GE 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 ge 2008 annual report

notes to consolidated financial statements

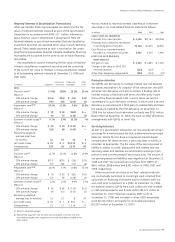

Counterparty Credit Risk

We manage counterparty credit risk, the risk that counterparties

will default and not make payments to us according to the terms

of the agreements, on an individual counterparty basis. Thus,

when a legal right of offset exists, we net certain exposures by

counterparty and include the value of collateral to determine the

amount of ensuing exposure. When net exposure to a counter-

party, based on the current market values of agreements and

collateral, exceeds credit exposure limits (see following table), we

take action to reduce exposure. Such actions include prohibiting

additional transactions with the counterparty, requiring collateral

from the counterparty (as described below) and terminating or

restructuring transactions.

Swaps are required to be executed under master agreements

containing mutual credit downgrade provisions that provide the

ability to require assignment or termination in the event either

party is downgraded below A3 or A–. In certain cases we have

entered into collateral arrangements that provide us with the right

to hold collateral (cash or U.S. Treasury or other highly-rated

securities) when the current market value of derivative contracts

exceeds a specified limit. We evaluate credit risk exposures and

compliance with credit exposure limits net of such collateral.

Fair values of our derivatives can change significantly from

period to period based on, among other factors, market move-

ments and changes in our positions. At December 31, 2008,

our exposure to counterparties, after consideration of netting

arrangements and collateral, was about $1,800 million.

Following is GECS policy relating to initial credit rating

requirements and to exposure limits to counterparties.

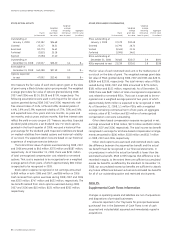

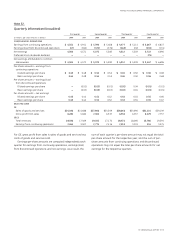

COUNTERPARTY CREDIT CRITERIA

Credit rating

Moody’s S&P

Foreign exchange forwards and other

derivatives less than one year P–1 A–1

All derivatives between one and five years Aa3 (a) AA– (a)

All derivatives greater than five years Aaa (a) AAA (a)

(a) Counterparties that have an obligation to provide collateral to cover credit

exposure in accordance with a credit support agreement must have a minimum

A3/A– rating.

EXPOSURE LIMITS

(In millions)

Minimum rating Exposure(a)

Without

With collateral collateral

Moody’s S&P arrangements arrangements

Aaa AAA $100 $75

Aa3 AA– 50 50

A3 A– 5 —

(a) For derivatives with maturities less than one year, counterparties are permitted to

have unsecured exposure up to $150 million with a minimum rating of A–1/P–1.

Exposure to a counterparty is determined net of collateral.

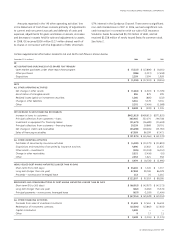

Note 30.

Off-Balance Sheet Arrangements

We securitize financial assets and arrange other forms of asset-

backed financing in the ordinary course of business to improve

shareowner returns. The securitization transactions we engage in

are similar to those used by many financial institutions. Beyond

improving returns, these securitization transactions serve as

funding sources for a variety of diversified lending and securities

transactions. Historically, we have used both GE-supported and

third-party Variable Interest Entities (VIEs) to execute off-balance

sheet securitization transactions funded in the commercial paper

and term markets.

Investors in these entities only have recourse to the assets

owned by the entity and not to our general credit, unless noted

below. We did not provide non-contractual support to consoli-

dated or unconsolidated VIEs in either 2008 or 2007. We do not

have implicit support arrangements with any VIEs.

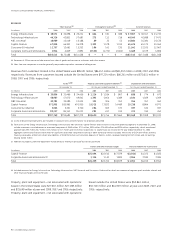

Variable Interest Entities

When evaluating whether we are the primary beneficiary of a

VIE and must therefore consolidate the entity, we perform a

qualitative analysis that considers the design of the VIE, the

nature of our involvement and the variable interests held by

other parties. If that evaluation is inconclusive as to which party

absorbs a majority of the entity’s expected losses or residual

returns, a quantitative analysis is performed to determine who is

the primary beneficiary. The largest single category of VIEs that

we are involved with are Qualifying Special Purpose Entities

(QSPEs), which meet specific characteristics defined in U.S. GAAP

that exclude them from the scope of consolidation standards.

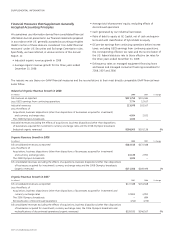

Consolidated Variable Interest Entities

Upon adoption of FIN 46 and FIN 46(R) on July 1, 2003 and

January 1, 2004, respectively, we consolidated certain VIEs with

$54.0 billion of assets and $52.6 billion of liabilities, which are

further described below. At December 31, 2008, assets and

liabilities of those VIEs, and additional VIEs consolidated as a

result of subsequent acquisitions of financial companies, totaled

$26,626 million and $21,256 million, respectively (at December 31,

2007, assets and liabilities were $32,382 million and $24,342 million,

respectively).