GE 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management’s discussion and analsis

ge 2008 annual report 49

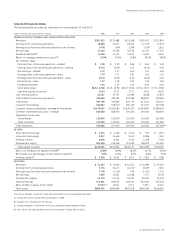

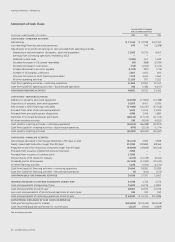

Selected Financial Data.

The following table provides key information for Consolidated, GE and GECS.

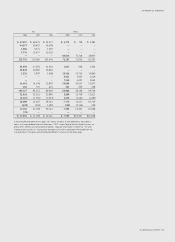

(Dollars in millions; per-share amounts in dollars) 2008 2007 2006 2005 2004

GENERAL ELECTRIC COMPANY AND CONSOLIDATED AFFILIATES

Revenues $182,515 $172,488 $151,568 $136,262 $123,814

Earnings from continuing operations 18,089 22,457 19,344 17,279 15,591

Earnings (loss) from discontinued operations, net of taxes (679) (249) 1,398 (559) 1,631

Net earnings 17,410 22,208 20,742 16,720 17,222

Dividends declared(a) 12,649 11,713 10,675 9,647 8,594

Return on average shareowners’ equity(b) 15.9% 20.4% 19.8% 18.1% 18.8%

Per common share

Earnings from continuing operations— diluted $ 1.78 $ 2.20 $ 1.86 $ 1.63 $ 1.49

Earnings (loss) from discontinued operations— diluted (0.07) (0.02) 0.13 (0.05) 0.16

Net earnings — diluted 1.72 2.17 2.00 1.57 1.65

Earnings from continuing operations— basic 1.79 2.21 1.87 1.63 1.50

Earnings (loss) from discontinued operations— basic (0.07) (0.02) 0.14 (0.05) 0.16

Net earnings — basic 1.72 2.18 2.00 1.58 1.66

Dividends declared 1.24 1.15 1.03 0.91 0.82

Stock price range 38.52–12.58 42.15–33.90 38.49–32.06 37.34–32.67 37.75–28.88

Year-end closing stock price 16.20 37.07 37.21 35.05 36.50

Cash and equivalents 48,187 15,731 14,086 8,608 11,833

Total assets of continuing operations 796,046 786,794 674,966 588,821 578,560

Total assets 797,769 795,683 697,273 673,210 750,252

Long-term borrowings 330,067 319,013 260,749 212,167 207,784

Common shares outstanding— average (in thousands) 10,079,923 10,182,083 10,359,320 10,569,805 10,399,629

Common shareowner accounts— average 604,000 608,000 624,000 634,000 658,000

Employees at year end

United States 152,000 155,000 155,000 161,000 165,000

Other countries 171,000 172,000 164,000 155,000 142,000

Total employees 323,000 327,000 319,000 316,000 307,000(c)

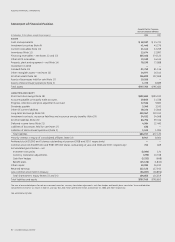

GE DATA

Short-term borrowings $ 2,375 $ 4,106 $ 2,076 $ 972 $ 3,252

Long-term borrowings 9,827 11,656 9,043 8,986 7,561

Minority interest 6,678 6,503 5,544 5,308 7,236

Shareowners’ equity 104,665 115,559 111,509 108,633 110,181

Total capital invested $123,545 $137,824 $128,172 $123,899 $128,230

Return on average total capital invested(b) 14.8% 18.9% 18.5% 16.7% 16.9%

Borrowings as a percentage of total capital invested(b) 9.9% 11.4% 8.7% 8.0% 9.0%

Working capital (b) $ 3,904 $ 6,433 $ 7,527 $ 7,853 $ 7,788

GECS DATA

Revenues $ 71,287 $ 71,936 $ 61,351 $ 54,889 $ 50,320

Earnings from continuing operations 7,774 12,417 10,219 8,929 7,614

Earnings (loss) from discontinued operations, net of taxes (719) (2,116) 439 (1,352) 1,114

Net earnings 7,055 10,301 10,658 7,577 8,728

Shareowner’s equity 53,279 57,676 54,097 50,812 54,379

Total borrowings 514,601 500,922 426,262 362,042 355,463

Ratio of debt to equity at GE Capital 8.76:1(d) 8.10:1 7.52:1 7.09:1 6.45:1

Total assets $660,902 $646,485 $565,258 $540,584 $618,614

Transactions between GE and GECS have been eliminated from the consolidated information.

(a) Includes $75 million of preferred stock dividends in 2008.

(b) Indicates terms are defined in the Glossary.

(c) Includes employees of Genworth, which was subsequently deconsolidated in 2005.

(d) 7.07:1 net of cash and equivalents and with classification of hybrid debt as equity.