GE 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

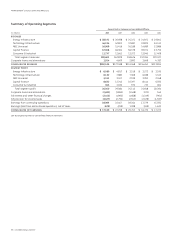

management’s discussion and analsis

36 ge 2008 annual report

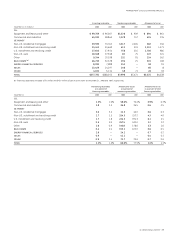

CLL— EQUIPMENT AND LEASING AND OTHER. Nonearning receivables

of $1.5 billion represented 19.1% of total nonearning receivables

at December 31, 2008. The ratio of allowance for losses as a

percent of nonearning receivables declined from 70.4% at

December 31, 2007, to 58.6% at December 31, 2008, primarily

from an increase in secured exposures which did not require

specific reserves based upon the strength of the underlying

collateral values.

CLL — COMMERCIAL AND INDUSTRIAL. Nonearning receivables of

$1.1 billion represented 14.1% of total nonearning receivables at

December 31, 2008. The ratio of allowance for losses as a percent

of nonearning receivables increased from 36.5% at December 31,

2007, to 36.8% at December 31, 2008. The ratio of nonearning

receivables as a percentage of financing receivables increased

from 1.3% at December 31, 2007, to 1.8% at December 31,

2008, primarily from an increase in nonearning receivables in

secured lending in media and communications, auto and trans-

portation, and consumer manufacturing companies.

GE MONEY — NON-U.S. RESIDENTIAL MORTGAGES. Nonearning

receivables of $3.3 billion represented 41.5% of total nonearning

receivables at December 31, 2008. The ratio of allowance for

losses as a percent of nonearning receivables increased from

10.0% at December 31, 2007, to 11.5% at December 31, 2008.

Our non-U.S. mortgage portfolio has a loan-to-value of approxi-

mately 74% at origination and the vast majority are first lien

positions. In addition, we carry mortgage insurance on most first

mortgage loans originated at a loan-to-value above 80%. In 2008,

our nonearning receivables increased primarily as a result of

the declining U.K. housing market and our allowance increased

accordingly. At December 31, 2008, we had foreclosed on fewer

than 1,000 houses in the U.K.

GE MONEY — U.S. INSTALLMENT AND REVOLVING CREDIT.

Nonearning receivables of $0.8 billion represented 9.5% of total

nonearning receivables at December 31, 2008. The ratio of allow-

ance for losses as a percent of nonearning receivables increased

from 191.3% at December 31, 2007, to 224.3% at December 31,

2008, reflecting the effects of the continued deterioration in our

U.S. portfolio in connection with rising unemployment.

GE MONEY — NON-U.S. AUTO. Nonearning receivables of $0.1 billion

represented 1% of total nonearning receivables at December 31,

2008. The ratio of allowance for losses as a percent of nonearning

receivables decreased from 432.0% at December 31, 2007, to

267.5% at December 31, 2008. This is primarily a result of the

disposition of our Thailand auto business, the decision to dispose

of our U.K. auto business, and the effects of recoveries.

The majority of the allowance for losses of $5.3 billion at

December 31, 2008, and $4.2 billion at December 31, 2007, is

determined based upon a formulaic approach. Further information

on the determination of the allowance for losses on financing

receivables is provided in the Critical Accounting Estimates section

and Notes 1 and 13.

A portion of the allowance for losses is related to specific

reserves on loans that have been determined to be individually

impaired under SFAS 114, Accounting by Creditors for Impairment

of a Loan. Under SFAS 114, individually impaired loans are defined

as larger balance or restructured loans for which it is probable that

the lender will be unable to collect all amounts due according to

original contractual terms of the loan agreement. These specific

reserves amounted to $0.6 billion and $0.4 billion at December 31,

2008 and December 31, 2007, respectively. Further information

pertaining to specific reserves is included in the table below.

December 31 (In millions) 2008 2007

Loans requiring allowance for losses $2,712 $ 986

Loans expected to be fully recoverable 871 391

Total impaired loans $3,583 $1,377

Allowance for losses $ 635 $ 361

Average investment during year 2,064 1,576

Interest income earned while impaired(a) 27 19

(a) Recognized principally on cash basis.

The portfolio of financing receivables, before allowance for losses,

was $377.8 billion at December 31, 2008, and $388.3 billion at

December 31, 2007. Financing receivables, before allowance for

losses, decreased $10.5 billion from December 31, 2007, primarily

as a result of commercial and equipment securitization and sales

($36.7 billion), the stronger U.S. dollar ($29.4 billion) and dispositions

($7.0 billion), partially offset by core growth ($42.9 billion) and

acquisitions ($31.9 billion).

Related nonearning receivables totaled $8.0 billion (2.1% of

outstanding receivables) at December 31, 2008, compared with

$5.5 billion (1.4% of outstanding receivables) at December 31, 2007.

Related nonearning receivables increased from December 31,

2007, primarily because of rising unemployment, along with the

increasingly challenging global economic environment.

The allowance for losses at December 31, 2008, totaled

$5.3 billion compared with $4.2 billion at December 31, 2007,

representing our best estimate of probable losses inherent in the

portfolio and reflecting the then current credit and economic

environment. Allowance for losses increased $1.1 billion from

December 31, 2007, primarily because of increasing delinquencies

and nonearning receivables reflecting the continued weakened

economic and credit environment. Coincident with the changes in

the environment, we saw a significant increase in delinquencies

in the latter half of 2008, particularly in the fourth quarter. As the

environment worsened in the latter half of the year, we recognized

provisions accordingly.