Holiday Inn 2014 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

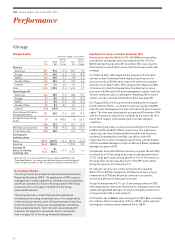

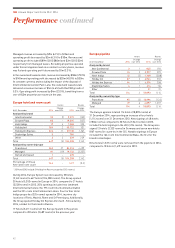

Americas results

12 months ended 31 December

2014

$m

2013

$m

2014 vs

2013 %

change

2012

$m

2013 vs

2012 %

change

Revenue

Franchised 630 576 9.4 541 6.5

Managed 103 128 (19.5) 97 32.0

Owned and leased 138 212 (34.9) 199 6.5

Total 871 916 (4.9) 837 9.4

Percentage of

Group Revenue 46.9 48.1 (1.2) 45.6 2.5

Operating profit before

exceptional items

Franchised 544 499 9.0 466 7.1

Managed 47 74 (36.5) 48 54.2

Owned and leased 18 30 (40.0) 24 25.0

609 603 1.0 538 12.1

Regional overheads (65) (53) (22.6) (52) (1.9)

Total 544 550 (1.1) 486 13.2

Percentage of Group

Operating profit before

central overheads and

exceptional items

67.5 66.8 0.7 63.4 3.4

Highlights for the year ended 31 December 2014

With 3,699 hotels (460,017 rooms), The Americas represented 65%

of the Group’s room count and 68% of the Group’s operating profit

before central overheads and exceptional operating items for the

year ended 31 December 2014. The key profit producing region is

the US, although the Group is also represented in Latin America,

Canada, Mexico and the Caribbean. 91% of rooms in the region

are operated under the franchise business model, primarily in the

upper midscale segment (Holiday Inn brand family). In the upscale

segment Crowne Plaza is predominantly franchised whereas in the

luxury segment InterContinental branded hotels are operated under

both franchise and management agreements. Eight of the Group’s

nine hotel brands are represented in The Americas, including

the wellness-focused EVEN Hotels brand, which made its global

debut in the region during the year, with two owned hotels

(296 rooms) open at 31 December 2014.

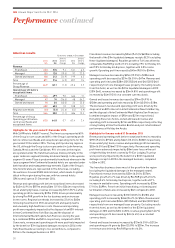

Revenue and operating profit before exceptional items decreased

by $45m (4.9%) to $871m and by $6m (1.1%) to $544m respectively.

On an underlying1 basis, revenue increased by $71m (9.7%), while

operating profit increased by $39m (7.8%) driven predominantly

by strong RevPAR growth in the fee business and an increase

in net rooms. Regional overheads increased by 22.6% to $65m

following investment in IHG’s development and quality teams

and unusually high healthcare costs. Revenue and operating

profit were negatively impacted by the disposal of an 80% interest

in InterContinental New York Barclay and the disposal of

InterContinental Mark Hopkins San Francisco during the year,

by a combined $95m and $21m respectively compared to 2013.

Conversely, revenue and operating profit were positively impacted

by the benefit of $7m liquidated damages receipts in 2014 in the

franchised business relating to two exited hotels, compared to

$31m in the managed business in 2013.

Franchised revenue increased by $54m (9.4%) to $630m including

the benefit of the $7m liquidated damages receipts (8.2% excluding

these liquidated damages). Royalties growth of 7.6% was driven by

comparable RevPAR growth of 7.2% including 7.9% for Holiday Inn

and 7.0% for Holiday Inn Express, together with 2.0% rooms

growth. Operating profit increased by $45m (9.0%) to $544m.

Managed revenue decreased by $25m (19.5%) to $103m and

operating profit decreased by $27m (36.5%) to $47m. Revenue and

operating profit included $38m (2013 $34m) and $nil (2013 $nil)

respectively from one managed lease property. Excluding results

from this hotel, as well as the $31m liquidated damages in 2013

(2014 $nil), revenue increased by $3m (4.8%) and operating profit

increased by $4m (9.3%) on a constant currency basis.

Owned and leased revenue decreased by $74m (34.9%) to

$138m and operating profit decreased by $12m (40.0%) to $18m.

The decrease in revenue and operating profit were driven by the

disposal of an 80% interest in InterContinental New York Barclay,

and the disposal of InterContinental Mark Hopkins San Francisco

(combined negative impact of $95m and $21m respectively).

Excluding these two hotels, owned and leased revenue and

operating profit increased by $21m and $9m respectively reflecting

strong trading at InterContinental Boston and post refurbishment

performance at Holiday Inn Aruba.

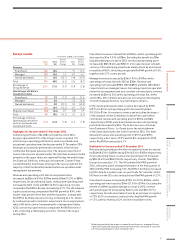

Highlights for the year ended 31 December 2013

Revenue and operating profit before exceptional items increased by

$79m (9.4%) to $916m and by $64m (13.2%) to $550m respectively.

On an underlying1 basis, revenue and operating profit increased by

$52m (6.5%) and $36m (7.5%) respectively. Revenue and operating

profit were adversely impacted by $8m lower fees on the exit

of eight Holiday Inn hotels owned by FelCor Lodging Trust but

were positively impacted by the benefit of a $31m liquidated

damages receipt in 2013 in the managed business, compared

to $3m in 2012.

The franchise business drove most of the growth in the region

(excluding the liquidated damages in the managed estate).

Franchised revenue increased by $35m (6.5%) to $576m.

Royalties growth of 4.7% was driven by RevPAR growth of 3.2%,

including 3.4% for Holiday Inn Express, together with a 0.7%

increase in available rooms. Operating profit increased by $33m

(7.1%) to $499m. Fees from initial franchising, relicensing and

termination of hotels also increased by $6m compared to 2012.

Managed revenue increased by $31m (32.0%) to $128m and

operating profit increased by $26m (54.2%) to $74m. Revenue and

operating profit included $34m (2012 $34m) and $nil (2012 $nil)

respectively from one managed lease property. Excluding results

from this hotel, as well as the benefit of the $31m liquidated

damages in 2013 and the $3m in 2012, revenue grew by $4m (6.7%)

and operating profit decreased by $2m (4.4%) on a constant

currency basis.

Owned and leased revenue increased by $13m (6.5%) to $212m

and operating profit grew by $6m (25.0%) to $30m. The increase

in revenue was driven by RevPAR growth of 6.0%.

38

IHG Annual Report and Form 20-F 2014

Performance continued