GE 2008 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management’s discussion and analsis

ge 2008 annual report 21

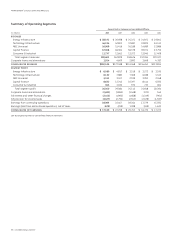

these cost reduction efforts, segment profit declined on higher

material and other costs.

Overall, acquisitions contributed $7.4 billion, $7.7 billion and

$3.9 billion to consolidated revenues in 2008, 2007 and 2006,

respectively. Our consolidated earnings included approximately

$0.8 billion in 2008, and $0.5 billion in both 2007 and 2006, from

acquired businesses. We integrate acquisitions as quickly as pos-

sible. Only revenues and earnings from the date we complete

the acquisition through the end of the fourth following quarter

are attributed to such businesses. Dispositions also affected our

ongoing results through higher revenues of $0.1 billion in 2008

and lower revenues of $3.6 billion and $1.3 billion in 2007 and

2006, respectively. This resulted in higher earnings of $0.4 billion

in both 2008 and 2007, and $0.1 billion in 2006.

Significant matters relating to our Statement of Earnings are

explained below.

DISCONTINUED OPERATIONS. In September 2007, we committed

to a plan to sell our Japanese personal loan business (Lake) upon

determining that, despite restructuring, Japanese regulatory lim-

its for interest charges on unsecured personal loans did not per-

mit us to earn an acceptable return. During 2008, we completed

the sale of GE Money Japan, which included Lake, along with our

Japanese mortgage and card businesses, excluding our minority

ownership in GE Nissen Credit Co., Ltd. In December 2007, we

completed the exit of WMC as a result of continued pressures in

the U.S. subprime mortgage industry. Both of these businesses

were previously reported in the Capital Finance segment.

In August 2007, we completed the sale of our Plastics busi-

ness. We sold this business because of its cyclicality, rising costs

of natural gas and raw materials, and the decision to redeploy

capital resources into higher-growth businesses. During 2006,

we sold our Advanced Materials business.

In 2006, we substantially completed our planned exit of the

insurance businesses through the sale of the property and casu-

alty insurance and reinsurance businesses and the European life

and health operations of GE Insurance Solutions Corporation (GE

Insurance Solutions) and the sale of GE Life, our U.K.-based life

insurance operation, to Swiss Reinsurance Company (Swiss Re),

and the sale, through a secondary public offering, of our remain-

ing 18% investment in Genworth Financial, Inc. (Genworth), our

formerly wholly-owned subsidiary that conducted most of our

consumer insurance business, including life and mortgage insur-

ance operations.

We reported the businesses described above as discontinued

operations for all periods presented. For further information

about discontinued operations, see Note 2.

WE DECLARED $12.6 BILLION IN DIVIDENDS IN 2008. Common per-

share dividends of $1.24 were up 8% from 2007, following a 12%

increase from the preceding year. On February 6, 2009, our Board

of Directors approved a regular quarterly dividend of $0.31 per

share of common stock, which is payable April 27, 2009, to share-

owners of record at close of business on February 23, 2009. This

payment will complete the dividend for the first half of 2009. The

Board will continue to evaluate the Company’s dividend level for

the second half of 2009 in light of the growing uncertainty in the

economy, including U.S. government actions, rising unemployment

and the recent announcements by the rating agencies. In 2008,

we declared $0.1 billion in preferred stock dividends.

Except as otherwise noted, the analysis in the remainder of

this section presents the results of GE (with GECS included on a

one-line basis) and GECS. See the Segment Operations section for

a more detailed discussion of the businesses within GE and GECS.

GE SALES OF PRODUCT SERVICES were $35.5 billion in 2008, a

10% increase from 2007. Increases in product services in 2008

and 2007 were led by growth at Energy Infrastructure and

Technology Infrastructure. Operating profit from product services

was $9.3 billion in 2008, up 3% from 2007.

POSTRETIREMENT BENEFIT PLANS costs were $2.2 billion, $2.6 bil-

lion and $2.3 billion in 2008, 2007 and 2006, respectively. The

cost decreased in 2008 primarily because of the effects of prior

years’ investment gains, higher discount rates and benefits from

new healthcare supplier contracts, partially offset by additional

costs of plan benefits resulting from union negotiations and a

pensioner increase in 2007. The cost increased in 2007 primarily

because of plan benefit changes resulting from new U.S. labor

agreements and increases in retiree medical and drug costs,

partially offset by increases in discount rates for the year and

effects of recent investment gains. The cost increased in 2006

primarily because of the effects of prior-years’ investment losses

and lower discount rates.

Considering the current and expected asset allocations, as

well as historical and expected returns on various categories of

assets in which our plans are invested, we have assumed that

long-term returns on our principal pension plan assets will be

8.5% for cost recognition in 2009, the same level as we assumed

in 2008, 2007 and 2006. GAAP provides recognition of differences

between assumed and actual returns over a period no longer

than the average future service of employees.

We expect the costs of our postretirement benefits in 2009 to

be about the same as the 2008 costs. The effects of decreasing

discount rates (principal pension plans’ discount rate decreasing

from 6.34% to 6.11%) will be largely offset by prior-years’ invest-

ment gains and benefits from new healthcare supplier contracts.

Assuming our 2009 actual experience is consistent with our

current benefit assumptions (e.g., expected return on assets,

discount rates and healthcare trend rates), we expect that costs

of our postretirement benefits will increase by approximately

$1.0 billion in 2010 as compared to 2009, primarily due to

amortization of our unamortized losses relating to our principal

pension plans.