GE 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management’s discussion and analsis

ge 2008 annual report 29

dollar ($0.6 billion). The decrease in net earnings resulted primarily

from core declines ($0.5 billion) and lower securitization income

($0.5 billion). The decreases were partially offset by the gain on

the sale of our CPS business ($0.2 billion), the weaker U.S. dollar

($0.1 billion) and acquisitions ($0.1 billion). Core declines primarily

resulted from lower results in the U.S., reflecting the effects of

higher delinquencies ($1.2 billion), partially offset by growth in

lower-taxed earnings from global operations ($1.0 billion), including

the decision to indefinitely reinvest, outside the U.S., prior-year

earnings.

GE Money 2007 revenues and net earnings increased 27%

and 32%, respectively, compared with 2006. Revenues in 2007

included $0.4 billion from acquisitions. Revenues in 2007 also

increased $4.8 billion as a result of organic revenue growth

($3.5 billion) and the weaker U.S. dollar ($1.4 billion). The increase

in net earnings resulted primarily from core growth ($0.3 billion),

higher securitization income ($0.4 billion), the sale of part of our

Garanti investment ($0.2 billion) and the weaker U.S. dollar

($0.2 billion). Core growth included growth in lower-taxed earn-

ings from global operations ($0.3 billion), partially offset by lower

results in the U.S., reflecting the effects of higher delinquencies

($0.4 billion).

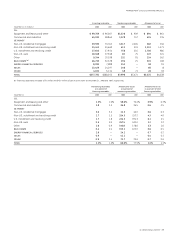

Real Estate 2008 revenues decreased 5% and net earnings

decreased 50% compared with 2007. Revenues for 2008 included

$0.3 billion from acquisitions. Revenues in 2008 also decreased

$0.7 billion compared with 2007 as a result of organic revenue

declines ($0.8 billion), partially offset by the weaker U.S. dollar

($0.2 billion). Real Estate net earnings decreased $1.1 billion

compared with 2007, primarily from a decline in net earnings

from real estate equity investments ($1.2 billion), partially offset

by an increase in net earnings from real estate lending. Net

earnings from the sale of real estate equity investments in 2008

were lower as a result of increasingly difficult market conditions.

In the normal course of our business operations, we sell certain

real estate equity investments when it is economically advanta-

geous for us to do so. However, as a result of deterioration in

current and expected real estate market liquidity and macro-

economic trends, it is difficult to predict with certainty the level

of future sales or sales prices.

Real Estate assets at December 31, 2008, increased $6.0 billion,

or 8%, from December 31, 2007, including $12.1 billion, or 34%,

attributable to an increase in real estate lending, partially offset

by a $6.4 billion, or 16%, decline in real estate equity investments.

During 2008, we sold real estate equity investment assets with a

book value totaling $5.8 billion, which resulted in net earnings of

$1.3 billion that were partially offset by losses, impairments and

depreciation.

Real Estate 2007 revenues and net earnings increased 40%

and 24%, respectively, compared with 2006. Revenues in 2007

included $0.3 billion from acquisitions. Revenues in 2007 also

increased $1.8 billion as a result of organic revenue growth

($1.5 billion) and the weaker U.S. dollar ($0.2 billion). Real Estate

net earnings increased 24% compared with 2006, primarily as a

result of a $0.5 billion increase in net earnings from sales of real

estate investments.

Capital Finance 2007 revenues and net earnings both

increased 18%, compared with 2006. Revenues in 2007 included

$3.5 billion from acquisitions and were reduced by $2.7 billion as a

result of dispositions. Revenues in 2007 also increased $9.1 billion

as a result of organic revenue growth ($6.8 billion) and the weaker

U.S. dollar ($2.3 billion). The increase in net earnings resulted

primarily from core growth ($1.0 billion), higher securitization

income ($0.4 billion) and the weaker U.S. dollar ($0.3 billion). Core

growth included $0.5 billion representing the total year’s tax

benefit on the disposition of our investment in SES, growth in

lower-taxed earnings from global operations ($0.4 billion) and the

sale of part of our Garanti investment ($0.2 billion), partially offset

by declines in fair value of retained interests in securitizations

($0.2 billion). See Corporate Items and Eliminations for a discussion

of items not allocated to this segment.

Additional information about certain Capital Finance businesses

follows.

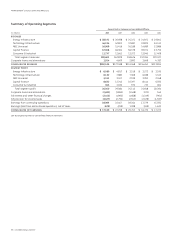

CLL 2008 revenues decreased 2% and net earnings decreased

53% compared with 2007. Revenues in 2008 and 2007 included

$1.8 billion and $0.2 billion, respectively, from acquisitions, and in

2008 were reduced by $0.3 billion as a result of dispositions.

Revenues in 2008 decreased $1.9 billion compared with 2007 as

a result of organic revenue declines ($2.3 billion), partially offset

by the weaker U.S. dollar ($0.5 billion). Net earnings decreased by

$2.0 billion in 2008, resulting from core declines ($2.2 billion),

including an increase of $0.5 billion in the provision for losses on

financing receivables and lower investment income ($0.3 billion),

partially offset by acquisitions ($0.4 billion) and the effect of the

weaker U.S. dollar ($0.1 billion). Net earnings included mark-to-

market losses and impairments ($0.8 billion), the absence of the

effects of the 2007 tax benefit on the disposition of our investment

in SES ($0.5 billion) and SES gains ($0.1 billion), partially offset by

Genpact mark-to-market gains ($0.2 billion).

CLL 2007 revenues and net earnings increased 6% and 9%,

respectively, compared with 2006. Revenues in 2007 and 2006

included $2.1 billion and $0.1 billion, respectively, from acquisi-

tions, and in 2007 were reduced by $2.7 billion as a result of

dispositions. Revenues in 2007 also increased $1.9 billion as a

result of organic revenue growth ($1.2 billion) and the weaker

U.S. dollar ($0.7 billion). The increase in net earnings resulted

from acquisitions ($0.2 billion), core growth ($0.1 billion) and the

weaker U.S. dollar ($0.1 billion), partially offset by dispositions

($0.1 billion). Core growth included $0.5 billion representing the

total year’s tax benefit on the disposition of our investment in

SES, partially offset by $0.2 billion of higher credit losses and

$0.1 billion in charges related to mark-to-market adjustments to

loans held-for-sale. Investment income included higher SES gains

($0.1 billion), offset by impairments of securitization retained

interests ($0.1 billion).

GE Money 2008 revenues increased 1% and net earnings

decreased 14% compared with 2007. Revenues for 2008 included

$0.7 billion from acquisitions and $0.4 billion from the gain on

sale of our Corporate Payment Services (CPS) business and were

reduced by $0.2 billion from dispositions. Revenues in 2008 also

decreased $0.6 billion compared with 2007 as a result of organic

revenue declines ($1.2 billion), partially offset by the weaker U.S.