GE 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ge 2008 annual report 75

notes to consolidated financial statements

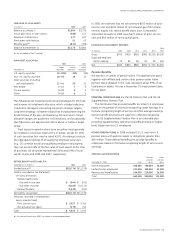

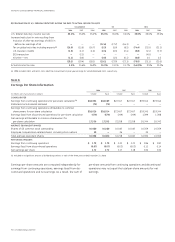

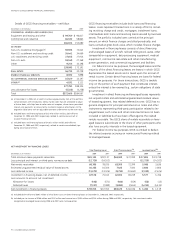

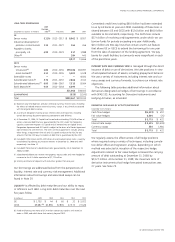

CONTRACTUAL MATURITIES

Net rentals

(In millions) Total loans receivable

Due in

2009 $ 86,957 $19,819

2010 36,970 13,725

2011 30,902 10,624

2012 26,421 7,150

2013 21,624 4,752

2014 and later 107,329 12,325

Total $310,203 $68,395

We expect actual maturities to differ from contractual maturities.

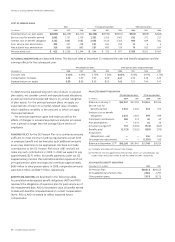

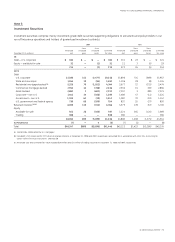

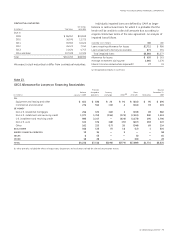

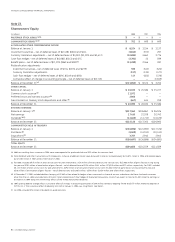

Individually impaired loans are defined by GAAP as larger

balance or restructured loans for which it is probable that the

lender will be unable to collect all amounts due according to

original contractual terms of the loan agreement. An analysis of

impaired loans follows.

December 31 (In millions) 2008 2007

Loans requiring allowance for losses $2,712 $ 986

Loans expected to be fully recoverable 871 391

Total impaired loans $3,583 $1,377

Allowance for losses $ 635 $ 361

Average investment during year 2,064 1,576

Interest income earned while impaired(a) 27 19

(a) Recognized principally on cash basis.

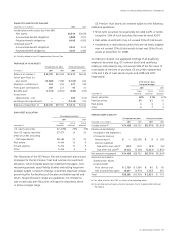

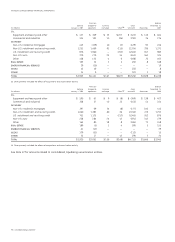

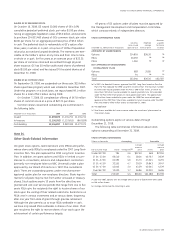

Note 13.

GECS Allowance for Losses on Financing Receivables

Provision Balance

Balance charged to Currency Gross December 31,

(In millions) January 1, 2008 operations exchange Other (a) write-offs Recoveries 2008

CLL

Equipment and leasing and other $ 661 $ 838 $ 24 $ 91 $ (815) $ 95 $ 894

Commercial and industrial 276 544 (12) 4 (416) 19 415

GE MONEY

Non-U.S. residential mortgages 246 323 (40) 2 (218) 69 382

Non-U.S. installment and revolving credit 1,371 1,748 (194) (223) (2,551) 900 1,051

U.S. installment and revolving credit 985 3,217 — (624) (2,173) 295 1,700

Non-U.S. auto 324 376 (48) (76) (637) 283 222

Other 162 220 (17) 28 (248) 69 214

REAL ESTATE 168 135 (7) 16 (12) 1 301

ENERGY FINANCIAL SERVICES 19 36 — 3 — — 58

GECAS 8 53 — — (1) — 60

OTHER 18 28 — — (18) — 28

TOTAL $4,238 $7,518 $(294) $(779) $(7,089) $1,731 $5,325

(a) Other primarily included the effects of acquisitions, dispositions, reclassifications to held for sale and securitization activity.