GE 2008 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management’s discussion and analsis

28 ge 2008 annual report

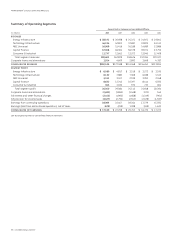

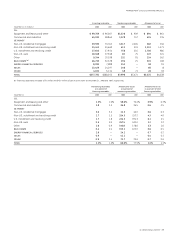

CAPITAL FINANCE

(In millions) 2008 2007 2006

REVENUES $67,008 $66,301 $56,378

SEGMENT PROFIT $ 8,632 $12,243 $10,397

December 31 (In millions) 2008 2007

TOTAL ASSETS $572,903 $583,965

(In millions) 2008 2007 2006

REVENUES

Commercial Lending and

Leasing (CLL) $26,742 $27,267 $25,833

GE Money 25,012 24,769 19,508

Real Estate 6,646 7,021 5,020

Energy Financial Services 3,707 2,405 1,664

GE Commercial Aviation

Services (GECAS) 4,901 4,839 4,353

SEGMENT PROFIT

CLL $ 1,805 $ 3,801 $ 3,503

GE Money 3,664 4,269 3,231

Real Estate 1,144 2,285 1,841

Energy Financial Services 825 677 648

GECAS 1,194 1,211 1,174

December 31 (In millions) 2008 2007

TOTAL ASSETS

CLL $232,486 $229,608

GE Money 183,617 209,178

Real Estate 85,266 79,285

Energy Financial Services 22,079 18,705

GECAS 49,455 47,189

Capital Finance 2008 revenues increased by 1%, and net earnings

decreased 29%, compared with 2007. Revenues in 2008 and

2007 included $4.4 billion and $0.5 billion from acquisitions,

respectively, and in 2008 were benefited by $0.1 billion as a result

of dispositions. Revenues in 2008 also decreased $3.3 billion as a

result of organic revenue declines ($4.5 billion), partially offset by

the weaker U.S. dollar ($1.2 billion). Net earnings decreased by

$3.6 billion in 2008, resulting from core declines ($3.5 billion),

including an increase of $1.9 billion in the provision for losses on

financing receivables, lower investment income ($0.6 billion) and

lower securitization income ($0.4 billion), offset by acquisitions

($0.5 billion), the weaker U.S. dollar ($0.3 billion) and dispositions

($0.1 billion). Net earnings included mark-to-market losses and

impairments ($1.4 billion), partially offset by increased tax benefits

from lower-taxed earnings from global operations ($0.7 billion)

and Genpact mark-to-market gains ($0.2 billion).

Segment profit rose 8% to $7.9 billion in 2007, compared with

$7.3 billion in 2006, as higher volume ($0.8 billion), productivity

($0.4 billion) and higher sales of minority interests in engine

programs ($0.1 billion) more than offset the effects of higher

material and other costs ($0.7 billion) and lower prices ($0.1 billion).

The increase in volume primarily related to Aviation, Healthcare

and Enterprise Solutions. The effects of productivity were primarily

at Healthcare and Transportation. The increase in material costs

was primarily at Aviation, partially offset by a decrease at

Healthcare, and labor and other costs increased across all busi-

nesses of the segment.

Technology Infrastructure orders were $47.2 billion in 2008,

down from $48.7 billion in 2007. The $37.6 billion total backlog at

year-end 2008 comprised unfilled product orders of $28.4 billion

(of which 48% was scheduled for delivery in 2009) and product

services orders of $9.2 billion scheduled for 2009 delivery.

Comparable December 31, 2007, total backlog was $35.5 billion,

of which $27.5 billion was for unfilled product orders and

$8.0 billion, for product services orders. See Corporate Items

and Eliminations for a discussion of items not allocated to this

segment.

NBC UNIVERSAL revenues increased $1.6 billion, or 10%, to

$17.0 billion in 2008, as revenues from the Olympics broadcasts

($1.0 billion) and higher revenues in cable ($0.6 billion) and film

($0.4 billion) were partially offset by lower earnings and impair-

ments related to associated companies and investment securities

($0.3 billion) and lower revenues from our television business

($0.1 billion). Segment profit of $3.1 billion in 2008 was flat com-

pared with 2007, as higher earnings from cable ($0.3 billion) and

proceeds from insurance claims ($0.4 billion) were offset by lower

earnings and impairments related to associated companies and

investment securities ($0.3 billion), losses from the Olympics

broadcasts ($0.2 billion), and lower earnings from our television

business ($0.1 billion) and film ($0.1 billion).

NBC Universal revenues declined 5%, or $0.8 billion, in 2007,

primarily from the lack of current-year counterparts to the 2006

Olympics broadcasts ($0.7 billion) and 2006 sale of television

stations ($0.2 billion), lower revenues in our broadcast network

and television stations as a result of lower advertising sales

($0.5 billion) and lower film revenues ($0.1 billion), partially offset

by higher revenues for cable ($0.4 billion) and television produc-

tion and distribution ($0.3 billion). Segment profit rose 6%, or

$0.2 billion, in 2007 as improvements in cable ($0.2 billion), tele-

vision production and distribution ($0.2 billion), film ($0.1 billion)

and the absence of Olympics broadcasts in 2007 ($0.1 billion)

were partially offset by the lack of a current-year counterpart to

the 2006 sale of four television stations ($0.2 billion) and lower

earnings from our broadcast network and television stations

($0.2 billion). See Corporate Items and Eliminations for a discussion

of items not allocated to this segment.