GE 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 ge 2008 annual report

notes to consolidated financial statements

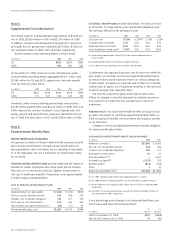

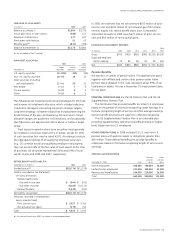

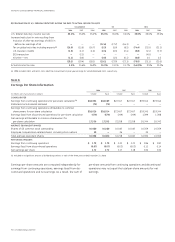

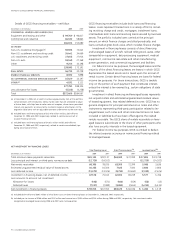

ACTUARIAL ASSUMPTIONS are described below. The discount rates

at December 31 measured the year-end benefit obligations and

the earnings effects for the subsequent year.

December 31 2008 2007 2006 2005

Discount rate 6.15% 6.31% (a) 5.75% 5.25%

Compensation increases 4.20 5.00 5.00 5.00

Expected return on assets 8.50 8.50 8.50 8.50

Initial healthcare trend rate(c) 7.00 (b) 9.10 9.20 10.00

(a) Weighted average discount rate of 6.34% was used for determination of

costs in 2008.

(b) Includes benefits from new healthcare supplier contracts.

(c) For 2008, ultimately declining to 6% for 2025 and thereafter.

To determine the expected long-term rate of return on retiree life

plan assets, we consider current and expected asset allocations,

as well as historical and expected returns on various categories

of plan assets. We apply our expected rate of return to a market-

related value of assets, which stabilizes variability in the amounts

to which we apply that expected return.

We amortize experience gains and losses as well as the

effects of changes in actuarial assumptions and plan provisions

over a period no longer than the average future service of

employees.

FUNDING POLICY. We fund retiree health benefits on a pay-as-you-

go basis. We expect to contribute approximately $665 million in

2009 to fund such benefits. We fund retiree life insurance benefits

at our discretion.

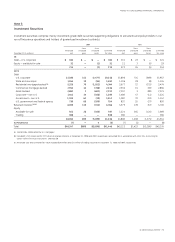

Changes in the accumulated postretirement benefit obligation

for retiree benefit plans follow.

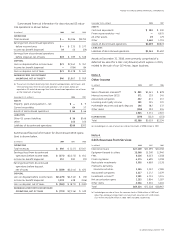

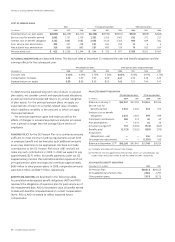

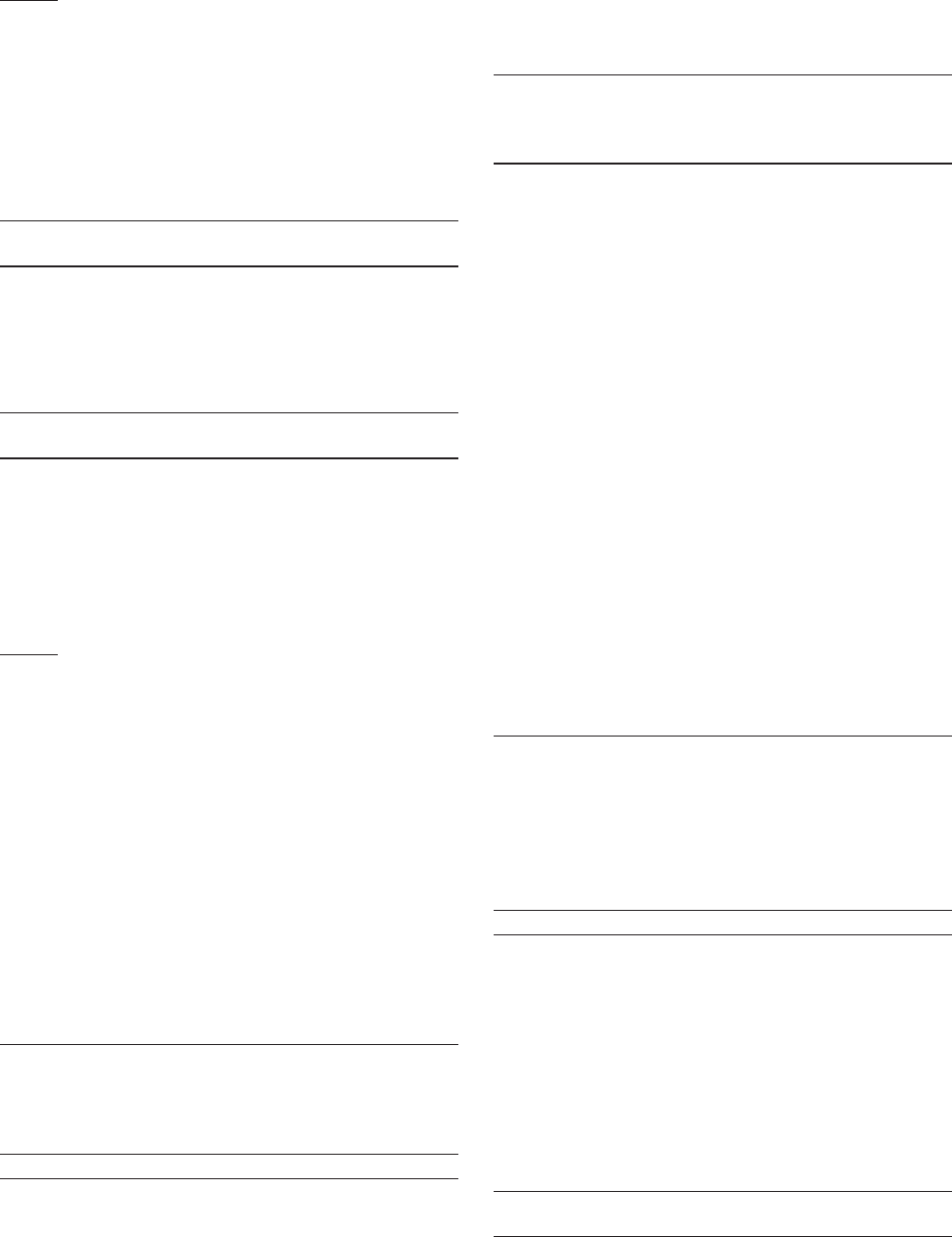

ACCUMULATED POSTRETIREMENT BENEFIT OBLIGATION (APBO)

(In millions) 2008 2007

Balance at January 1 $12,983 $ 8,262

Service cost for benefits earned 326 286

Interest cost on benefit obligation 750 577

Participant contributions 51 47

Plan amendments (a) —4,257

Actuarial loss (gain) (b) (1,351) 320

Benefits paid (c) (811) (796)

Other 130

Balance at December 31 (d) $11,949 $12,983

(a) For 2007, related to labor agreements negotiated with U.S. unions.

(b) For 2008, primarily related to benefits from new healthcare supplier contracts.

(c) Net of Medicare Part D subsidy of $83 million and $73 million in 2008 and 2007,

respectively.

(d) The APBO for the retiree health plans was $9,749 million and $10,847 million at

year-end 2008 and 2007, respectively.

A one percentage point change in the assumed healthcare cost

trend rate would have the following effects.

1% 1%

(In millions) increase decrease

APBO at December 31, 2008 $990 $(848)

Service and interest cost in 2008 95 (80)

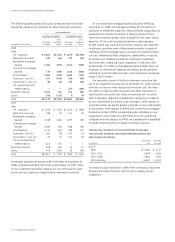

Note 5.

Supplemental Cost Information

We funded research and development expenditures of $3,020 mil-

lion in 2008, $3,009 million in 2007 and $2,790 million in 2006.

In addition, research and development funding from customers,

principally the U.S. government, totaled $1,287 million, $1,066 mil-

lion and $690 million in 2008, 2007 and 2006, respectively.

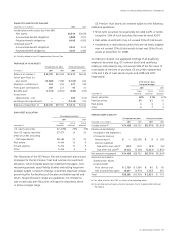

Rental expense under operating leases is shown below.

(In millions) 2008 2007 2006

GE $912 $929 $854

GECS 992 955 863

At December 31, 2008, minimum rental commitments under

noncancellable operating leases aggregated $3,022 million and

$3,565 million for GE and GECS, respectively. Amounts payable

over the next five years follow.

(In millions) 2009 2010 2011 2012 2013

GE $550 $548 $496 $429 $390

GECS 774 621 508 435 303

Payments under revenue sharing partnerships amounted to

$2,290 million, $1,878 million and $1,413 million in 2008, 2007 and

2006, respectively, and are included in cost of goods sold. GE’s

selling, general and administrative expenses totaled $14,401 mil-

lion in 2008, $14,148 million in 2007 and $12,893 million in 2006.

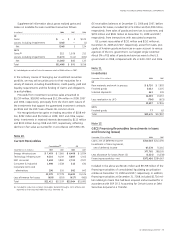

Note 6.

Postretirement Benefit Plans

Retiree Health and Life Benefits

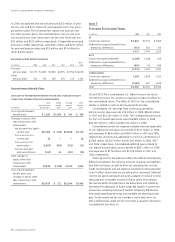

We sponsor a number of retiree health and life insurance benefit

plans (retiree benefit plans). Principal retiree benefit plans are

discussed below; other such plans are not significant individually

or in the aggregate. We use a December 31 measurement date

for our plans.

PRINCIPAL RETIREE BENEFIT PLANS provide health and life insurance

benefits to certain employees who retire under the GE Pension

Plan with 10 or more years of service. Eligible retirees share in

the cost of healthcare benefits. These plans cover approximately

225,000 retirees and dependents.

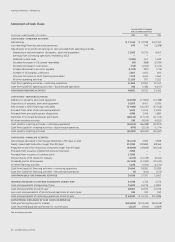

COST OF PRINCIPAL RETIREE BENEFIT PLANS

(In millions) 2008 2007 2006

Expected return on plan assets $ (131) $ (125) $(127)

Service cost for benefits earned 326 286 229

Interest cost on benefit obligation 750 577 455

Prior service cost amortization 673 603 363

Net actuarial loss (gain) amortization (49) (17) 64

Retiree benefit plans cost $1,569 $1,324 $ 984