HSBC 2003 Annual Report Download - page 343

Download and view the complete annual report

Please find page 343 of the 2003 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

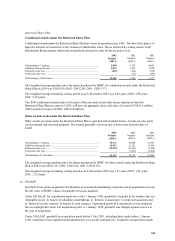

341

of relevant tax assets of US$824 million (2002: US$335 million), would be to reduce the Group’ s shareholders’

equity under US GAAP by US$1,951 million (2002: US$824 million).

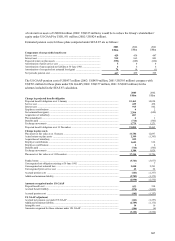

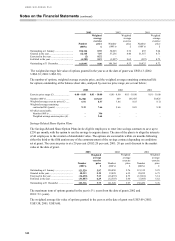

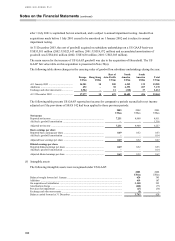

Estimated pension costs for these plans computed under SFAS 87 are as follows:

2003 2002 2001

US$m US$m US$m

Components of net periodic benefit cost

Service cost ..................................................................................................... 429 438 447

Interest cost ..................................................................................................... 915 862 801

Expected return on plan assets ........................................................................ (992

)

(885

)

(862

)

Amortisation of prior service cost ................................................................... 544

Amortisation of unrecognised net liability at 30 June 1992 ............................. 666

Amortisation of recognised net actuarial loss/(gain) ....................................... 74 14 (1

)

Net periodic pension cost ................................................................................ 437 439 395

The US GAAP pension cost of US$437 million (2002: US$439 million; 2001 US$395 million) compares with

US$703 million for these plans under UK GAAP (2002: US$377 million; 2001: US$369 million) for the

schemes included in the SFAS 87 calculation.

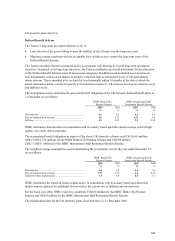

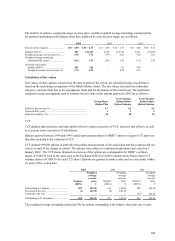

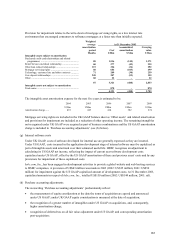

2003 2002

US$m US$m

Change in projected benefit obligation

Projected benefit obligation as at 1 January ................................................................................. 15,463 14,054

Service cost .................................................................................................................................. 429 438

Interest cost .................................................................................................................................. 915 862

Employee contributions ............................................................................................................... 42

Net actuarial loss/(gain) ............................................................................................................... 2,306 (600

)

Acquisition of subsidiary ............................................................................................................. 897 –

Plan amendment ........................................................................................................................... 61

Benefits paid ................................................................................................................................ (714) (565

)

Exchange movements ................................................................................................................... 1,779 1,271

Projected benefit obligation as at 31 December ........................................................................... 21,085 15,463

Change in plan assets

Plan assets at fair value as at 1 January ........................................................................................ 11,786 12,097

Actual return on plan assets ......................................................................................................... 2,399 (1,393

)

Acquisition of subsidiary ............................................................................................................. 832 –

Employer contributions ................................................................................................................ 1,653 616

Employee contributions ............................................................................................................... 42

Benefits paid ................................................................................................................................ (714

)

(565

)

Exchange movements ................................................................................................................... 1,384 1,029

Plan assets at fair value as at 31 December .................................................................................. 17,344 11,786

Funded status ............................................................................................................................... (3,741

)

(3,677

)

Unrecognised net obligation existing at 30 June 1992 ................................................................. –7

Unrecognised net actuarial loss .................................................................................................... 3,558 2,291

Unrecognised prior service cost ................................................................................................... 42 22

Accrued pension cost ................................................................................................................... (141

)

(1,357

)

Additional minimum liability ....................................................................................................... (2,789

)

(1,175

)

(2,930

)

(2,532

)

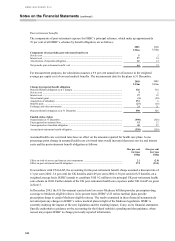

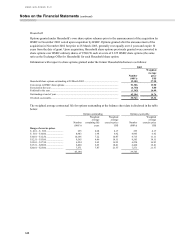

Amounts recognised under US GAAP

Prepaid benefit cost ...................................................................................................................... 833 538

Accrued benefit liability ............................................................................................................... (974

)

(1,895

)

Accrued pension cost ................................................................................................................... (141

)

(1,357

)

US GAAP adjustment

Accrued net pension cost under US GAAP .................................................................................. (141

)

(1,357

)

Additional minimum liability ....................................................................................................... (2,789

)

(1,175

)

Intangible asset ............................................................................................................................. 14 16

Amounts recognised for these schemes under UK GAAP ............................................................ (206

)

(6

)

(3,122

)

(2,522

)