HSBC 2003 Annual Report Download - page 369

Download and view the complete annual report

Please find page 369 of the 2003 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384

|

|

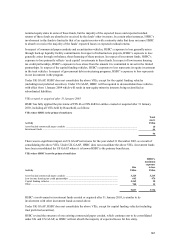

HSBC HOLDINGS PLC

Taxation of Shares and Dividends

367

Taxation

The following is a summary, under current law, of

the principal UK tax considerations that are likely to

be material to the ownership and disposition of

shares. The summary does not purport to be a

comprehensive description of all the tax

considerations that may be relevant to a holder of

shares. In particular, the summary deals principally

with shareholders who are resident in the United

Kingdom for UK tax purposes and only with holders

who hold the shares as investments and who are the

beneficial owners of the shares, and does not address

the tax treatment of certain classes of holders such as

dealers in securities. Holders and prospective

purchasers should consult their own advisers

regarding the tax consequences of an investment in

shares in light of their particular circumstances,

including the effect of any national, state or local

laws.

Taxation of dividends

No tax is currently withheld from dividends paid by

HSBC Holdings. However, dividends are paid with

an associated tax credit which is available for set-off

by certain shareholders against any liability they may

have to UK income tax. Currently, the associated tax

credit is equivalent to 10 per cent of the combined

cash dividend and tax credit, i.e. one-ninth of the

cash dividend.

For individual shareholders who are resident in

the United Kingdom for taxation purposes and liable

to UK income tax at the basic rate, no further UK

income tax liability arises on the receipt of a

dividend from HSBC Holdings. Individual

shareholders who are liable to UK income tax at the

higher rate on UK dividend income (currently

32.5 per cent) are taxed on the combined amount of

the dividend and the tax credit. The tax credit is

available for set-off against the higher rate liability,

leaving net higher rate tax to pay equal to 25 per cent

of the cash dividend. From 6 April 1999, individual

UK resident shareholders have not been entitled to

any tax credit repayment, unless the dividend income

arises in a Personal Equity Plan (PEP) or Individual

Savings Account (ISA), and then only for a five-year

period to 5 April 2004.

Although non-UK-resident shareholders are

generally not entitled to any repayment of the tax

credit in respect of any UK dividend received, some

such shareholders may be so entitled under the

provisions of a double taxation agreement between

their country of residence and the United Kingdom.

However, in most cases no amount of the tax credit

is in practice repayable.

Information on the taxation consequences of the

HSBC Holdings scrip dividends offered in lieu of the

2003 first and second interim dividends was set out

in the Secretary’s letters to shareholders of 1 April

2003, 3 September 2003 and 9 December 2003. The

market value of the scrip dividend was not

substantially different from the dividend forgone

and, accordingly, the price of HSBC Holdings

US$0.50 ordinary shares (the ‘shares’ ) for UK tax

purposes for the dividends was the cash dividend

foregone.

Taxation of capital gains

The computation of the capital gains tax liability

arising on disposals of shares in HSBC Holdings by

shareholders subject to UK capital gains tax can be

complex, partly depending on whether, for example,

the shares were purchased since April 1991, acquired

in 1991 in exchange for shares in The Hongkong and

Shanghai Banking Corporation Limited, or acquired

in 1992 in exchange for shares in Midland Bank plc,

now HSBC Bank plc.

For capital gains tax purposes, the acquisition

cost for ordinary shares is adjusted to take account of

subsequent rights and capitalisation issues. Further

adjustments apply where an individual shareholder

has chosen to receive shares instead of cash

dividends, subject to scrip issues made since 6 April

1998 being treated for tax as separate holdings. Any

capital gain arising on a disposal may also be

adjusted to take account of indexation allowance

and, in the case of individuals, taper relief. Except

for gains made by a company chargeable to UK

corporation tax, any such indexation allowance will

be calculated up to 5 April 1998 only.

If in doubt, shareholders are recommended to

consult their professional advisers.

Stamp duty and stamp duty reserve tax

Transfers of shares generally will be subject to UK

stamp duty at the rate of 0.5 per cent of the

consideration paid for the transfer, and such stamp

duty is generally payable by the transferee.

An agreement to transfer shares, or any interest

therein, normally will give rise to a charge to stamp