GE 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ge 2008 annual report 77

notes to consolidated financial statements

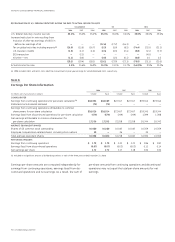

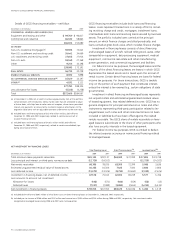

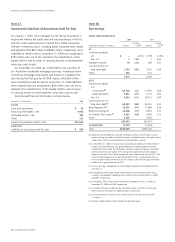

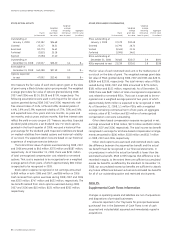

Amortization of GECS equipment leased to others was $8,173 mil-

lion, $7,222 million and $5,839 million in 2008, 2007 and 2006,

respectively. Noncancellable future rentals due from customers

for equipment on operating leases at December 31, 2008, are as

follows:

(In millions)

Due in

2009 $ 9,103

2010 7,396

2011 5,542

2012 4,157

2013 3,109

2014 and later 8,714

Total $38,021

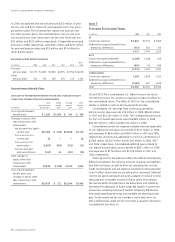

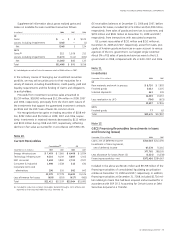

Note 15.

Goodwill and Other Intangible Assets

December 31 (In millions) 2008 2007

GOODWILL

GE $56,394 $55,689

GECS 25,365 25,427

Total $81,759 $81,116

December 31 (In millions) 2008 2007

OTHER INTANGIBLE ASSETS

GE

Intangible assets subject to amortization $ 9,010 $ 9,278

Indefinite-lived intangible assets (a)

2,354 2,355

11,364 11,633

GECS

Intangible assets subject to amortization 3,613 4,509

Total $14,977 $16,142

(a) Indefinite-lived intangible assets principally comprised trademarks, tradenames

and U.S. Federal Communications Commission licenses.

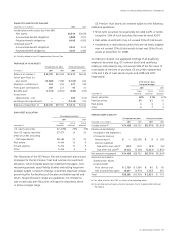

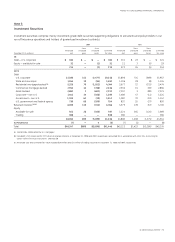

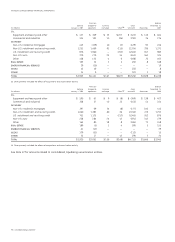

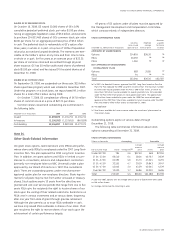

Note 14.

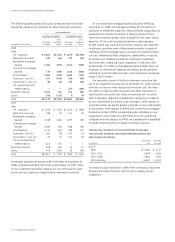

Property, Plant and Equipment

Depreciable

December 31 (Dollars in millions) lives-new (in years) 2008 2007

ORIGINAL COST

GE

Land and improvements 8 (a) $ 738 $ 698

Buildings, structures and

related equipment 8–40 7,354 7,700

Machinery and equipment 4–20 22,114 20,569

Leasehold costs and manufacturing

plant under construction 1–10 2,305 2,121

32,511 31,088

GECS (b)

Land and improvements, buildings,

structures and related equipment 2–40 (a) 7,076 6,051

Equipment leased to others

Aircraft 20 40,478 37,271

Vehicles 1–14 32,098 32,079

Railroad rolling stock 5–36 4,402 3,866

Construction and manufacturing 2–25 3,363 3,031

Mobile equipment 12–25 2,954 2,964

All other 2–40 2,789 2,961

93,160 88,223

Total $125,671 $119,311

NET CARRYING VALUE

GE

Land and improvements $ 705 $ 612

Buildings, structures and

related equipment 3,768 4,101

Machinery and equipment 7,999 7,634

Leasehold costs and manufacturing

plant under construction 1,961 1,795

14,433 14,142

GECS (b)

Land and improvements, buildings,

structures and related equipment 4,527 3,703

Equipment leased to others

Aircraft(c) 32,288 30,414

Vehicles 18,149 20,701

Railroad rolling stock 2,915 2,789

Construction and manufacturing 2,333 2,055

Mobile equipment 2,022 1,976

All other 1,863 2,108

64,097 63,746

Total $ 78,530 $ 77,888

(a) Depreciable lives exclude land.

(b) Included $1,748 million and $1,513 million of original cost of assets leased to GE

with accumulated amortization of $491 million and $315 million at December 31,

2008 and 2007, respectively.

(c) The GECAS business of Capital Finance recognized impairment losses of $72 million

in 2008 and $110 million in 2007 recorded in the caption “Other costs and expenses”

in the Statement of Earnings to reflect adjustments to fair value based on current

market values from independent appraisers.