Holiday Inn 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

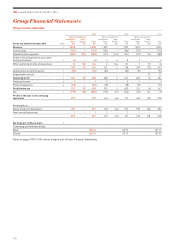

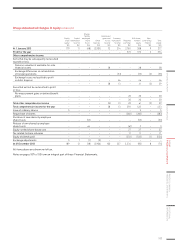

Group statement of cash flows

For the year ended 31 December 2014 Note

2014

$m

2013

$m

2012

$m

Profit for the year 392 374 538

Adjustments for:

Net financial expenses 80 73 54

Income tax charge 7208 226 9

Depreciation and amortisation 96 85 94

Impairment reversal 5––(23)

Other exceptional operating items (29) (5) 27

Equity-settled share-based cost 26 21 22 22

Dividends from associates and joint ventures 14 25 1

Other items 42(3)

Operating cash flow before movements in working capital 774 782 719

Increase in trade and other receivables (18) (9) (50)

Net change in loyalty programme liability and System Fund surplus 32 58 61 57

Increase in other trade and other payables 61 826

Utilisation of provisions 19 (2) (3) (12)

Retirement benefit contributions, net of costs (6) (18) (95)

Cash flows relating to exceptional operating items (114) (33) (6)

Cash flow from operations 753 788 639

Interest paid (76) (74) (50)

Interest received 22 2

Tax paid on operating activities 7(136) (92) (119)

Net cash from operating activities 543 624 472

Cash flow from investing activities

Purchase of property, plant and equipment (84) (159) (44)

Purchase of intangible assets (162) (86) (84)

Investment in other financial assets (5) (154) (2)

Investment in associates and joint ventures (15) (10) (3)

Loan advances to associates and joint ventures (3) – –

Capitalised interest paid (2) – –

Disposal of hotel assets, net of costs 11 345 460 4

Proceeds from other financial assets 49 109 4

Distribution from associate on sale of hotel –17 –

Proceeds from other associates and joint ventures –3 –

Tax paid on disposals 7–(5) (3)

Net cash from investing activities 123 175 (128)

Cash flow from financing activities

Proceeds from the issue of share capital –510

Purchase of own shares (110) (283) (107)

Purchase of own shares by employee share trusts (68) (44) (84)

Dividends paid to shareholders 8(942) (533) (679)

Dividend paid to non-controlling interests (1) (1) –

Transaction costs relating to shareholder returns (1) –(2)

Issue of long-term bonds ––632

Increase/(decrease) in other borrowings 382 (1) (99)

Close-out of currency swaps 4– –

Net cash from financing activities (736) (857) (329)

Net movement in cash and cash equivalents in the year (70) (58) 15

Cash and cash equivalents at beginning of the year 17 134 195 182

Exchange rate effects (9) (3) (2)

Cash and cash equivalents at end of the year 17 55 134 195

Notes on pages 107 to 153 form an integral part of these Financial Statements.

IHG Annual Report and Form 20-F 2014

106

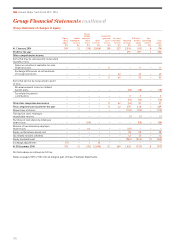

continuedGroup Financial Statements