Holiday Inn 2014 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

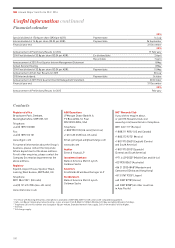

Return of funds

Since March 2004, the Group has returned over £4.8bn of funds to shareholders by way of special dividends, capital returns and share

repurchase programmes.

On 2 May 2014, the Company announced a $750m return of funds to shareholders via special dividend with share consolidation.

The special dividend was paid on 14 July 2014.

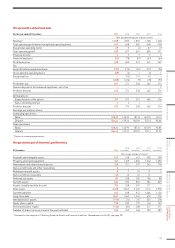

Return of funds programme Timing Total return Returned to date

£501m special dividend1Paid in December 2004 £501m £501m

£250m share buyback Completed in 2004 £250m £250m

£996m capital return1Paid in July 2005 £996m £996m

£250m share buyback Completed in 2006 £250m £250m

£497m special dividend1Paid in June 2006 £497m £497m

£250m share buyback Completed in 2007 £250m £250m

£709m special dividend1Paid in June 2007 £709m £709m

£150m share buyback n/a2£150m £120m

$500m special dividend1,3 Paid in October 2012 £315m4 ($500m) £315m ($505m)5

$500m share buyback Completed in 2014 £315m4 ($500m) £315m ($500m)6

$350m special dividend Paid in October 2013 £229m7 ($350m) £228m ($355m)8

$750m special dividend1 Paid in July 2014 £447m9 ($750m) £446m ($763m)10

Total £4,909m £4,877m

1 Accompanied by a share consolidation.

2 This programme was superseded by the share buyback programme announced on 7 August 2012.

3 IHG changed the reporting currency of its Consolidated Financial Statements from sterling to US dollars effective from the Half-Year Results as at 30 June 2008.

4

The dividend was first determined in US dollars and converted to sterling immediately before announcement at the rate of $1=£0.63, as set out in the circular

detailing the special dividend and share buyback programme published on 14 September 2012.

5

Sterling dividend translated at $1=£0.624.

6

Translated into US dollars at the average rates of exchange for the relevant years (2014 $1=£0.61; 2013 $1=£0.64; 2012 $1 = £0.63).

7

The dividend was first determined in US dollars and converted to sterling immediately before announcement at the rate of $1=£0.65, as announced in the Half-Year

Results to 30 June 2013.

8

Sterling dividend translated at $1=£0.644.

9 The dividend was first determined in US dollars and converted to sterling immediately before announcement at the rate translated at $1=£0.597.

10 Sterling dividend translated at $1=£0.5845.

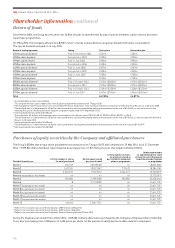

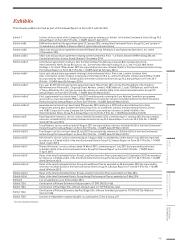

Purchases of equity securities by the Company and aliated purchasers

The Group’s $500m share repurchase programme was announced on 7 August 2012 and completed on 29 May 2014. As at 31 December

2014, 17,339,845 shares had been repurchased at an average price of 1,811.7674 pence per share (approximately £314m).

Period of financial year

(a) Total number of shares

(or units) purchased

(b) Average price paid

per share (or unit)

(c) Total number of shares

(or units) purchased as

part of publicly announced

plans or programmes

(d) Maximum number

(or approximate dollar value)

of shares (or units) that may yet

be purchased under the plans

or programmes

Month 1 350,249 2,007.8500 nil 18,855,0081

Month 2 1,617,551 1,950.2062 770,412 18,084,5961

Month 3 2,354,577 1,914.9212 2,354,577 15,730,0191

Month 4 (no purchases this month) nil nil nil 15,730,0191

Month 5 296,984 2,259.9608 296,984 25,620,0462

Month 6 82,311.0000 nil 23,611,7253

Month 7 (no purchases this month) nil nil nil 23,611,7253

Month 8 (no purchases this month) nil nil nil 23,611,7253

Month 9 (no purchases this month) nil nil nil 23,611,7253

Month 10 (no purchases this month) nil nil nil 23,611,7253

Month 11 (no purchases this month) nil nil nil 23,611,7253

Month 12 461,815 2,580.3724 nil 23,611,7253

1 Reflects the resolution passed at the Company’s AGM held on 24 May 2013.

2 Reflects the resolution passed at the Company’s AGM held on 2 May 2014.

3 Reflects the resolution passed at the Company’s General Meeting held on 30 June 2014.

During the financial year ended 31 December 2014, 1,659,203 ordinary shares were purchased by the Company’s Employee Share Ownership

Trust, at prices ranging from 1,928 pence to 2,633 pence per share, for the purpose of satisfying future share awards to employees.

176

IHG Annual Report and Form 20-F 2014

Shareholder information continued