GE 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management’s discussion and analsis

38 ge 2008 annual report

During the fourth quarter of 2008, the FDIC adopted the TLGP

to address disruptions in the credit market, particularly the inter-

bank lending market, which reduced banks’ liquidity and impaired

their ability to lend. The goal of the TLGP is to decrease the cost

of bank funding so that bank lending to consumers and businesses

will normalize. The TLGP guarantees certain newly issued senior,

unsecured debt of banks, thrifts, and certain holding companies.

Under the FDIC’s Final Rule adopted on November 21, 2008,

certain senior, unsecured debt issued before June 30, 2009, with

a maturity of greater than 30 days that matures on or prior to

June 30, 2012, is automatically included in the program. GECC has

elected to participate in this program. The fees associated with

this program range from 50 to 100 basis points on an annualized

basis and vary according to the maturity of the debt issuance.

GECC also pays an additional 10 basis points, as it is not an insured

depository institution. On February 10, 2009, in a Joint Statement,

the Secretary of the Treasury, the Chairman of the Board of

Governors of the Federal Reserve, the Chairman of the FDIC, the

Comptroller of the Currency and the Director of the Office of Thrift

Supervision (OTS) announced that, for an additional premium,

the FDIC will extend the Debt Guarantee Program of the TLGP

through October 2009.

Included in GECS issuances above is $13.4 billion of senior,

unsecured long-term debt issued by GECC in the fourth quarter

of 2008 under the TLGP with varying maturities up to June 30,

2012. Additionally, GECC had commercial paper of $21.8 billion

outstanding at December 31, 2008, which was issued under the

TLGP (which is required for all commercial paper issuances with

maturities greater than 30 days).

In the fourth quarter of 2008, GE Capital extended $21.8 billion

of credit to U.S. customers, including 5 million new accounts,

and $7.7 billion of credit (including unfunded commitments of

$2.5 billion) to U.S. companies, with an average transaction size

of $2.4 million.

During the fourth quarter of 2008, GECS issued commercial

paper into the CPFF. The last tranche of this commercial paper

matures in February 2009. Although we do not anticipate further

utilization of the CPFF, it remains available until October 31,

2009. We incurred $0.6 billion of fees for our participation in the

TLGP and CPFF programs through December 31, 2008.

Our 2009 funding plan anticipates approximately $45 billion

of senior, unsecured long-term debt issuance. In January 2009,

we completed issuances of $11.0 billion funding under the TLGP.

We also issued $5.1 billion in non-guaranteed senior, unsecured

debt with a maturity of 30 years under the non-guarantee option

of the TLGP. These issuances, along with the $13.4 billion of pre-

funding done in December 2008, bring our aggregate issuances

to $29.5 billion or 66% of our anticipated 2009 funding plan.

Additionally, we anticipate that we will be 90% complete with our

2009 funding plan by June 30, 2009.

LIQUIDITY AND BORROWINGS

We manage our liquidity to help ensure access to sufficient fund-

ing at acceptable costs to meet our business needs and financial

obligations throughout business cycles. We rely on cash generated

through our operating activities as well as unsecured and secured

funding sources, including commercial paper, term debt, bank

deposits, bank borrowings, securitization and other retail funding

products.

The global credit markets have recently experienced unprec-

edented volatility, which has affected both the availability and

cost of our funding sources. In this current volatile credit

environment, we have taken a number of initiatives to strengthen

our liquidity, maintain our dividend, and maintain the highest

credit ratings. Specifically, we have:

Þ Reduced the GECS dividend to GE from 40% to 10% of GECS

earnings and suspended our stock repurchase program.

Þ Raised $15 billion in cash through common and preferred

stock offerings in October 2008 and contributed $5.5 billion

to GE Capital. In February 2009, the GE Board authorized a

capital contribution of up to $9.5 billion to GE Capital, which

is expected to be made in the first quarter of 2009.

Þ Reduced our commercial paper borrowings at GECS to

$72 billion at December 31, 2008.

Þ Targeted to further reduce GECS commercial paper borrowings

to $50 billion by the end of 2009 and to target committed

credit lines equal to GECS commercial paper borrowings going

forward.

Þ Grown our alternative funding to $54 billion at December 31,

2008, including $36 billion of bank deposits.

Þ Registered to use the Federal Reserve’s Commercial Paper

Funding Facility (CPFF) for up to $98 billion, which is available

through October 31, 2009.

Þ Registered to use the Federal Deposit Insurance Corporation’s

(FDIC) Temporary Liquidity Guarantee Program (TLGP) for

approximately $126 billion.

Þ At GECS, we are managing collections versus originations to

help support liquidity needs and are estimating $25 billion of

excess collections in 2009.

Throughout this period of volatility, we have been able to continue

to meet our funding needs at acceptable costs. We continue to

access the commercial paper markets without interruption.

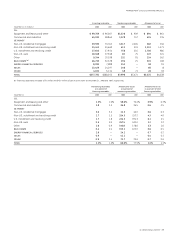

During 2008, GECS and its affiliates issued $84.3 billion of

senior, unsecured long-term debt. This debt was both fixed and

floating rate and was issued to institutional and retail investors in

the U.S. and 17 other global markets. Maturities for these issuances

ranged from one to 40 years.