GE 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 ge 2008 annual report

notes to consolidated financial statements

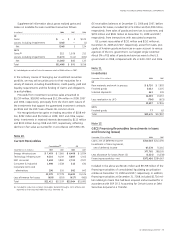

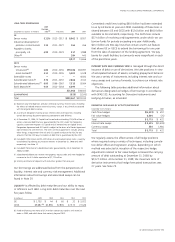

Goodwill balances increased $3,694 million in 2008 from new

acquisitions. The most significant increases related to acquisitions

of Hydril Pressure Control ($725 million) at Energy Infrastructure,

Merrill Lynch Capital ($643 million) at Capital Finance, Vital Signs

($594 million) and Whatman plc. ($592 million) at Technology

Infrastructure, Bank BPH ($470 million) at Capital Finance, CDM

Resource Management, Ltd. ($229 million) at Capital Finance and

CitiCapital ($166 million) at Capital Finance. During 2008, the

goodwill balance increased by $599 million related to purchase

accounting adjustments for prior-year acquisitions. The most

significant of these adjustments were increases of $267 million

and $171 million associated with the 2007 acquisitions of Oxygen

Media Corp. by NBC Universal and Sanyo Electric Credit Co., Ltd.

by Capital Finance, respectively. In 2008, goodwill balances

decreased $2,639 million as a result of the stronger U.S. dollar.

Goodwill balances increased $9,028 million in 2007 from new

acquisitions. The most significant increases related to acquisitions

of Smiths Aerospace Group Ltd. ($3,877 million) by Technology

Infrastructure; Vetco Gray ($1,379 million) by Energy Infrastructure;

Diskont und Kredit AG and Disko Leasing GmbH (DISKO) and ASL

Auto Service-Leasing GmbH (ASL), the leasing businesses of KG

Allgemeine Leasing GmbH & Co. ($694 million) by Capital Finance;

Oxygen Media ($604 million) by NBC Universal; and Sanyo Electric

Credit Co., Ltd. ($548 million) by Capital Finance. During 2007, the

goodwill balance declined by $269 million related to purchase

accounting adjustments for prior-year acquisitions.

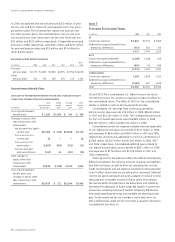

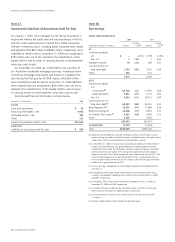

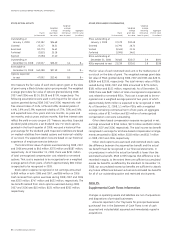

Changes in goodwill balances follow.

2008 2007

Acquisitions/ Dispositions, Acquisitions/ Dispositions,

purchase currency purchase currency

Balance accounting exchange Balance Balance accounting exchange Balance

(In millions) January 1 adjustments and other December 31 January 1(a) adjustments and other December 31

Energy Infrastructure $ 9,960 $ 750 $ (767) $ 9,943 $ 7,956 $1,818 $ 186 $ 9,960

Technology Infrastructure 26,130 1,116 (562) 26,684 22,043 4,292 (205) 26,130

NBC Universal 18,733 403 (163) 18,973 18,000 733 — 18,733

Capital Finance 25,427 2,024 (2,086) 25,365 22,754 1,938 735 25,427

Consumer & Industrial 866 — (72) 794 557 (22) 331 866

Total $81,116 $4,293 $(3,650) $81,759 $71,310 $8,759 $1,047 $81,116

(a) January 1, 2007, balance decreased by $89 million related to new accounting standards. See Note 1.

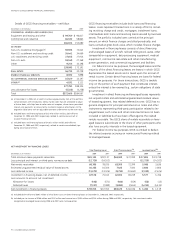

Upon closing an acquisition, we estimate the fair values of

assets and liabilities acquired and consolidate the acquisition as

quickly as possible. Given the time it takes to obtain pertinent

information to finalize the acquired company’s balance sheet,

then to adjust the acquired company’s accounting policies,

procedures, and books and records to our standards, it is often

several quarters before we are able to finalize those initial fair

value estimates. Accordingly, it is not uncommon for our initial

estimates to be subsequently revised.

We test goodwill for impairment at least annually. Given the

significant changes in the business climate for financial services

and our stated strategy to reduce our Capital Finance ending

net investment, we re-tested goodwill for impairment at the

reporting units within Capital Finance during the fourth quarter

of 2008. In performing this analysis, we revised our estimated

future cash flows and discount rates, as appropriate, to reflect

current market conditions in the financial services industry. In

each case, no impairment was indicated. Reporting units within

Capital Finance are CLL, GE Money, Real Estate, Energy Financial

Services and GECAS, which had goodwill balances at December 31,

2008 of $12,784 million, $9,081 million, $1,183 million, $2,162 mil-

lion and $155 million, respectively.