Holiday Inn 2014 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

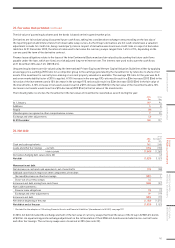

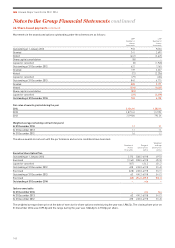

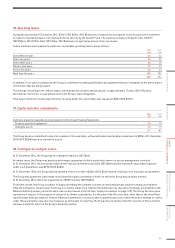

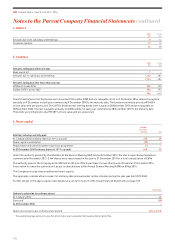

28. Operating leases

During the year ended 31 December 2014, $72m (2013 $67m, 2012 $64m) was recognised as an expense in the Group income statement

in respect of operating leases, net of amounts borne directly by the System Fund. The expense includes contingent rents of $27m

(2013 $24m, 2012 $19m). $4m (2013 $4m, 2012 $4m) was recognised as income from sub-leases.

Future minimum lease payments under non-cancellable operating leases are as follows:

2014

$m

2013

$m

Due within one year 40 42

One to two years 34 33

Two to three years 28 29

Three to four years 27 23

Four to five years 20 23

More than five years 200 202

349 352

In addition, in certain circumstances the Group is committed to making additional lease payments that are contingent on the performance

of the hotels that are being leased.

The average remaining term of these leases, which generally contain renewal options, is approximately 17 years (2013 18 years).

Nomaterialrestrictions or guarantees exist in the Group’s lease obligations.

Total future minimum rentals expected to be received under non-cancellable sub-leases are $8m (2013 $10m).

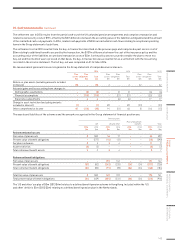

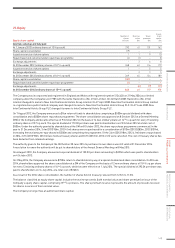

29. Capital and other commitments

2014

$m

2013

$m

Contracts placed for expenditure not provided for in the Group Financial Statements:

Property, plant and equipment 70 70

Intangible assets 47 13

117 83

The Group has also committed to invest in a number of its associates, with an estimated outstanding commitment of $89m at 31 December

2014 (2013 $20m) based on current forecasts.

30. Contingencies and guarantees

At 31 December 2014, the Group had no contingent liabilities (2013 $nil).

In limited cases, the Group may provide performance guarantees to third-party hotel owners to secure management contracts.

At 31 December 2014, the amount provided in the Financial Statements was $2m (2013 $6m) and the maximum unprovided exposure

under such guarantees was $29m (2013 $48m).

At 31 December 2014, the Group had outstanding letters of credit of $40m (2013 $41m) mainly relating to self insurance programmes.

The Group may guarantee loans made to facilitate third-party ownership of hotels in which the Group has an equity interest.

At 31 December 2014, there were guarantees of $20m in place (2013 $20m).

From time to time, the Group is subject to legal proceedings the ultimate outcome of each being always subject to many uncertainties

inherent in litigation. In particular, the Group is currently subject to a claim by Pan American Life Insurance Company, a Competition and

Markets Authority enquiry in the UK and a class action lawsuit in the US (see ‘Legal proceedings’ on page 170). The Group has also given

warranties in respect of the disposal of certain of its former subsidiaries. It is the view of the Directors that, other than to the extent that

liabilities have been provided for in these Financial Statements, it is not possible to quantify any loss to which these proceedings or claims

under these warranties may give rise, however, as at the date of reporting, the Group does not believe that the outcome of these matters

will have a material effect on the Group’s financial position.

STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS

ADDITIONAL

INFORMATION

151