GE 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 ge 2008 annual report

notes to consolidated financial statements

Note 20.

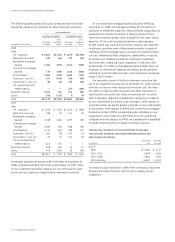

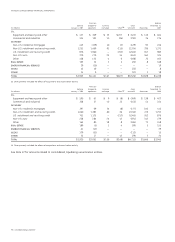

All Other Liabilities

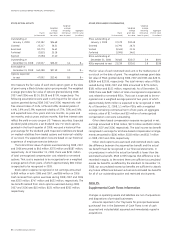

This caption includes liabilities for various items including non-

current compensation and benefits, deferred income, interest on

tax liabilities, unrecognized tax benefits, accrued participation and

residuals, environmental remediation, asset retirement obligations,

derivative instruments, product warranties and a variety of sun-

dry items.

Accruals for non-current compensation and benefits amounted

to $22,543 million and $22,322 million for year-end 2008 and

2007, respectively. These amounts include postretirement benefits,

pension accruals, and other compensation and benefit accruals

such as deferred incentive compensation. The increase in 2008

was primarily the result of an increase in pension accruals, partially

offset by a decrease in accrued deferred incentive compensation

and benefits from new healthcare supplier contracts.

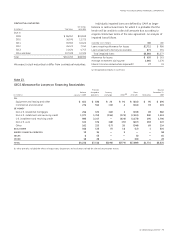

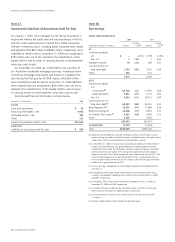

We are involved in numerous remediation actions to clean up

hazardous wastes as required by federal and state laws. Liabilities

for remediation costs exclude possible insurance recoveries and,

when dates and amounts of such costs are not known, are not

discounted. When there appears to be a range of possible costs

with equal likelihood, liabilities are based on the low end of such

range. Uncertainties about the status of laws, regulations, tech-

nology and information related to individual sites make it difficult

to develop a meaningful estimate of the reasonably possible

aggregate environmental remediation exposure.

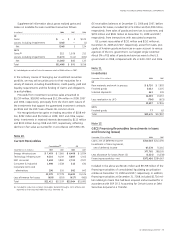

Note 19.

GECS Investment Contracts, Insurance Liabilities and

Insurance Annuity Benefits

GECS investment contracts, insurance liabilities and insurance

annuity benefits comprise mainly obligations to annuitants and

policyholders in our run-off insurance operations and holders of

guaranteed investment contracts.

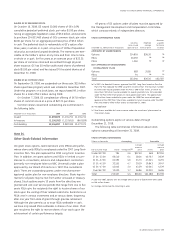

December 31 (In millions) 2008 2007

Investment contracts $ 4,212 $ 4,536

Guaranteed investment contracts 10,828 11,705

Total investment contracts 15,040 16,241

Life insurance benefits (a) 16,259 15,416

Unpaid claims and claims adjustment expenses 2,145 1,726

Unearned premiums 623 656

Universal life benefits 302 320

Total $34,369 $34,359

(a) Life insurance benefits are accounted for mainly by a net-level-premium method

using estimated yields generally ranging from 3.0% to 8.5% in both 2008 and 2007.

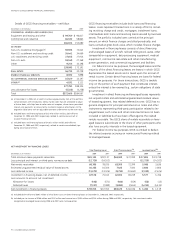

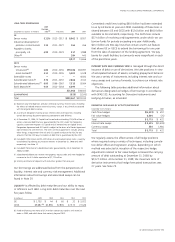

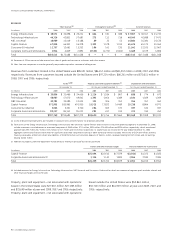

When insurance affiliates cede insurance to third parties, such

as reinsurers, they are not relieved of their primary obligation

to policyholders. Losses on ceded risks give rise to claims for

recovery; we establish allowances for probable losses on such

receivables from reinsurers as required. Reinsurance recoverables

are included in the caption “Other GECS receivables” on our

Statement of Financial Position, and amounted to $1,062 million

and $381 million at December 31, 2008 and 2007, respectively.

We recognize reinsurance recoveries as a reduction of the

Statement of Earnings caption “Investment contracts, insurance

losses and insurance annuity benefits.” Reinsurance recoveries

were $221 million, $104 million and $162 million for the years

ended December 31, 2008, 2007 and 2006, respectively.