Holiday Inn 2014 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

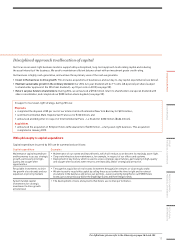

Disciplined approach to allocation of capital

IHG’s philosophy to capital expenditure

For definitions, please refer to the Glossary on pages 184 and 185.

Capital expenditure incurred by IHG can be summarised as follows:

Capital expenditure Examples

Maintenance capital expenditure

and key money to access strategic

growth, particularly into high-

quality and sought-after

opportunities

• Maintenance of our owned and leased hotels, which will reduce as we become increasingly asset-light.

• Corporate infrastructure maintenance, for example, in respect of our offices and systems.

• Deployment of key money, which is used to access strategic opportunities, particularly in high-quality

and sought-after locations when returns are financially and/or strategically attractive.

Recyclable investments to drive

the growth of our brands and our

expansion in priority markets

• Through the acquisition of real estate, investment through joint ventures or via an equity stake.

• We aim to seek to recycle this capital by selling these assets when the time is right and to reinvest

elsewhere in the business and across our portfolio – we are currently doing this for our EVEN Hotels

brand, just as we previously did for the Staybridge Suites and Hotel Indigo brands.

System funded capital

investments for strategic

investment to drive growth

at hotel level

• The development of tools and systems that hotels use to drive performance.

Our focus on an asset-light business model is supported by a disciplined, long-term approach to allocating capital and reducing

the asset intensity of the business. We seek to maintain an efficient balance sheet with an investment grade credit rating.

Our business is highly cash-generative, and we have three primary uses of the cash we generate:

• Invest in the business to drive growth: This includes acquisitions of businesses and our day-to-day capital expenditures (see below).

• Maintain sustainable growth in the ordinary dividend: Our 2014 full-year dividend will be 77 cents (48.6 pence) per share (subject

to shareholder approval of the 2014 final dividend) – up 10 per cent on 2013 (see page 50).

• Return surplus funds to shareholders: During 2014, we announced a $750 million return to shareholders via special dividend with

share consolidation, and completed our $500 million share buyback (see page 50).

In support of our asset-light strategy, during 2014 we:

Disposals

• completed the disposal of 80 per cent of our interest in InterContinental New York Barclay for $274 million;

• sold InterContinental Mark Hopkins San Francisco for $120 million; and

• announced a binding offer in respect of InterContinental Paris – Le Grand for €330 million ($406 million).

Acquisitions

• announced the acquisition of Kimpton Hotels & Restaurants for $430 million – a fully asset-light business. This acquisition

completed in January 2015.

13

STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

ADDITIONAL

INFORMATION

PARENT COMPANY

FINANCIAL STATEMENTS