Holiday Inn 2014 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

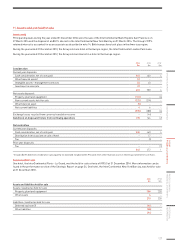

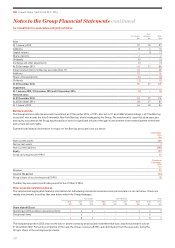

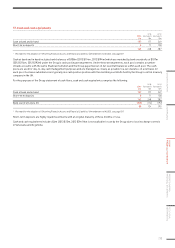

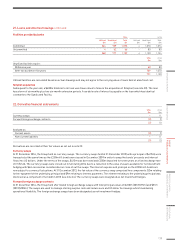

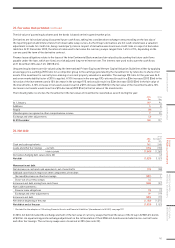

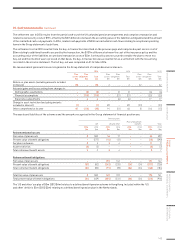

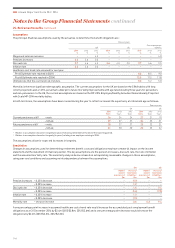

20. Financial risk management

Overview

The Group’s treasury policy is to manage financial risks that arise in relation to underlying business needs. The activities of the treasury

function are carried out in accordance with Board approved policies and are subject to regular audit. The treasury function does not

operate as a profit centre.

The treasury function seeks to reduce the financial risks faced by the Group and manages liquidity to meet all foreseeable cash needs.

Treasury activities may include money market investments, spot and forward foreign exchange instruments, currency swaps, interest

rate swaps and forward rate agreements. One of the primary objectives of the Group’s treasury risk management policy is to mitigate

the adverse impact of movements in interest rates and foreign exchange rates.

Market risk exposure

The US dollar is the predominant currency of the Group’s revenue andcash flows. Movements in foreign exchange rates can affect

theGroup’s reported profit, net assets and interest cover. To hedge translation exposure, wherever possible, the Group matches

the currency of its debt (either directly or via derivatives) to the currency ofits net assets, whilst maximising the amount of US dollars

borrowedto reflect the predominant trading currency.

From time to time, foreign exchange transaction exposure is managed by the forward purchase or sale of foreign currencies.

Most significant exposures of the Group are in currencies that are freely convertible.

A general strengthening of the US dollar (specifically a five cent fall in the sterling: US dollar rate) would increase the Group’s profit

before tax by an estimated $4.5m (2013 $4.1m, 2012 $2.8m) and increase net assets by an estimated $29.1m (2013 $16.0m, 2012 $1.8m).

Similarly, a five cent fall in the euro:US dollar rate would reduce the Group’s profit before tax by an estimated $2.2m (2013 $2.6m, 2012

$2.3m) and decrease net assets by an estimated $10.9m (2013 $14.8m, 2012 $16.1m).

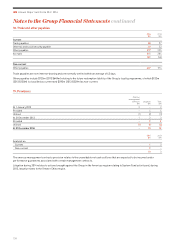

Interest rate exposure is managed, using interest rate swaps if appropriate, within set parameters depending on the term of the debt,

with a minimum fixed proportion of 25% of borrowings for each major currency. No interest rate swaps were used during 2013 or 2014.

Based on the year-end net debt position plus the $400m bilateral term loan drawn in 2015 to finance the Kimpton acquisition (see note

21), a one percentage point rise in USdollar interest rates would increase the annual net interest charge by $6.7m. A similar rise in euro

interest rates would increase the annual net interest charge by approximately $0.9m, and a similar rise in sterling interest rates would

reduce the annual net interest charge by approximately $0.7m. 100% of borrowings in major currencies were fixed rate debt at

31 December 2013.

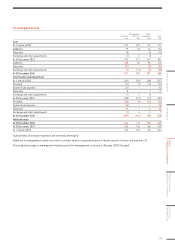

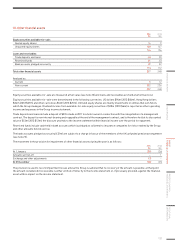

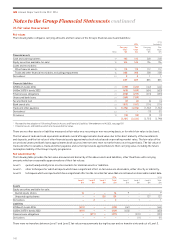

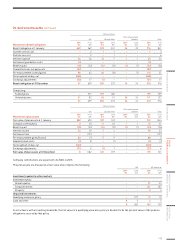

Liquidity risk exposure

The treasury function ensures that the Group has access to sufficient funds to allow the implementation of the strategy set by the Board.

Medium and long-term borrowing requirements are met through the $1.07bn Syndicated Facility which expires in November 2016,

through the £250m 6% bonds that are repayable on 9December 2016 and through the £400m 3.875% bonds repayable on 28 November

2022. The bonds were issued under the Group’s £750m Medium Term Notes programme. Short-term borrowing requirements are met

from drawings under bilateral bank facilities.

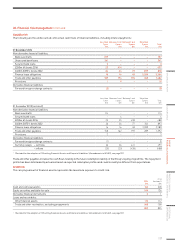

The Syndicated Facility contains two financial covenants: interest cover and net debt divided by earnings before interest, tax, depreciation

and amortisation (EBITDA). The Group has been in compliance with all of the financial covenants in its loan documents throughout the

year, none of which is expected to present a material restriction on funding in the near future.

At the year end, the Group had cash of $162m which is predominantly held in short-term deposits and cash funds which allow daily

withdrawals of cash. The Group also had overdrafts of $107m as part of cash pooling arrangements (see note 17). Most of the Group’s

funds are held in the UK or US, although $4m (2013 $12m) is held in countries where repatriation is restricted as a result of foreign

exchange regulations.

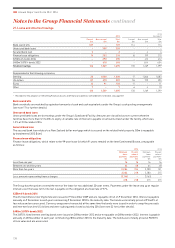

The Group had net liabilities of $717m at 31 December 2014 reflecting that its brands, in accordance with accounting standards, are not

recorded on the balance sheet.

STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS

ADDITIONAL

INFORMATION

135