GE 2008 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management’s discussion and analsis

22 ge 2008 annual report

$521.2 billion, $456.4 billion and $389.0 billion in 2008, 2007 and

2006, respectively. GECS average composite effective interest

rate was 4.8% in 2008, 5.0% in 2007 and 4.6% in 2006. In 2008,

GECS average assets of $667.2 billion were 13% higher than in

2007, which in turn were 17% higher than in 2006. We anticipate

that our composite rates will continue to decline through 2009

as a result of decreased benchmark rates globally. However,

these decreases in benchmark rates will be partially offset by

higher credit spreads and fees associated with government

guarantees and higher cash balances resulting from pre-funding

of debt maturities and the need to maintain greater liquidity in the

current environment. See the Liquidity and Borrowings section

for a discussion of liquidity, borrowings and interest rate risk

management.

INCOME TAXES are a significant cost. As a global commercial

enterprise, our tax rates are affected by many factors, including

our global mix of earnings, the extent to which those global

earnings are indefinitely reinvested outside the United States,

legislation, acquisitions, dispositions and tax characteristics of our

income. Our tax returns are routinely audited and settlements of

issues raised in these audits sometimes affect our tax provisions.

Income taxes on consolidated earnings from continuing

operations were 5.5% in 2008 compared with 15.6% in 2007 and

16.9% in 2006. Our consolidated income tax rate decreased from

2007 to 2008 primarily because of a reduction during 2008 of

income in higher-taxed jurisdictions. This increased the relative

effect of tax benefits from lower-taxed global operations on the

tax rate. In addition, earnings from lower-taxed global operations

increased from 2007 to 2008. The increase in the benefit from

lower-taxed global operations includes a benefit from the 2008

decision to indefinitely reinvest, outside the U.S., prior-year

earnings because the use of foreign tax credits no longer required

the repatriation of those prior-year earnings.

Our consolidated income tax rate decreased from 2006 to

2007 as the tax benefit on the disposition of our investment in

SES and an increase in favorable settlements with tax authorities

more than offset a decrease in the benefit from lower-taxed

earnings from global operations, which in 2006 included one-time

tax benefits from planning to use non-U.S. tax net operating losses.

A more detailed analysis of differences between the U.S.

federal statutory rate and the consolidated rate, as well as other

information about our income tax provisions, is provided in

Note 7. The nature of business activities and associated income

taxes differ for GE and for GECS and a separate analysis of each

is presented in the paragraphs that follow.

Because GE tax expense does not include taxes on GECS

earnings, the GE effective tax rate is best analyzed in relation to

GE earnings excluding GECS. GE pre-tax earnings from continuing

operations, excluding GECS earnings from continuing operations,

were $13.7 billion, $12.8 billion and $11.7 billion for 2008, 2007

and 2006, respectively. On this basis, GE’s effective tax rate was

24.9% in 2008, 21.8% in 2007 and 21.9% in 2006.

Our principal pension plans were underfunded by $4.4 billion

at the end of 2008 as compared to overfunded by $16.8 billion at

December 31, 2007. At December 31, 2008, the GE Pension Plan

was underfunded by $0.9 billion and the GE Supplementary

Pension Plan, which is an unfunded plan, had a projected benefit

obligation of $3.5 billion. The reduction in surplus from year-end

2007 was primarily attributable to asset investment performance

resulting from the deteriorating market conditions and economic

environment in 2008. Our principal pension plans’ assets

decreased from $59.7 billion at the end of 2007 to $40.7 billion

at December 31, 2008, a 28.2% decline in investment values

during the year. Assets of the GE Pension Plan are held in trust,

solely for the benefit of Plan participants, and are not available for

general Company operations. Although the reduction in pension

plan assets in 2008 will impact future pension plan costs, the

Company’s requirement to make future cash contributions to the

Trust will depend on future market and economic conditions.

On an Employee Retirement Income Security Act (ERISA) basis,

the GE Pension Plan remains fully funded at January 1, 2009. We

will not make any contributions to the GE Pension Plan in 2009.

Assuming our 2009 actual experience is consistent with our

current benefit assumptions (e.g., expected return on assets and

interest rates), we will not be required to make contributions to

the GE Pension Plan in 2010.

At December 31, 2008, the fair value of assets for our other

pension plans was $2.4 billion less than the respective projected

benefit obligations. The comparable amount at December 31,

2007 was $1.6 billion. We expect to contribute $0.7 billion to our

other pension plans in 2009, compared with actual contributions

of $0.6 billion and $0.7 billion in 2008 and 2007, respectively.

Our principal retiree health and life plans obligations exceeded

the fair value of related assets by $10.8 billion and $11.2 billion at

December 31, 2008 and 2007, respectively. We fund our retiree

health benefits on a pay-as-you-go basis. We expect to contribute

$0.7 billion to these plans in 2009 compared with actual contri-

butions of $0.6 billion in 2008 and 2007.

The funded status of our postretirement benefits plans and

future effects on operating results depend on economic conditions

and investment performance. See Note 6 for additional informa-

tion about funded status, components of earnings effects and

actuarial assumptions.

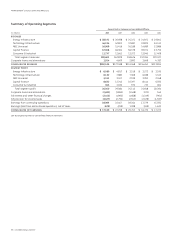

GE OTHER COSTS AND EXPENSES are selling, general and adminis-

trative expenses. These costs were 12.9%, 14.2% and 14.3% of

total GE sales in 2008, 2007 and 2006, respectively.

INTEREST ON BORROWINGS AND OTHER FINANCIAL CHARGES

amounted to $26.2 billion, $23.8 billion and $18.9 billion in 2008,

2007 and 2006, respectively. Substantially all of our borrowings

are in financial services, where interest expense was $25.1 billion,

$22.7 billion and $17.8 billion in 2008, 2007 and 2006, respectively.

Average borrowings increased over the three-year period. Interest

rates increased from 2006 to 2007 attributable to rising credit

spreads. Interest rates have decreased from 2007 to 2008 in line

with general market conditions. GECS average borrowings were