Holiday Inn 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

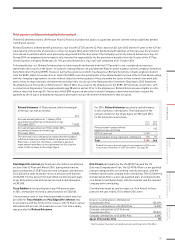

The scope of our audit

Following our assessment of the risk of material misstatement to

the Group Financial Statements, we selected 32 components which

represent the principal business units within the Group. 21 of these

components were subject to a full audit and 11 were subject to a

specific scope audit where the extent of audit work was based on

our assessment of the risks of material misstatement and the

materiality of the component’s business operations relative to the

Group. The audit scope of these components may not have included

testing of all significant accounts of the location but will have

contributed to the coverage of significant accounts tested for the

Group. The four Group audit significant risks in relation to System

Fund, IHG Rewards Club points liability, capitalisation and carrying

value of capitalised software assets, and deferred tax asset

recognition were subject to full scope audit procedures.

For the remaining components not subject to full or specific

scope audits, we performed other procedures to test or assess

that there were no significant risks of material misstatement in

these components in relation to the Group Financial Statements.

The components subject to full audit or specific audit procedures

account for 77% of Group revenue and 86% of the Group’s profit

before tax before pre-tax exceptional items.

Audit work at the individual components is undertaken based on a

percentage of our total performance materiality. The performance

materiality set for each component is based on the relative size of

the component and our view of the risk of misstatement at that

component. In the current year the range of performance

materiality allocated to components was $1m to $21m. The upper

end of the range was allocated to those components which

reflected 100% of a single line item within the Group statement

of financial position or the related notes.

The Group audit team directs the component teams at all stages

of the audit. The audit engagement partner, or her designate,

visited with the key locations in the Americas and IHG’s global

accounting centre in India during planning, interim and at year end.

In addition, the audit engagement partner visited Greater China,

including the Group’s owned hotel in Hong Kong.

These visits involved discussing the audit strategy and any issues

arising from our work, reviewing key workpapers, as well as

meeting local management.

This, together with additional procedures performed at the Group

level, gave us the evidence we needed for our opinion on the

Financial Statements as a whole.

Our assessment of risk of material misstatement

We identified the following risks of material misstatement which

had the greatest effect on the audit strategy; the allocation of

resources in the audit; and directing the efforts of the engagement

team, including the more senior members of the team. This is not

a complete list of all the risks identified in our audit.

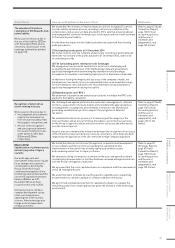

Area of focus How our audit addressed the area of focus References

Accounting for the hotel

assessments collected as part

of the revenue cycle and the

allocation of expenditures

related to the marketing,

advertising and loyalty point

programmes (the System Fund)

As outlined in the Strategic

Report on page 49, the System

Fund (the Fund) is a key part

of the Group’s business model.

For the year ended 31 December

2014, and as detailed in Note 32,

the Fund has assessment fees

and contributions of $1,271m

and expenses of $1,485m. These

amounts are not included in

IHG’s income statement.

We focus on this area because

there is a risk that the hotel

assessments could be included

in IHG’s reported revenue, which

would overstate IHG’s revenues;

or that Group costs are

incorrectly charged to the Fund,

improperly reducing IHG’s

expenses and leading to a

misstatement of IHG’s income

statement.

We have tested internal financial controls over the calculation of hotel

assessments, charges to the Fund, allocation of expenses (in addition to those

over the Group’s procurement process), related IT systems, and exclusion from

IHG’s ledgers.

For a sample of hotel assessments and expenses recorded in the Fund, we

agreed that they are supported by appropriate documentation and, based on

our inspection of that supporting documentation, we have made an independent

assessment of whether the hotel assessments and contributions and expenses

relate to the Fund.

Given the accounting treatment adopted for the Fund is a key judgement; we have

considered the appropriateness of the related disclosures provided in the Group

Financial Statements.

Refer to page 49

(Strategic Report),

page 67 (Audit

Committee Report),

page 112 (Critical

accounting policies

and the use of

estimates and

judgements), and

page 152 (notes).

IHG Annual Report and Form 20-F 2014

96

continuedIndependent Auditor’s UK Report