Holiday Inn 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

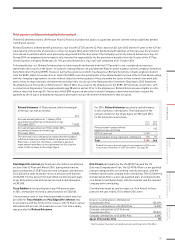

Pension arrangements

For a number of years, we have been working to de-risk the

potential liabilities of the Group’s legacy UK pension arrangements.

The defined benefit pension closed to new members in 2002

and to future accrual in 2013, after which benefits were secured

with an insurer.

One of the last elements of de-risking we announced was

our intention to change the long-established enhanced early

retirement arrangements. These terms were inappropriate

in the current wider pensions context. The conditions were

changed during the year and this will be phased out over the

coming years, as explained on pages 85 and 87.

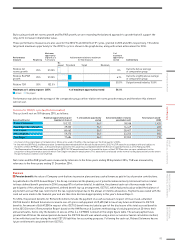

The main exceptional payment in this Directors’ Remuneration

Report relates to the decision announced last year to seek to cash

out the closed senior executive pension scheme – InterContinental

Hotels Executive Top-Up Scheme (ICETUS). This was the final stage

of the de-risking plan. I am pleased that we had a positive response

from those members of the scheme with the most potential value.

Richard Solomons was one of those who agreed to cash out this

part of the pension. The value of the pension was substantial,

reflecting his 22 years with the business. As a result, there is a

one-off additional element in his overall remuneration for 2014

only. This is explained in the single remuneration figure section

on page 82.

No other changes are proposed and the Board believes that any

remaining UK pensions risk is not significant.

Board change

Kirk Kinsell left the Board and his role as President, The Americas

on 13 February 2015, aged 60, after a total of 19 years’ service with

the business.

Mr Kinsell was succeeded by Elie Maalouf who was appointed

to the role of Chief Executive Officer, The Americas, effective

as of 13 February 2015 and who also became a member of IHG’s

Executive Committee.

The remuneration consequences of Mr Kinsell’s departure

were determined in line with the DR Policy and the rules of the

relevant incentive plans. Details of Mr Kinsell’s remuneration

arrangements on departure are included in the Directors’

Remuneration Report and have been disclosed on the Company’s

website at www.ihgplc.com/investors

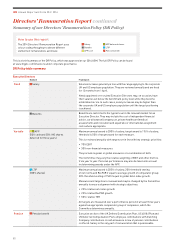

About this report

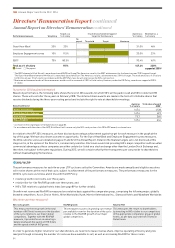

This statement aims to set out the more significant parts of the

report for those who want to know the headlines, main issues

considered in 2014 and the priorities for 2015. The Annual Report

on Directors’ Remuneration contains more detailed disclosures,

many of which are prescribed by legislation or regulation, but we

have tried to make it easier to follow by also taking into account

current thinking on best practice in remuneration reporting. We

have included a summary of our approved DR Policy (see pages 80

and 81) for ease of reference only, as it provides investors with an

understanding of the detail of the remuneration outcomes that

follow. The full DR Policy is available at www.ihgplc.com/investors.

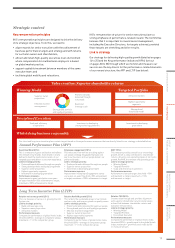

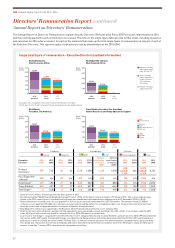

We have also looked to simplify the graphs and tables wherever

possible and ensure that the link between our strategy and

remuneration is clear.

The 2012 Directors’ Remuneration Report won the PwC ‘Building

Public Trust Award’ for Executive Remuneration Reporting in the

FTSE 100 and the 2013 Annual Report on Directors’ Remuneration

received ‘Highly Commended’.

Conclusion

This Directors’ Remuneration Report was approved by the Board

on 16 February 2015. The Board recommends this Directors’

Remuneration Report to shareholders.

The Annual Report on Directors’ Remuneration and the Chairman’s

Statement are subject to an advisory vote at the 2015 AGM.

Luke Mayhew, Remuneration Committee Chairman

16 February 2015

Governance

Roles and responsibilities

The Remuneration Committee agrees, on behalf of the Board,

all aspects of the remuneration of the Executive Directors and

the Executive Committee, and agrees the strategy, direction and

policy for the remuneration of other senior executives who have

a significant influence over the Company’s ability to meet its

strategic objectives.

The Committee’s role and responsibilities are set out in the Terms

of Reference (ToR) which are available on the Company’s website

at www.ihgplc.com/investors under corporate governance/

committees or from the Company Secretary’s office on request.

The ToR are reviewed annually and there were no changes to

them during 2014.

Governance

All members are independent Non-Executive Directors, as

required under the ToR. During 2014, Jo Harlow joined the

Committee and both David Kappler and Jonathan Linen retired.

All members have the necessary experience and expertise to

meet the Committee’s responsibilities.

77

STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS

ADDITIONAL

INFORMATION