GE 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management’s discussion and analsis

40 ge 2008 annual report

As discussed in the previous Liquidity and Borrowings section, in

the fourth quarter of 2008 we took a number of actions to

strengthen our liquidity, maintain our dividend and maintain the

highest credit ratings on our borrowing capability. Actions that

were taken that affected our 2008 shareowners’ equity included:

Þ We raised $12.0 billion from the issuance of 547.8 million shares

of common stock at an issuance price of $22.25 per share.

Þ We issued 30,000 shares of preferred stock and related

warrants for $3.0 billion in proceeds.

Þ We suspended our share repurchase program.

As a result of these actions, Other Capital increased by

$14.3 billion in 2008, compared with increases of $0.6 billion

and $0.3 billion in 2007 and 2006, respectively.

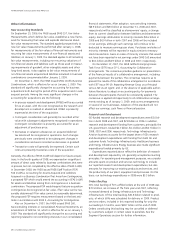

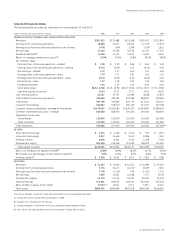

Overview of Our Cash Flow from 2006 through 2008

Consolidated cash and equivalents were $48.2 billion at

December 31, 2008, an increase of $32.5 billion from

December 31, 2007. Cash and equivalents amounted to

$15.7 billion at December 31, 2007, an increase of $1.6 billion

from December 31, 2006.

We evaluate our cash flow performance by reviewing our

industrial (non-financial services) businesses and financial services

businesses separately. Cash from operating activities (CFOA) is the

principal source of cash generation for our industrial businesses.

The industrial businesses also have liquidity available via the

public capital markets. Our financial services businesses use a

variety of financial resources to meet our capital needs. Cash

for financial services businesses is primarily provided from the

issuance of term debt and commercial paper in the public and

private markets, as well as financing receivables collections,

sales and securitizations.

GE Cash Flow

GE CFOA is a useful measure of performance for our non-finan-

cial businesses and totaled $19.1 billion in 2008, $23.3 billion in

2007 and $23.8 billion in 2006. Generally, factors that affect our

earnings —for example, pricing, volume, costs and productivity —

affect CFOA similarly. However, while management of working

capital, including timing of collections and payments and levels

of inventory, affects operating results only indirectly, the effect

of these programs on CFOA can be significant.

Our GE Statement of Cash Flows shows CFOA in the required

format. While that display is of some use in analyzing how various

assets and liabilities affected our year-end cash positions, we

believe that it is also useful to supplement that display and to

examine in a broader context the business activities that provide

and require cash.

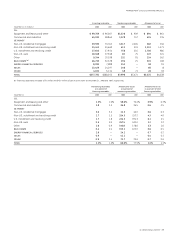

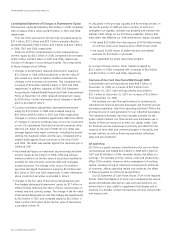

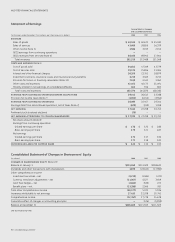

Consolidated Statement of Changes in Shareowners’ Equity

Shareowners’ equity decreased by $10.9 billion in 2008, compared

with increases of $4.1 billion and $2.9 billion in 2007 and 2006,

respectively.

Over the three-year period, net earnings increased equity by

$17.4 billion, $22.2 billion and $20.7 billion, partially offset by

dividends declared of $12.6 billion, $11.7 billion and $10.7 billion

in 2008, 2007 and 2006, respectively.

Elements of Other Comprehensive Income reduced share-

owners’ equity by $30.2 billion in 2008, compared with increases

of $5.1 billion and $0.1 billion in 2007 and 2006, respectively,

inclusive of changes in accounting principles. The components

of these changes are as follows:

Þ Changes in benefit plans reduced shareowners’ equity by

$13.3 billion in 2008, reflecting declines in the fair value of

plan assets as a result of market conditions and adverse

changes in the economic environment. This compared with

increases of $2.6 billion and $0.3 billion in 2007 and 2006,

respectively. In addition, adoption of SFAS 158, Employers’

Accounting for Defined Benefit Pension and Other Postretirement

Plans, at December 31, 2006, reduced shareowners’ equity

by $3.8 billion. Further information about changes in benefit

plans is provided in Note 6.

Þ Currency translation adjustments decreased shareowners’

equity by $11.0 billion in 2008 and increased equity by

$4.5 billion and $3.6 billion in 2007 and 2006, respectively.

Changes in currency translation adjustments reflect the effects

of changes in currency exchange rates on our net investment

in non-U.S. subsidiaries that have functional currencies other

than the U.S. dollar. At the end of 2008, the U.S. dollar was

stronger against most major currencies, including the pound

sterling, the Australian dollar and the euro, compared with a

weaker dollar against those currencies at the end of 2007

and 2006. The dollar was weaker against the Japanese yen in

2008 and 2007.

Þ Net unrealized losses on investment securities reduced share-

owners’ equity by $3.2 billion in 2008, reflecting adverse

market conditions on the fair value of securities classified as

available for sale, primarily corporate debt and mortgage-

backed securities. The change in fair value of investment

securities decreased shareowners’ equity by $1.5 billion and

$0.2 billion in 2007 and 2006, respectively. Further information

about investment securities is provided in Note 9.

Þ Changes in the fair value of derivatives designated as cash

flow hedges decreased shareowners’ equity by $2.7 billion in

2008, primarily reflecting the effect of lower interest rates on

interest rate and currency swaps. The change in the fair value

of derivatives designated as cash flow hedges decreased equity

by $0.5 billion in 2007 and increased equity by $0.2 billion in

2006. Further information about the fair value of derivatives

is provided in Note 29.