GE 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 ge 2008 annual report

notes to consolidated financial statements

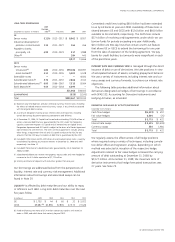

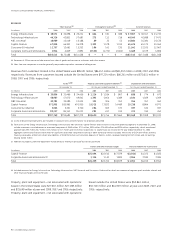

Note 27.

Operating Segments

Basis for Presentation

Our operating businesses are organized based on the nature of

markets and customers. Segment accounting policies are the

same as described in Note 1. Segment results for our financial

services businesses reflect the discrete tax effect of transactions,

but the intraperiod tax allocation is reflected outside of the seg-

ment unless otherwise noted in segment results.

Effects of transactions between related companies are elimi-

nated and consist primarily of GECS dividends to GE; GE customer

receivables sold to GECS; GECS services for trade receivables

management and material procurement; buildings and equipment

(including automobiles) leased by GE from GECS; IT and other

services sold to GECS by GE; aircraft engines manufactured by GE

that are installed on aircraft purchased by GECS from third-party

producers for lease to others; medical equipment manufactured

by GE that is leased by GECS to others; and various investments,

loans and allocations of GE corporate overhead costs.

A description of our operating segments as of December 31,

2008, can be found below, and details of segment profit by

operating segment can be found in the Summary of Operating

Segments table in Management’s Discussion and Analysis.

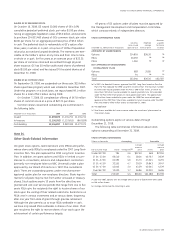

Energy Infrastructure

Power plant products and services, including design, installation,

operation and maintenance services are sold into global markets.

Gas, steam and aeroderivative turbines, generators, combined

cycle systems, controls and related services, including total asset

optimization solutions, equipment upgrades and long-term main-

tenance service agreements are sold to power generation and

other industrial customers. Renewable energy solutions include

wind turbines and solar technology. Water treatment services

and equipment include specialty chemical treatment programs,

water purification equipment, mobile treatment systems and

desalination processes.

The Oil & Gas business sells surface and subsea drilling and

production systems, equipment for floating production platforms,

compressors, turbines, turboexpanders and high pressure reactors

to national, international and independent oil and gas companies.

Services include equipment overhauls and upgrades, pipeline

inspection and integrity services, remote diagnostic and monitor-

ing and contractual service agreements. The acquisition of Hydril

Pressure Controls in April 2008 strengthened the drilling solutions

portfolio through the addition of blow out preventers, control

technology and associated services.

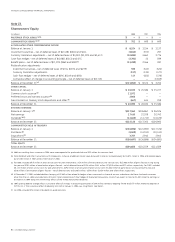

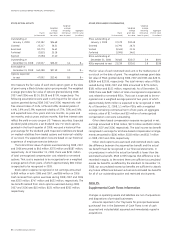

Note 26.

Intercompany Transactions

Effects of transactions between related companies are elimi-

nated and consist primarily of GECS dividend to GE; GE customer

receivables sold to GECS; GECS services for trade receivables

management and material procurement; buildings and equip-

ment (including automobiles) leased by GE from GECS; information

technology (IT) and other services sold to GECS by GE; aircraft

engines manufactured by GE that are installed on aircraft pur-

chased by GECS from third-party producers for lease to others;

medical equipment manufactured by GE that is leased by GECS

to others; and various investments, loans and allocations of GE

corporate overhead costs.

These intercompany transactions are reported in the GE and

GECS columns of our financial statements (and include customer

receivables sold from GE to GECS), but are eliminated in deriving

our Consolidated financial statements. The effects of these elimi-

nations on our Consolidated cash flows from operating, investing

and financing activities follow.

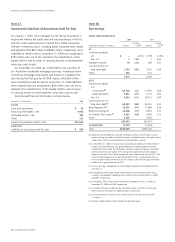

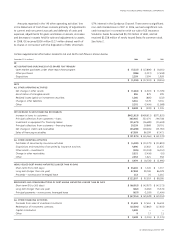

December 31 (In millions) 2008 2007 2006

OPERATING

Sum of GE and GECS cash from

operating activities —continuing

operations $ 50,290 $ 48,316 $ 45,351

Elimination of GECS dividend to GE (2,351) (7,291) (9,847)

Net decrease (increase) in GE

customer receivables sold to GECS 90 (255) (2,036)

Other reclassifications and eliminations (188) (828) (956)

Consolidated cash from operating

activities —continuing operations $ 47,841 $ 39,942 $ 32,512

INVESTING

Sum of GE and GECS cash used for

investing activities —continuing

operations $(39,615) $(67,845) $(54,132)

Net increase (decrease) in GE

customer receivables sold to GECS (90) 255 2,036

Other reclassifications and eliminations (320) 1,202 1,223

Consolidated cash used for investing

activities —continuing operations $(40,025) $(66,388) $(50,873)

FINANCING

Sum of GE and GECS cash from

financing activities —continuing

operations $ 22,760 $ 18,751 $ 16,772

Elimination of short-term

intercompany borrowings(a) (787) 1,950 (2,732)

Elimination of GECS dividend to GE 2,351 7,291 9,847

Other reclassifications and eliminations 316 99 (48)

Consolidated cash from financing

activities —continuing operations $ 24,640 $ 28,091 $ 23,839

(a) Represents GE investment in GECS short-term borrowings, such as commercial paper.