Holiday Inn 2014 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

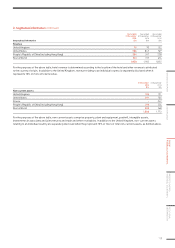

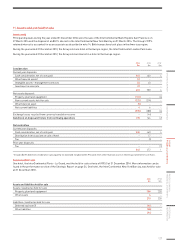

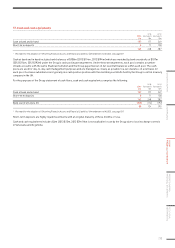

12. Goodwill

2014

$m

2013

$m

Cost

At 1 January 221 234

Exchange adjustments (6) (13)

At 31 December 215 221

Impairment

At 1 January and 31 December (141) (141)

Net book value

At 31 December 74 80

At 1 January 80 93

Goodwill arising on business combinations that occurred before 1 January 2005 was not restated on adoption of IFRS as permitted by IFRS 1.

All cumulative impairment losses relate to the Americas managed cash-generating unit (CGU).

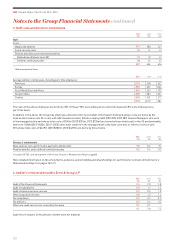

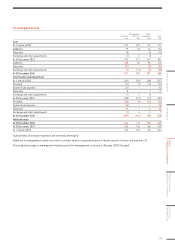

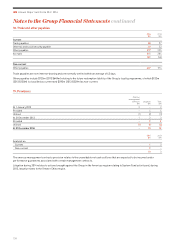

Goodwill has been allocated to CGUs for impairment testing as follows:

Cost Net book value

2014

$m

2013

$m

2014

$m

2013

$m

AMEA franchised and managed operations 74 80 74 80

Americas managed operations 141 141 ––

215 221 74 80

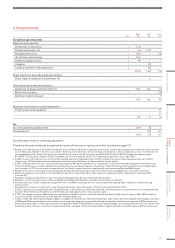

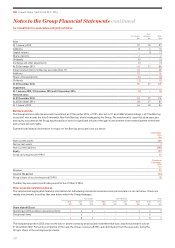

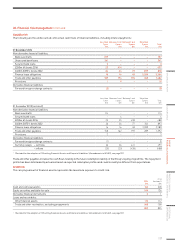

Asia, Middle East and Africa (AMEA) goodwill

The Group tests goodwill for impairment annually, or more frequently if there are any indications that an impairment may have arisen.

Therecoverable amounts of the CGUs are determined from value in use calculations. These calculations use pre-tax cash flow forecasts

derived from the most recent financial budgets and strategic plans approved by management covering a five-year period using growth

rates based on management’s past experience and industry growth forecasts.

At 31 December 2014, the recoverable amount of the CGU has been assessed based on the approved budget for 2015 and strategic plans

covering a five-year period, a perpetual growth rate of 3.5% (2013 3.5%) and a discount rate of 13.7% (2013 15.5%). The perpetual

growth rates do not exceed the average long-term growth rates for the relevant markets. Pre-tax discount rates are used to discount the

cash flows based on the Group’s weighted average cost of capital adjusted to reflect the risks specific to the businessmodel and territory

of the CGU being tested.

Impairment was not required at either 31 December 2014 or 31 December 2013 and management have determined that the carrying value

of the CGU would only exceed its recoverable amount in the event of highly unlikely changes in the key assumptions.

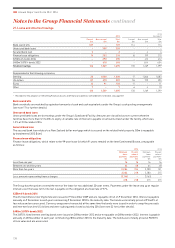

continuedNotes to the Group Financial Statements

IHG Annual Report and Form 20-F 2014

128