HSBC 2003 Annual Report Download - page 358

Download and view the complete annual report

Please find page 358 of the 2003 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Notes on the Financial Statements (continued)

356

six months. The only exception to this policy is in respect of debt securities where their decline in market value

is due solely to an increase in underlying rates of interest and where HSBC has the ability to hold these

securities until maturity. None of the securities disclosed in the table above are considered ‘Other-than-

temporarily’ impaired at 31 December 2003.

(l) Foreign exchange losses on Argentine funding

The mandatory and asymmetrical conversion of onshore US dollar denominated assets and liabilities in

Argentina (‘pesification’ ) caused significant erosion of the capital base of HSBC Argentina, in part because of

the asymmetry of the conversion and in part through the creation of a structural foreign exchange mismatch to

the extent of residual external US dollar liabilities which were no longer matched with US dollar assets. HSBC

recognised these losses through its income statement in 2001; these amounted to US$520 million.

Following pesification, HSBC Argentina’s balance sheet primarily reflected Argentine peso assets more than

fully funded by Argentine peso liabilities and this represents HSBC’s ongoing business in Argentina. On top of

this HSBC Argentina had residual external US dollar liabilities which essentially represented a portion of the

loss recognised in 2001.

Under UK GAAP these US dollar liabilities, as they were no longer funding the ongoing business, were treated

as a separate operation with the US dollar as the unit of account. These liabilities were settled as they fell due

by the Group outside Argentina. As HSBC prepares its accounts in US dollars no further translation effect

arose.

Under US GAAP this accounting treatment was not possible and the US dollar liabilities were treated as part of

the Argentine operation which accounts in Argentine pesos. As a result, when the Argentine peso weakened the

US dollar denominated liabilities generated a substantial loss in Argentine pesos which was reflected in US

GAAP income. However, as HSBC accounts in US dollars and economically there was no change in the

amount of US dollars owing, an exactly offsetting gain was reflected in the US GAAP accounts in shareholders’

equity.

(m) Taxation

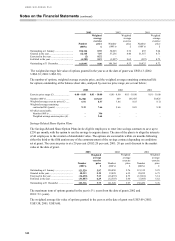

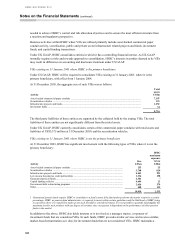

The components of the net deferred tax liability calculated under SFAS 109 ‘Accounting for Income Taxes’, are

as follows:

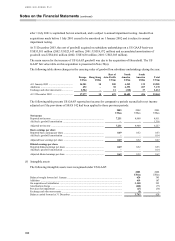

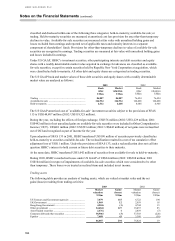

2003 2002

US$m US$m

Deferred tax liabilities

Leasing transactions ..................................................................................................................... 1,587 1,247

Capital allowances ....................................................................................................................... 293

2

73

Provision for additional UK tax on overseas dividends ............................................................... 61 44

Reconciling items ........................................................................................................................ 2,417

2

1,060

Other ............................................................................................................................................ 1,076 460

Total deferred tax liabilities ......................................................................................................... 5,434 2,884

Deferred tax assets

Provisions for bad and doubtful debts .......................................................................................... 3,122 1,259

Tax losses .................................................................................................................................... 972

3

908

Reconciling items ........................................................................................................................ 2,273 1,316

Other ............................................................................................................................................ 1,332

2

661

Total deferred tax assets before valuation allowance ................................................................... 7,699 4,144

Less: valuation allowance ............................................................................................................ (964

)

(868

)

Deferred tax assets less valuation allowance ................................................................................ 6,735 3,276

Net deferred tax (asset) under SFAS 109 ..................................................................................... (1,301

)

(392

)

Included within ‘other assets’ under US GAAP ........................................................................... (2,669

)

(2,585

)

Included within ‘deferred tax liabilities’ under US GAAP ........................................................... 1,368 2,193

The valuation allowance against deferred tax assets principally relates to trading and capital losses carried

forward, which have not been recognised due to uncertainty over their utilisation. A valuation allowance is