GE 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ge 2008 annual report 95

notes to consolidated financial statements

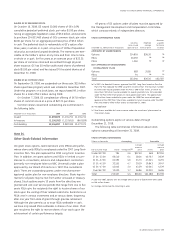

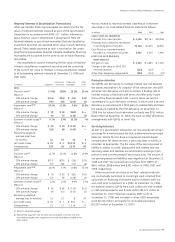

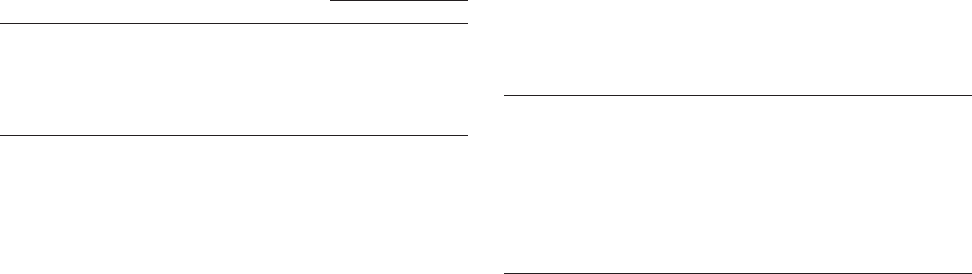

LOAN COMMITMENTS

Notional amount

December 31 (In millions) 2008 2007

Ordinary course of business lending

commitments (a) (b) $ 8,507 $ 11,731

Unused revolving credit lines(c)

Commercial 25,011 24,554

Consumer —principally credit cards 252,867 477,285

(a) Excluded investment commitments of $3,501 million and $4,864 million as of

December 31, 2008 and 2007, respectively.

(b) Included a $1,067 million secured commitment associated with an arrangement

that can increase to a maximum of $4,943 million based on the asset volume

under the arrangement.

(c) Excluded inventory financing arrangements, which may be withdrawn at our

option, of $14,503 million and $14,654 million as of December 31, 2008 and 2007,

respectively.

Derivatives and Hedging

We conduct our business activities in diverse markets around

the world, including countries where obtaining local funding is

sometimes inefficient. The nature of our activities exposes us to

changes in interest rates and currency exchange rates. We

manage such risks using various techniques including issuing

debt whose terms correspond to terms of the funded assets, as

well as combinations of debt and derivatives that achieve our

objectives. We also are exposed to various commodity price risks

and address certain of these risks with commodity contracts.

By policy, we do not use derivatives for speculative purposes.

We value derivatives that are not exchange-traded with internal

market-based valuation models. When necessary, we also obtain

information from our derivative counterparties to validate our

models and to value the few products that our internal models

do not address.

We use interest rate swaps, currency derivatives and commod-

ity derivatives to reduce the variability of expected future cash

flows associated with variable rate borrowings and commercial

purchase and sale transactions, including commodities. We use

interest rate swaps, currency swaps and interest rate and currency

forwards to hedge the fair value effects of interest rate and

currency exchange rate changes on local and non-functional

currency denominated fixed-rate borrowings and certain types

of fixed-rate assets. We use currency swaps and forwards to

protect our net investments in global operations conducted in non-

U.S. dollar currencies. We intend all of these positions to qualify

as hedges and to be accounted for as hedges.

We use swaps, futures and option contracts, including caps,

floors and collars, as economic hedges of changes in interest rates,

currency exchange rates and equity prices on certain types of

assets and liabilities. We sometimes use credit default swaps to

economically hedge the credit risk of various counterparties

with which we have entered into loan or leasing arrangements.

We occasionally obtain equity warrants as part of sourcing or

financing transactions. Although these instruments are derivatives,

their economic risks are similar to, and managed on the same

basis as, risks of other equity instruments we hold. These instru-

ments are marked to market through earnings.

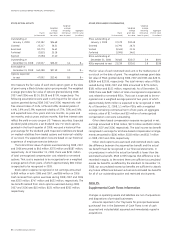

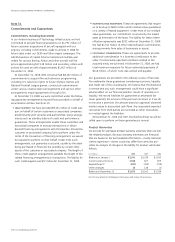

Earnings Effects of Derivatives Designated as Hedges

The following table provides information about the earnings

effects of derivatives designated and qualifying as hedges.

PRE-TAX GAINS (LOSSES)

December 31 (In millions) 2008 2007 2006

CASH FLOW HEDGES

Ineffectiveness $ 8 $ (3) $ 10

Amounts excluded from the measure

of effectiveness 5(17) (16)

FAIR VALUE HEDGES

Ineffectiveness (600) 7 (47)

Amounts excluded from the measure

of effectiveness (26) (13) 33

Ineffectiveness primarily related to changes in the present value

of the initial credit spread over the benchmark interest rate

associated with hedges of our fixed rate borrowings.

In 2008, 2007 and 2006, we recognized insignificant gains

and losses related to hedged forecasted transactions and firm

commitments that did not occur by the end of the originally

specified period.

Guarantees of Derivatives

We do not sell credit default swaps; however, as a part of our

risk management services, we provide performance guarantees

to third-party financial institutions related to plain vanilla interest

rate swaps on behalf of certain customers related to variable rate

loans we have extended to them. The underwriting risk inherent

in these arrangements is essentially similar to that of a fixed rate

loan. Under these arrangements, the guarantee is secured, usually

by the asset being purchased or financed, or by other assets of

the guaranteed party. In addition, these agreements are under-

written to provide for collateral value that exceeds the combination

of the loan amount and the initial expected future exposure of

the derivative. These credit support arrangements mature on the

same date as the related financing arrangements or transactions

and are across a broad spectrum of diversified industries and

companies. The fair value of our guarantee is $28 million at

December 31, 2008. Because we are guaranteeing the performance

of the customer under these arrangements, our exposure to loss

at any point in time is limited to the fair value of the customer’s

derivative contracts that are in a liability position. The aggregate

termination value of such contracts at December 31, 2008, was

$386 million before consideration of any offsetting effect of

collateral. At December 31, 2008, collateral value was sufficient

to cover the loan amount and the fair value of the customer’s

derivative, in the event we had been called upon to perform under

the guarantee. If we assumed that, on January 1, 2009, interest

rates moved unfavorably by 100 basis points across the yield curve

(a “parallel shift” in that curve), the effect on the fair value of such

contracts, without considering any potential offset of the under-

lying collateral, would have been an increase of $161 million.

Given our strict underwriting criteria, we believe the likelihood that

we will be required to perform under the guarantee is remote.

Additional information regarding our use of derivatives is

provided in Note 18 and Note 23.