2014,

with two 10-year extension rights at IHG’s discretion, giving an

expected contract length of 50 years.

Constellation Barclay Holding US, LLC and IHG’s affiliates

have agreed to invest through the joint venture in a significant

refurbishment, repositioning and extension of the hotel.

This commenced in 2014 and will take place over a period

of approximately 18 months.

Under the contribution agreement, IHG’s affiliates gave certain

customary warranties and indemnities to Constellation Barclay

Holding US, LLC.

169

STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS

ADDITIONAL

INFORMATION