Holiday Inn 2014 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We measure our performance through a set of carefully selected KPIs

which monitor our success in achieving our strategy and the progress

of our Group to deliver high-quality growth. The KPIs are organised

around the framework of our strategy – our Winning Model and

Targeted Portfolio, underpinned by Disciplined Execution and Doing

Business Responsibly.

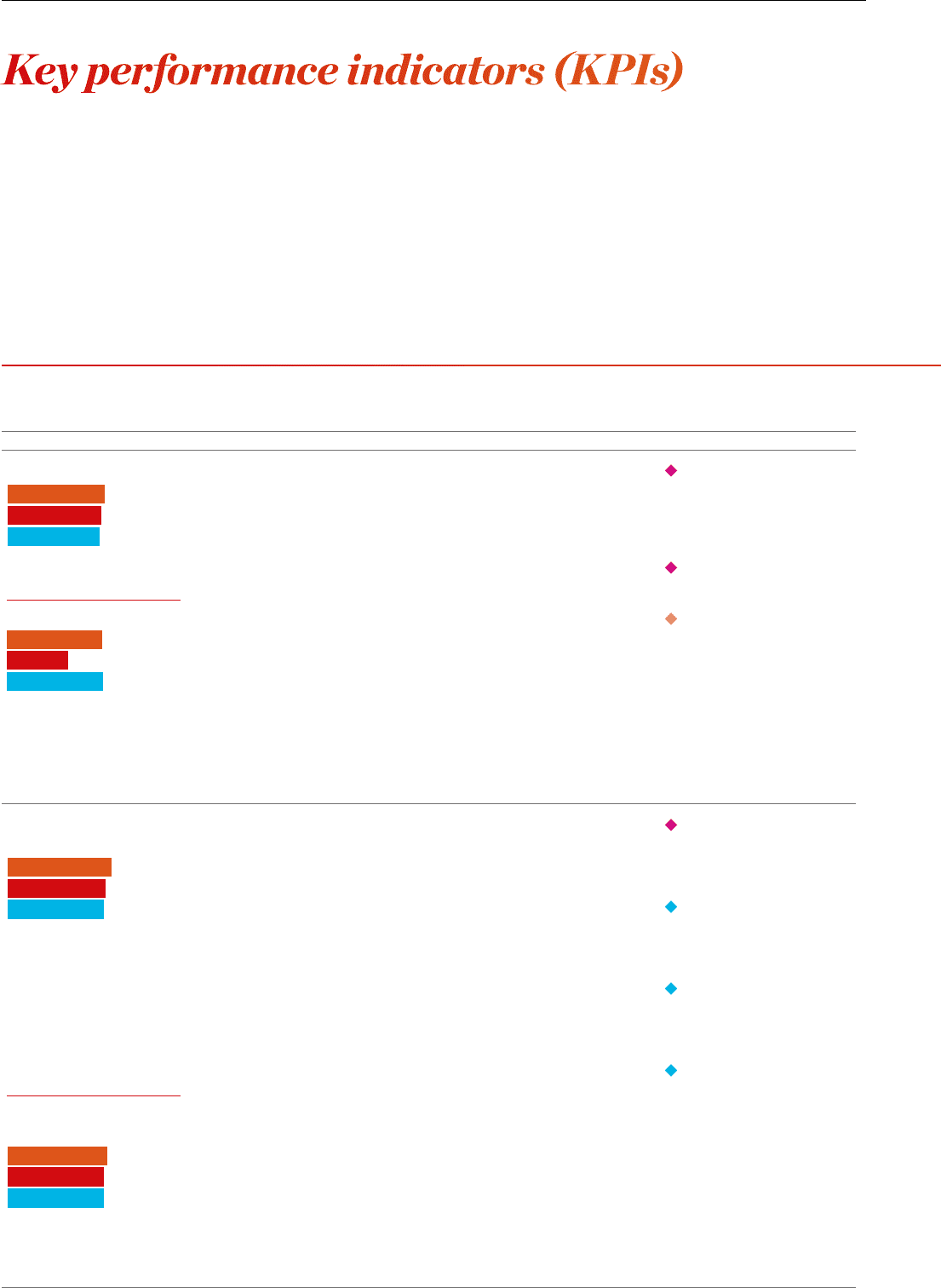

Winning Model and Targeted Portfolio

KPIs 2014 progress 2015 priorities

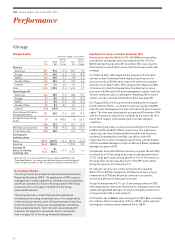

Net rooms supply1,2

Net total number of IHG

rooms in the IHG System.

In line with our 2014 priorities, in relation to:

• growth, particularly in priority markets (as at 31 December 2014):

- IHG System size – 710,295 rooms (4,840 hotels), reflecting 3.4%

net IHG System size growth in 2014, the strongest since 2009;

- 610,274 rooms (4,351 hotels) of the IHG System are in our priority

markets – 85%;

- IHG’s pipeline – 193,772 rooms (1,221 hotels), with 2014 having

the highest signings in six years; and

- 173,252 rooms (1,117 hotels) of our pipeline are in our priority markets

– 89%.

• supporting the growth of the HUALUXE Hotels and Resorts and EVEN

Hotels brands, we:

- opened our first 2 EVEN hotels in 2014 (see page 20) and, in February

2015, the first HUALUXE hotel (see page 19); and

- had 3 EVEN hotels (one of which is owned) and 24 HUALUXE hotels in

the pipeline (as at 31 December 2014).

Continue to accelerate

growth strategies in priority

markets, and key locations

in agreed scale markets,

and continue to leverage

scale.

Continue to support the

growth of the EVEN and

HUALUXE brands.

Drive growth of the Kimpton

brand in the US and create

the foundation to establish

the brand globally.

Growth in fee revenues1,2

Group revenue excluding

revenue from owned and

leased hotels, managed

leases and significant

liquidated damages.

Total gross revenue from

hotels in IHG’s System

Total rooms revenue from

franchised hotels and total

hotel revenue from managed,

owned and leased hotels. It is

not revenue attributable to

IHG, as it is derived from

hotels owned by third parties.

It is an indicator of the scale

and reach of IHG’s brands.

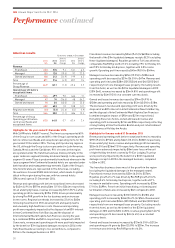

In line with our 2014 priorities, in relation to:

• continuing to drive loyalty to our portfolio of brands and driving awareness

of IHG Rewards Club, we:

- enrolled 7m new IHG Rewards Club members (up 9% on 2013), taking

the total to 84m members;

- continued to win awards including the ‘Best Hotel Rewards Programme in

the World’ by Global Traveler magazine (see www.ihgplc.com/ourbrands);

- extended free internet access for all IHG Rewards Club members

across our hotels globally;

- launched the first global promotion by IHG Rewards Club, ‘Big Win’, aimed

at encouraging members to stay at more hotels within IHG’s portfolio; and

- enhanced our ancillary programmes such as Business Rewards,

Dining Rewards and co-branded credit cards to extend our relationship

with guests.

• continuing with investment in technology systems and platforms:

- we launched Mobile Check-in and Check-out at more than 500 hotels; and

- see page 22 for further initiatives undertaken in 2014.

• continuing to strengthen our revenue delivery, we delivered 71% system

contribution to revenue, including $4bn of digital revenues with 50%

growth in mobile bookings to over $900m.

• continuing to drive the adoption and impact of our performance tools,

systems and processes amongst our owners – there was an increase of

over 20% in the adoption of Revenue Management for Hire.

Continue to drive

adoption and impact

of our performance tools,

systems and processes

amongst our owners.

Continue to enhance

the functionality and

performance of our direct

channels to make these

the preferred way to book.

Drive preference for IHG

Rewards Club and leverage

this to build deeper, lifetime

relationships with our

guests.

Continue with investment

in technology systems

and platforms and embed

leading-edge digital

technology and enhanced

capabilities.

System contribution to

revenue1,2

The per cent of room revenue

delivered through IHG’s

direct and indirect systems

and channels.

2013

2012

2014

686,873

675,982

710,295

2013

2012

2014

4.3%

6.8%

6.7%

At constant currency

2013

2012

2014

$21.6bn

$21.2bn

Actual $bn

$22.8bn

2013

2012

2014

69%

69%

71%

30

IHG Annual Report and Form 20-F 2014

Key performance indicators (KPIs)