GE 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ge 2008 annual report 81

notes to consolidated financial statements

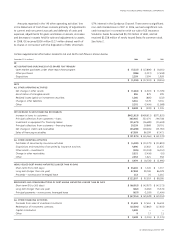

Committed credit lines totaling $60.0 billion had been extended

to us by 65 banks at year-end 2008. Availability of these lines is

shared between GE and GECS with $12.6 billion and $60.0 billion

available to GE and GECS, respectively. The GECS lines include

$37.4 billion of revolving credit agreements under which we can

borrow funds for periods exceeding one year. Additionally,

$21.3 billion are 364-day lines that contain a term-out feature

that allows GE or GECS to extend the borrowings for one year

from the date of expiration of the lending agreement. We pay

banks for credit facilities, but amounts were insignificant in each

of the past three years.

INTEREST RATE AND CURRENCY RISK is managed through the direct

issuance of debt or use of derivatives. We take positions in view

of anticipated behavior of assets, including prepayment behavior.

We use a variety of instruments, including interest rate and cur-

rency swaps and currency forwards, to achieve our interest rate

objectives.

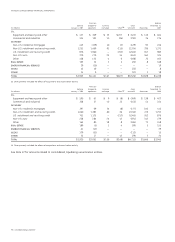

The following table provides additional information about

derivatives designated as hedges of borrowings in accordance

with SFAS 133, Accounting for Derivative Instruments and

Hedging Activities, as amended.

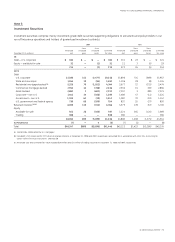

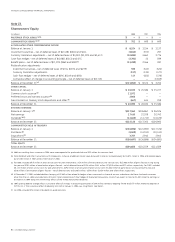

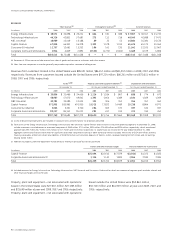

DERIVATIVE FAIR VALUES BY ACTIVITY/INSTRUMENT

December 31 (In millions) 2008 2007

Cash flow hedges $(4,529) $ 497

Fair value hedges 8,304 (75)

Total $ 3,775 $ 422

Interest rate swaps $ 3,425 $(1,559)

Currency swaps 350 1,981

Total $ 3,775 $ 422

We regularly assess the effectiveness of all hedge positions

where required using a variety of techniques, including cumula-

tive dollar offset and regression analysis, depending on which

method was selected at inception of the respective hedge.

Adjustments related to fair value hedges increased the carrying

amount of debt outstanding at December 31, 2008, by

$9,127 million. At December 31, 2008, the maximum term of

derivative instruments that hedge forecasted transactions was

27 years. See Note 29.

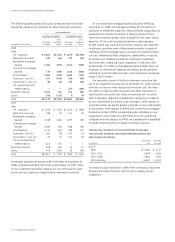

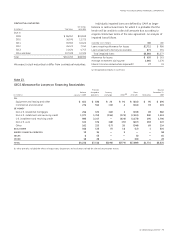

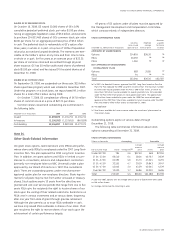

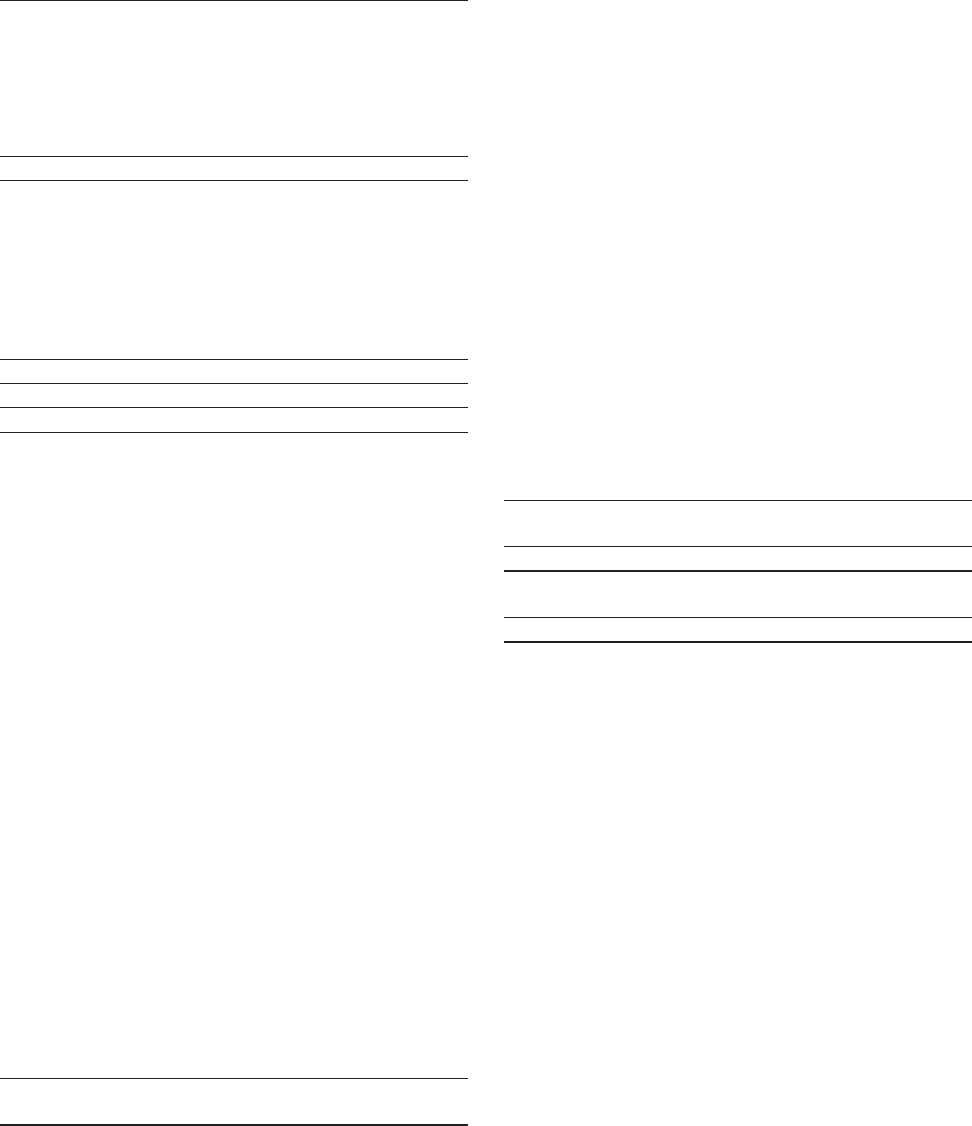

LONG-TERM BORROWINGS

2008

Average

December 31 (Dollars in millions) rate (a) Maturities 2008 2007

GE

Senior notes 5.11% 2013–2017 $ 8,962 $ 8,957

Industrial development/

pollution control bonds 1.10 2011–2027 264 266

Payable to banks,

principally U.S. 6.93 2010–2023 317 1,988

Other (b) 284 445

9,827 11,656

GECS

Senior notes

Unsecured (c) 4.80 2010–2055 299,186 283,097

Asset-backed (d) 5.12 2010–2035 5,002 5,528

Extendible notes ———8,500

Subordinated notes (e) 5.70 2012–2037 2,866 3,313

Subordinated debentures(f) 6.00 2066–2067 7,315 8,064

Bank deposits (g) 4.49 2010–2018 6,699 —

321,068 308,502

ELIMINATIONS (828) (1,145)

Total $330,067 $319,013

(a) Based on year-end balances and year-end local currency interest rates, including

the effects of related interest rate and currency swaps, if any, directly associated

with the original debt issuance.

(b) A variety of obligations having various interest rates and maturities, including

certain borrowings by parent operating components and affiliates.

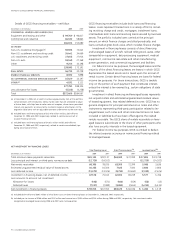

(c) At December 31, 2008, GE Capital had issued and outstanding, $13,420 million of

senior, unsecured debt that was guaranteed by the FDIC under the Temporary

Liquidity Guarantee Program. GE Capital and GE entered into an Eligible Entity

Designation Agreement and GE Capital is subject to the terms of a Master Agreement,

each entered into with the FDIC. The terms of these agreements include, among

other things, a requirement that GE and GE Capital reimburse the FDIC for any

amounts that the FDIC pays to holders of debt that is guaranteed by the FDIC.

(d) Included $2,104 million and $3,410 million of asset-backed senior notes, issued by

consolidated, liquidating securitization entities at December 31, 2008 and 2007,

respectively. See Note 12.

(e) Included $750 million of subordinated notes guaranteed by GE at December 31,

2008 and 2007.

(f) Subordinated debentures receive rating agency equity credit and were hedged at

issuance to the U.S. dollar equivalent of $7,725 million.

(g) Entirely certificates of deposits with maturities greater than one year.

Our borrowings are addressed below from the perspectives of

liquidity, interest rate and currency risk management. Additional

information about borrowings and associated swaps can be

found in Note 29.

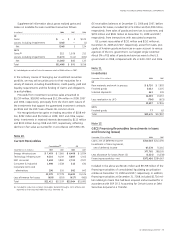

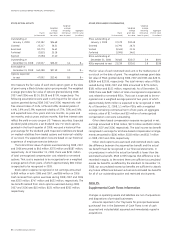

LIQUIDITY is affected by debt maturities and our ability to repay

or refinance such debt. Long-term debt maturities over the next

five years follow.

(In millions) 2009 2010 2011 2012 2013

GE $ 1,703 $ 44 $ 65 $ 32 $ 5,022

GECS 69,682(a) 62,894 52,835 47,573 27,426

(a) Fixed and floating rate notes of $734 million contain put options with exercise

dates in 2009, and which have final maturity beyond 2013.